What is the return on assets??What does it have to do with the return on shareholders' equity??

The return on total assets (ROA) and the return on shareholders' equity (ROE) are both important indicators used to assess a company's profitability, and the higher the ROA value result, the more efficient the company is in using its assets to make money.。

The most direct way to tap a company with growth potential is to see if the company's profits are growing year by year.。In fundamental analysis, in addition to observing earnings per share (EPS) and return on shareholders' equity (ROE), there is another metric that can be used to assess a company's profitability, which is the return on assets (ROA).。

This article will cover all aspects of the return on assets (ROA), including the concept of ROA, what the values calculated by ROA represent, the relationship with ROE and the DuPont equation, and how to actually use ROA when selecting stocks.。

What is the return on assets.?

Return on Assets (ROA), also known as the return on assets, can measure the effective utilization and utilization of an enterprise's assets, the higher the value, the better the efficiency of the enterprise's use of assets to make money.

Formula for calculating return on assets

Net profit after tax: the operating income obtained by the enterprise after making money, after deducting operating costs (raw materials, labor, manufacturing expenses), operating expenses (marketing expenses, management expenses, research and development expenses), non-operating income and expenditure and income tax.。

Total assets: resources owned by an enterprise, including tangible assets such as capital, equipment, land and plant; intangible assets such as goodwill and patents that contribute to production and business activities are also part of the assets.。

The meaning of the return on assets.

The return on assets measures a company's ability to effectively use its assets to create profits, so the higher the return on assets, the more efficient the use of assets, the higher the profits created by the use of assets, and the greater the profitability.。

Conversely, if a firm's return on assets is lower, it means that the firm's assets are not being used efficiently and therefore generate less profit and less profitable performance。

Considerations for the rate of return on assets

- Industry Comparison

When comparing ROA, it is more appropriate to compare the same industries with each other, as different industries use assets differently from each other, such as finance and electronics.。

- Observe long-term trends

As with other financial indicators, it is easy to misjudge if you only look at short-term data results.。It is more appropriate for investors to observe long-term trends in order to clearly assess whether a company's profitability is growing, stagnating, or turning into a recession year by year.。

ROA vs ROE

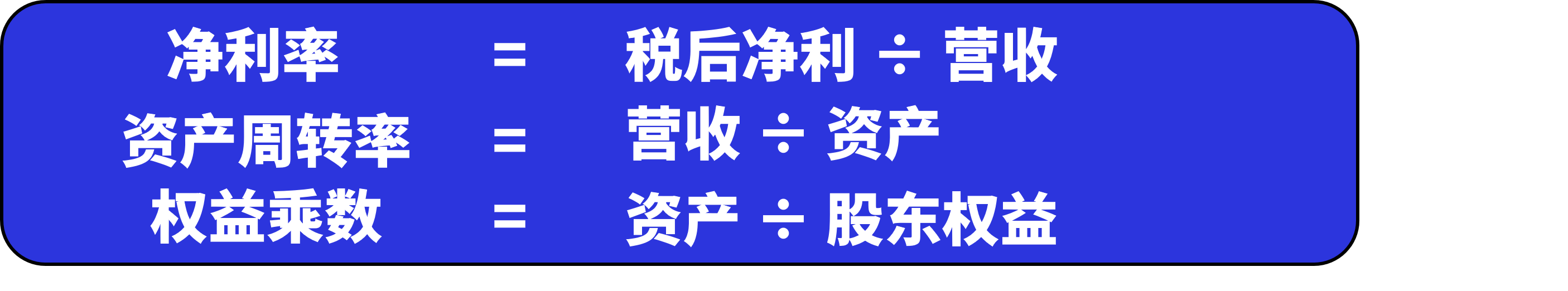

Through DuPont analysis, it will be found that the return on shareholders' equity (ROE) can be calculated by multiplying the return on assets (ROA) by the equity multiplier, which is financial leverage.。

Thus, if a firm is found to have a high ROE, but a low ROA, it is highly likely that the firm is generating profits by raising high amounts of debt.。In a recession, the investment risks associated with such highly financially leveraged companies are magnified, or even insolvent, into financial distress.。

Return on Assets (ROA) and Return on Shareholders' Equity (ROE) are both measures of profitability.。

The return on assets is a measure of a company's ability to use its assets to create profits, while the return on shareholders' equity is a measure of the company's ability to use the funds invested by shareholders to create profits.。

Total assets are equal to the sum of shareholders' equity and total liabilities, so simply, ROA considers corporate debt; ROE does not look at debt。So when a firm itself has no debt, the results of ROE and ROA will be equal。

How to use ROA and ROE?

In evaluating a company's profitability, in addition to financial indicators such as earnings per share, operating margin, gross margin, and net profit margin after tax, ROA and ROE are also referenced.。

The difference between ROE and ROA is whether debt is taken into account in the calculation, and since an increase in the debt ratio will lead to an increase in ROE as well, most companies with high debt ratios (such as finance and insurance, leasing, construction, etc.) will use ROA to assess the profitability of the company's use of assets.。

When the debt ratio is not as high, the use of ROE assessment is more likely to show the company's ability to use shareholder money to create profits.

SUMMARY

The return on total assets (ROA) and the return on shareholders' equity (ROE) are both important indicators used to assess a company's profitability, and the higher the ROA value result, the more efficient the company is in using its assets to make money.。

In making comparisons, comparisons should be made in the same industry category to be meaningful.。At the same time, it is necessary to observe the long-term development trend, in order to see whether the profitability of the enterprise is maintained at a certain level, will not be due to a sudden increase or decrease in a certain year caused by miscalculation.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.