Why novices don't recommend using financing deals?

This article shares the concept of financing transactions, the financing maintenance rate, transaction fees, and the advantages and risks of financing.。

In investing, many people will choose to make financing transactions to make larger profits with less principal.。However, excessive leverage makes financing transactions risky.。

The author will share the basics of credit and financing transactions with readers in this article, and if you have any questions, please leave a comment in the comments section to discuss。

What is a credit transaction??

In the securities market, transactions can be divided into two types: "cash transactions" and "credit transactions."。Investors choose to use their existing funds for stock trading, which is cash trading (Cash Trading); if the funds for stock trading are borrowed, it is credit trading (deal on credit), also known as margin trading (Margin Trading).。

Credit trading refers to "financing" (Margin Trading) and "Securities Lending" (Securities Lending, Short Selling) three kinds, simply put, when investors want to buy a stock but do not have sufficient funds, or want to sell a stock but do not currently have the stock, investors can borrow money from a brokerage firm or borrow shares to trade a way.。

The securities accounts that provide such margin trading are called Margin Account in English and Margin Account in Chinese: credit account, margin account, margin account, etc.。

- Financing (Margin Trading): borrowing money from brokerage firms to buy stocks

- Short Selling (Short Selling): Borrowing shares from brokerages to sell

What is financing??

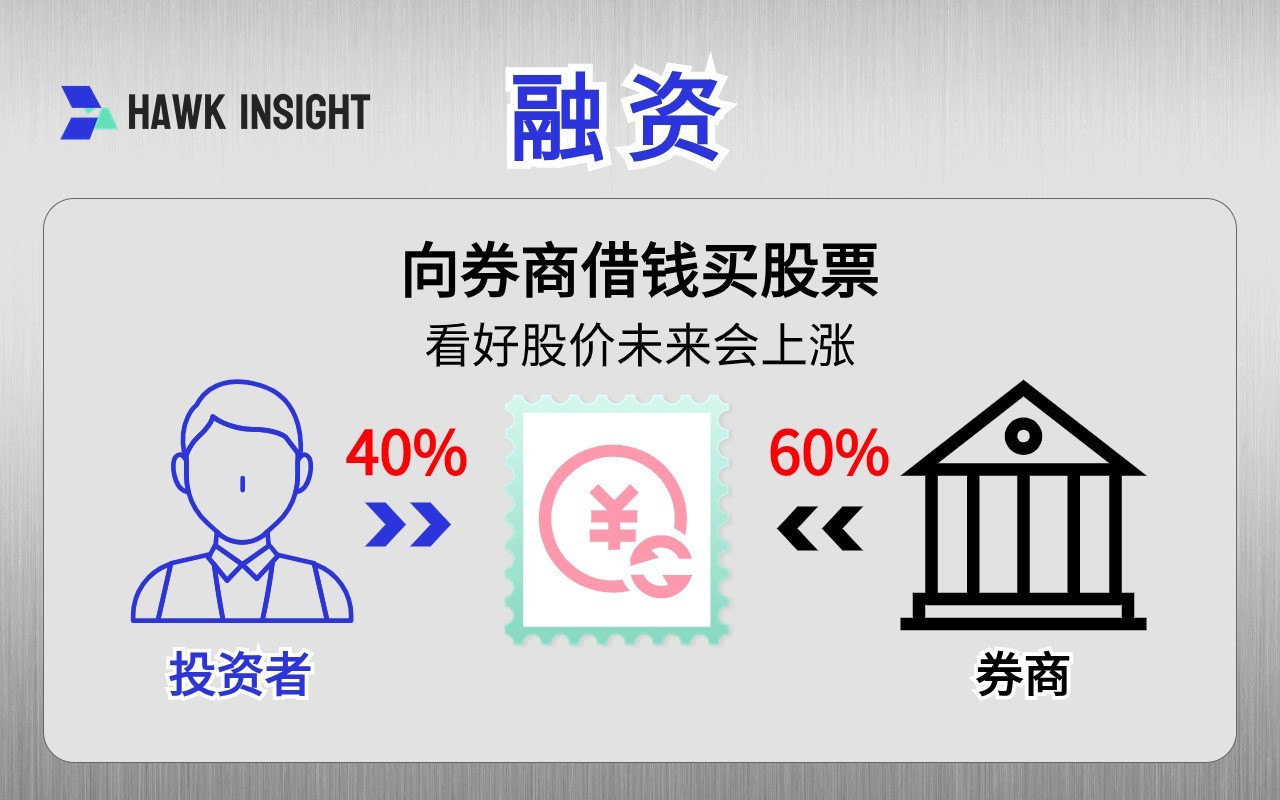

Financing (Margin Trading, Financing Transaction, Margin Transaction) refers to borrowing money from a brokerage firm to buy shares and then returning the money to the brokerage firm after the shares are sold.。

Simply put, using less principal to buy stocks is a legitimate conduit for credit expansion。

When an investor believes that a stock will rise in the future, but due to lack of funds on hand, or want to use the borrowed money to buy more shares, will consider the use of financing transactions。

Use financing to buy a stock, not that the broker will lend you the full amount, the broker will provide 60% of the funds, and the investor must bring their own 40% of the funds。

For example, if an investor wants to buy a stock with a share price of $20 ($20,000 for one)。To use financing to buy, you must bring your own $8,000 and the broker provides $12,000.。

- Financing amount: 20 (RMB / share) x 1,000 (shares) x 60% = 12,000 (RMB)

- Financing self-provision: 20,000 - 12,000 = 8,000 ($)

* One Taiwan share is 1,000 shares

Financing is financial leverage.?

As illustrated by the above example, if you buy a stock with a share price of $20 in a general cash transaction and buy one on behalf of an investor, you will need to pay $20,000 in cash。But if you use financing to buy, the investor only needs to come up with 40% of the money, which is $8,000.。

If the stock price rises smoothly to $25, the return on investment is 25% if it is bought in a cash transaction, but the return on the use of a financing exchange is as high as 62.5%!

- cash transaction rate of return(25,000-20,000)÷ 20,000 × 100% = 25%

- rate of return on financing transactions(25,000-20,000)÷ 8,000 × 100% = 62.5%

If you buy a stock with a share price of $20 in a general cash transaction and buy one on behalf of an investor, you will need to pay $20,000 in cash。But if you use financing to buy, the investor only needs to come up with 40% of the money, which is $8,000.。

If the share price rises smoothly to $25 and the profit is $5,000 (25,000-20,000), the return on investment is 25% if bought in a cash transaction; however, the return on the use of a financing exchange is as high as 62.5%!

In other words, the same is to earn 5,000 yuan, financing transactions with 8,000 yuan to earn, cash transactions with 20,000 yuan to earn 5,000 yuan.。

Therefore, you will find that if you use financing for a transaction, as opposed to a cash transaction, you are using 2.5 times financial leverage。Financing transactions can amplify profits when share prices rise smoothly as expected。

But relatively, if the stock price does not rise as expected and instead falls, then the loss on the use of the financing transaction will increase by a multiple.

What is the number of financing.?

Financing ratio, which refers to the proportion of funds borrowed from a brokerage firm when using financing to buy。For now, financing to buy listed stocks can borrow 60%, that is, self-provided funds only need to prepare 40%; buy OTC stocks can borrow 50%, self-provided funds need to prepare 50%。

But sometimes there are exceptions。When the share price of a stock fluctuates excessively sharply, the trading volume is excessive and abnormal, there is a huge default delivery, excessive concentration of equity or disposal status and other factors, there will be an adjustment of the financing ratio, the detailed information of Taiwan stocks is mainly published on the official website of the Taiwan Stock Exchange.。

What is the financing maintenance rate??

Brokers lend money to investors, in order to reduce the risk of borrowing money, for fear that investors will not be able to repay the money, so there will be a certain protection mechanism, that is, "financing maintenance rate," English is Maintenance Margin, calculated as "the present value of the stock" divided by "the amount of financing."。

- Financing maintenance rate formula - the present value of the stock - the amount of financing.

If an investor encounters a decline in the share price after using financing to buy, when the principal is reduced to a certain ratio, the brokerage firm will issue a financing recovery notice (Margin Call), requiring the customer to make up the money as soon as possible.。

For example, an investor uses financing to buy a $200,000 stock, of which $120,000 is borrowed from a brokerage firm, and the financing maintenance rate after purchase is 166% (200,000 ÷ 120,000 × 100%)。

According to the regulations, when the stock price falls, resulting in a decrease in the present value of the stock, so that the financing maintenance rate "less than 130%," the brokerage will issue a notice of financing recovery to investors, investors need to make up the money action.。

So, when you buy a stock with a share price of $200 ($200,000 a piece), how much will the investor be issued a notice of financing recovery??

The answer is 156 yuan (156,000 ÷ 120,000 × 100% = 130%)。

To simplify the calculation, you can simply multiply the current price of the financing buy by 0.78, it will be the price of financing recovery.。

- Simplified formula for financing maintenance rate = financing purchase share price x 0.78

▍ How to deal with when being recovered by securities dealers?

In the event that a brokerage firm issues a notice of financing recovery, the replenishment must be completed within 2 days from the day the financing maintenance rate is insufficient (T-day) (before the close of trading on T + 2)。If you don't make up the difference, you'll be decapitated by a brokerage firm and force you to sell your stock。

So how much do you need to make up??Can be divided into 2 situations。

1.In 2 days to make up money to financing maintenance rate of more than 166%

If, within 2 days, the money is made up above the financing maintenance rate of 166%, the financing recovery order will be revoked.。

2.Make up the money to the financing maintenance rate of more than 130% and less than 166% within 2 days.

This approach is to make up the funds to the limit that they will not be decapitated by the brokerage firm, raise the financing maintenance rate to 130%, and the stock will not be decapitated for forced sale, but the financing recovery order still exists。In other words, investors only get through the crisis briefly。

However, in case the stock price unfortunately falls again, making the financing maintenance rate below 130% again, then this time it must be completed in the "afternoon" to make up the money, otherwise the broker will sell the stock directly the next day.。

What happens if you don't make up the money at all when it's recovered by a brokerage firm??

On the first receipt of a notice of recovery from a brokerage firm (T-day), if the money is not replenished within the next 2 days to increase the financing maintenance rate, the brokerage firm will sell the stock at the market price at the opening of the 3rd day (T + 3), which is often heard in the market as "financing decapitation," known in English as Forced Selling, Forced Liquidation。

Especially when there is a series of sharp falls in the stock market, investors who use financing transactions in the market are more likely to be decapitated.。The sale of stocks by brokerages triggers huge selling pressure that can lead to a sharp drop in the stock price, or even cause the stock price to fall to an unlimited limit.。

What are the costs of financing transactions??How to Calculate Interest?

Financing is a trading model for borrowing money from a brokerage firm, and since it is borrowing money, you will have to pay interest charges.。Therefore, the transaction costs of using financing to buy and sell, in addition to buying and selling fees, securities tax, in the sale of shares also need to pay "financing interest Margin Rate" fees.。

The financing rate may vary from brokerage to brokerage, with a typical annual interest rate of around 6%。Dividing the annual interest rate by 365 days is the daily interest, and the number of days of interest is calculated from the delivery date until one day from the sale delivery date.。

- Financing interest calculation method = financing amount x financing rate x (days ÷ 365)

For example, assume that the brokerage firm's annual interest rate on financing is 6.5%, the investor raises money to buy a $200,000 stock and holds it for 20 days and sells it for $240,000, so what is the cost of his deal?

the transaction costs of buying shares

- Transaction fee = 200,000 × 0.1425% = 285 (yuan)

transaction costs of selling shares

- Transaction fee = 240,000 × 0.1425% = 342 (yuan)

- Tax paid on certificates = 240,000 × 0.3% = 720 (yuan)

- Interest on financing = 120,000 (amount of financing) x 6.5% (financing rate) x 20 ÷ 365 = 427 ($)

Total transaction costs:

- Transaction costs = 285 + 342 + 720 + 427 = 1,774 ($)

▍ How to apply for stock letter users?

-

Taiwan Unit Application Letter User

After the completion of the securities account, want to carry out financing transactions, you must apply with the brokerage firm to open a "credit account," after the successful opening will be able to carry out financing to buy and sell stocks.。

The application conditions for opening a letter user are as follows.

- Applicants must be at least 20 years old

- Open a securities account for 3 months

- More than 10 transactions in the past year

- The cumulative transaction amount in the past year exceeds 50% of the applied credit limit.

- Proof of financial strength is required to reach 30% of the credit limit applied for (no more than $500,000 is required)

The following consolidated credit line trial balance:

| Credit user quota | Accumulated transaction amount in recent one year | Proof of financial resources |

| 500,000 yuan | 250,000 yuan | Free |

| 1 million yuan | 500,000 yuan | 300,000 yuan |

| 2.5 million yuan | 1.25 million yuan | 750,000 yuan |

| 5 million yuan | 2.5 million yuan | 1.5 million yuan |

| 10 million yuan | 5 million yuan | 3 million yuan |

| 15 million yuan | $7.5 million | $4.5 million |

| 20 million yuan | 10 million yuan | 6 million yuan |

| 25 million yuan | 12.5 million yuan | $7.5 million |

| 30 million yuan | 15 million yuan | 9 million yuan |

-

U.S. Stock Application Letter Users

Here's an example of Firstrade First Securities.。If the investor already has a cash account with Firstrade First Securities, then simply download the "Financing Account Application Form" on the official website, fill it out and upload it to be sent back to Firstrade First Securities by mail, fax or email.。

Once the account has been reviewed and opened, the financing transaction can begin。It is important to note, however, that the minimum deposit requirement in a financing account is $2,000, which means that at least $2,000 or more must be in the account to make a financing transaction.。

▍ Financing transaction trading methods

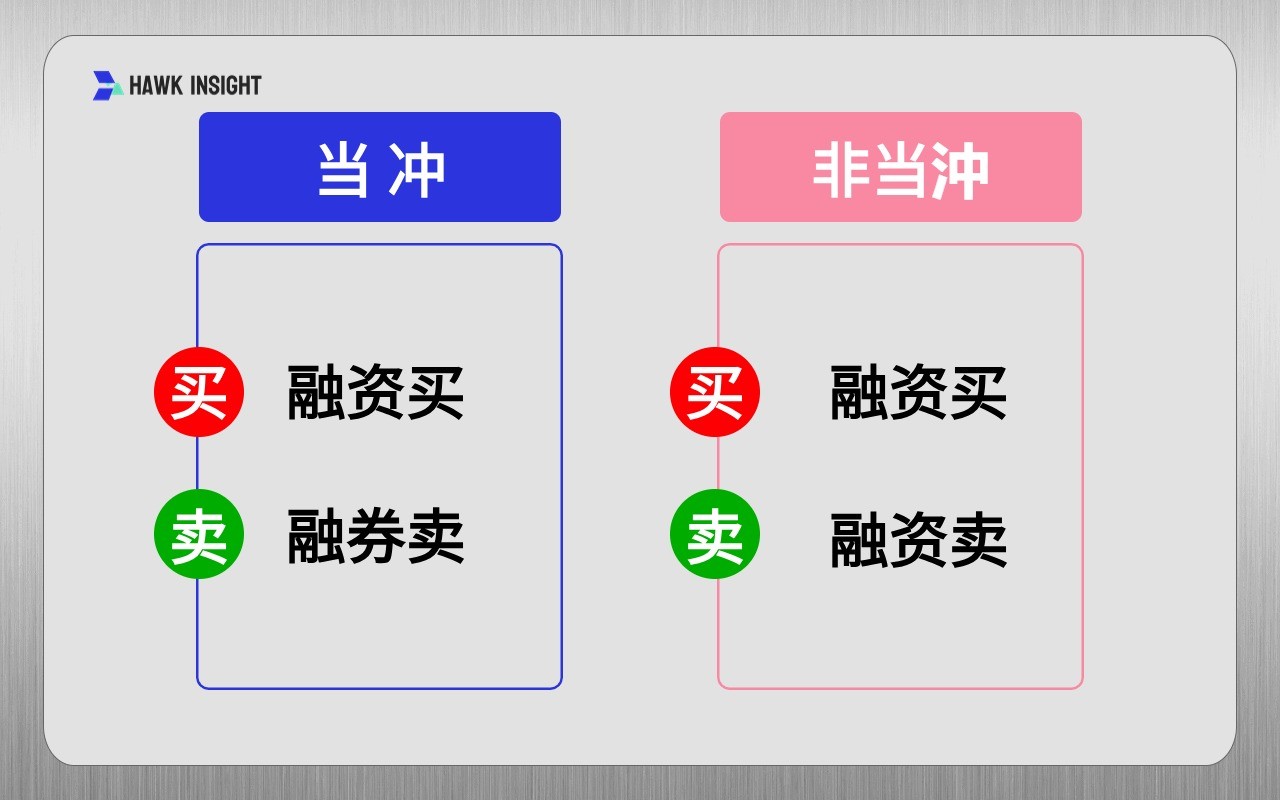

Trading methods can be divided into "general trading" and "current trading Day Trading," these two trading methods if you want to carry out credit transactions, when entrusting to pay special attention to the way of entrustment trading.。

If the purchase (capital purchase) is followed by a same-day offsetting sale, the commission is to be made by way of a margin sale (coupon sale).。

If it is not a same-day write-off, after using the financing to buy (capital buy), when you want to sell the stock after the next day, you are entrusted by financing to sell (capital sell).。

The advantages of financing transactions.

When investing, the power of financial leverage can be used to double profits。Financing transactions are a legitimate pipeline of credit expansion that can earn larger profits with smaller funds。Compared to the general use of cash transactions, the financial leverage of financing transactions is as high as 2..5 times。

Leverage in the hands of a master can amplify the profit and loss of investment returns, but in the hands of a novice with immature investment skills and investment mentality, it can ruin himself。

▍ Disadvantages and risks of financing transactions

The disadvantage of financing transactions is that interest charges are high and interest is calculated on a "day" basis, which means that holidays are included.。The longer you hold it, the more you will accumulate a significant amount of money in transaction costs.。

The biggest risk of financing transactions comes from the role of leverage, if the stock price does not rise as expected, investors do not decisively sell shares to leave the market, the magnitude of the loss will also be amplified, accelerated.。

▍ Summary

Financing transaction is a kind of "small fight big" trading method, if used properly, the market as expected to rise, will be able to significantly increase the profit compensation.。But relatively, high pay comes with high risk。If the market does not go down as expected, then the losses caused by the financing exchange will be magnified.。

Therefore, it is not recommended that novice investors engage in financing transactions in order to amplify their profits。Most people in the investment mentality and skills are not mature, the use of financing but easy to get hurt, or even directly graduated from the market.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.