Japan's second-quarter growth exceeded expectations, external concerns remain

Higher-than-expected economic growth may continue to push the Bank of Japan to raise interest rates further.

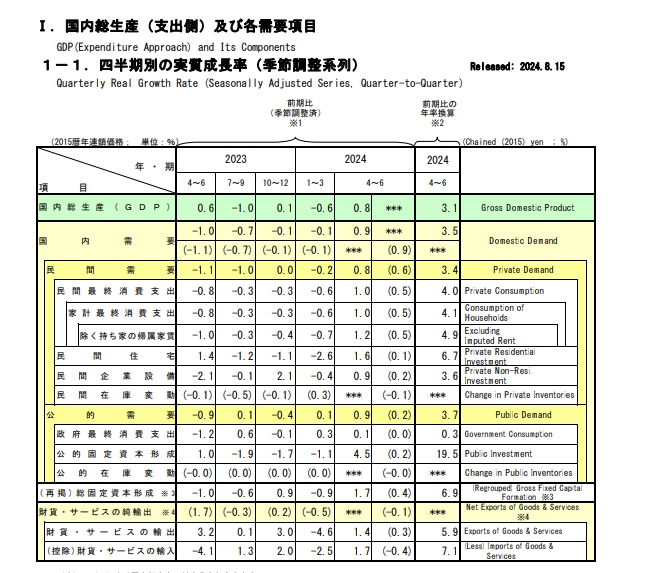

On August 15th, the Cabinet Office of Japan announced the GDP data for the second quarter of Japan.

The data released by the Cabinet Office showed that Japan's real GDP grew by 0.8% on a quarter-on-quarter basis and by 3.1% on an annualized basis in the second quarter, both exceeding expectations. This growth was mainly due to the recovery of private consumption, which increased by 1% year-on-year, ending four consecutive quarters of negative growth. In addition, the growth in consumption of automobiles and durable goods also provided momentum for the economy.

After the data was announced, Barclays Bank raised its forecast for Japan's GDP growth from 0.3% to 0.5%, reflecting confidence in the recovery of private consumption and the resilience of corporate capital expenditure.

The higher-than-expected economic growth rate may continue to push the Bank of Japan for further interest rate hikes.

At the end of July, the Bank of Japan had raised interest rates to 0.25% in its decision-making and hinted at the possibility of further rate hikes. This move by the central bank showed confidence in the economic recovery and also reflected concerns about the weakness of the yen.

The GDP data exceeded expectations, and the market's expectations for the Bank of Japan to raise interest rates have risen again. Economist Kazutaka Maeda from the Meiji Yasuda Research Institute believes that the recovery of private consumption is positive, which supports the view of further interest rate hikes by the Bank of Japan. Capital Economics also said that the first increase in consumption should encourage the Bank of Japan to raise interest rates again later this year.

After the data was announced, both the Nikkei 225 index and the Topix index rose, and the yen strengthened slightly against the US dollar.

Looking specifically at this data, in the second quarter, private consumption in Japan increased by 1% quarter-on-quarter, marking the first increase in five quarters. Consumption of automobiles, electrical appliances, and other durable goods increased by 8.1% year-on-year; consumption of semi-durable goods such as clothing increased by 2%; and the purchase volume of non-durable goods such as food increased by 0.8%.

The positive performance of consumption growth has become the main engine for Japan's better-than-expected growth in the second quarter, but the market has different views on whether consumption can continue to grow.

On the one hand, some believe that consumption growth will be supported by the rise in wages and the implementation of tax cut policies. The NLI Research Institute predicts that consumption will continue to grow by about 3% from July to September next year due to tax cuts.

On the other hand, there are concerns that the impact of one-time tax cut policies will gradually decrease, and premature interest rate hikes may suppress inflation and lead to economic slowdown.

In fact, if we break down the demand in the second quarter of Japan, the recovery of domestic demand is the main factor driving economic growth in that quarter.

The data shows that domestic demand contributed 0.9 percentage points to economic growth in the second quarter, while external demand contributed a negative value - Japan's exports grew by 1.4% quarter-on-quarter, and imports grew by 1.7% quarter-on-quarter, with net exports contributing a negative 0.1 percentage point to economic growth after offsetting imports and exports. Japan's economic data is still dragged down by weak external demand.

As for the future external environment, Japan cannot be completely at ease. The potential economic recession in the United States and fluctuations in the global financial market may have adverse effects on the Japanese economy.

The Dai-ichi Life Research Institute pointed out that if the stock market falls, it may indirectly lead to a slowdown in wage growth in Japan, thereby affecting the future economic outlook, and the specific outlook for the Japanese stock market depends on the economic data of the United States in the next few months.

Bloomberg Economics said, "GDP data can help the Bank of Japan prove that its decision to raise interest rates last month was correct, even so, the recent fluctuations in the stock market and the yen (partly due to concerns about a recession in the United States) may make the Bank of Japan more cautious."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.