Microsoft FY24 Q4: Revenue and Net Income Up, Cloud Business Slowdown Raises Concerns

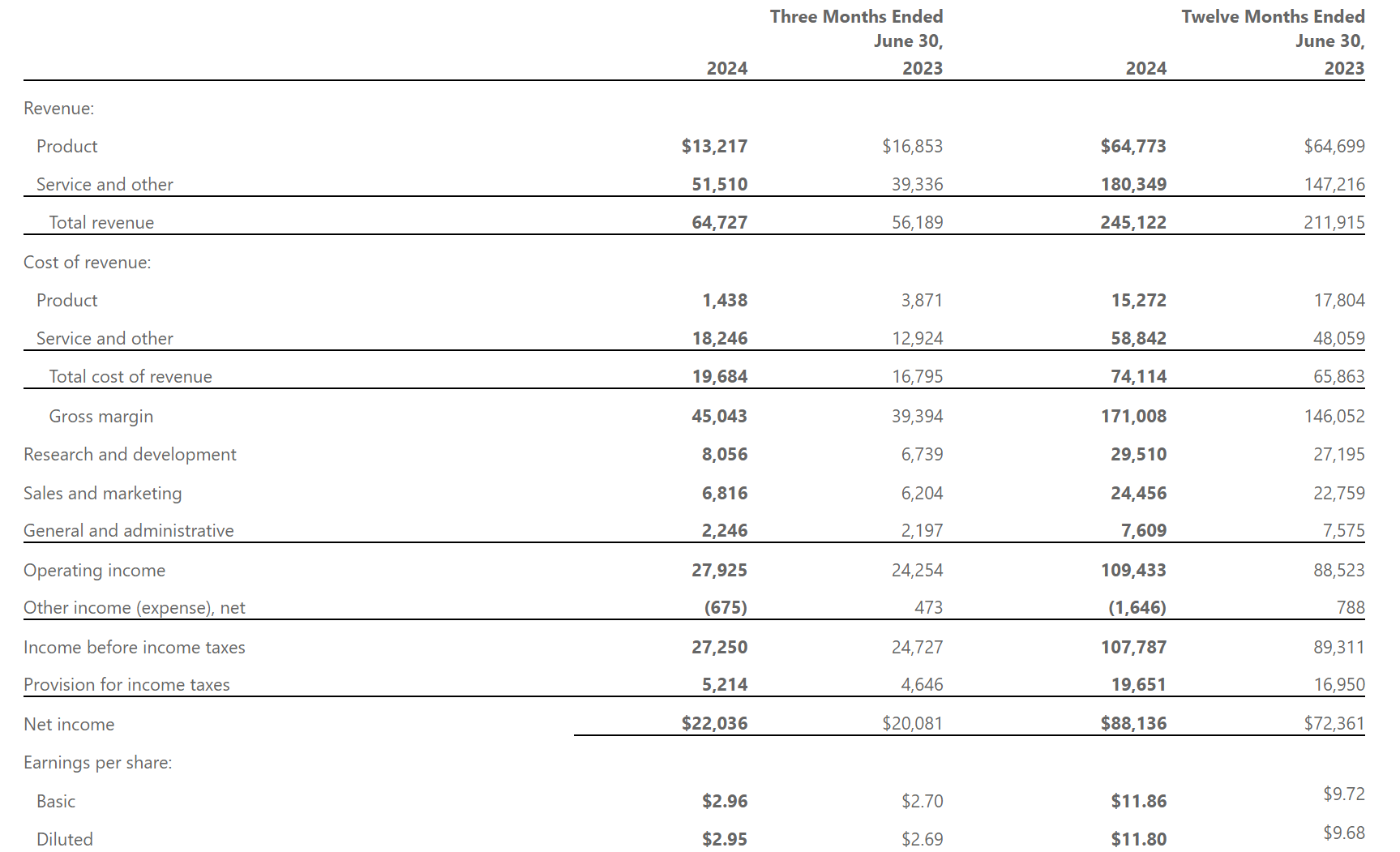

Microsoft's total revenue for the fiscal fourth quarter rose 15 percent year-over-year to $64.73 billion, beating estimates of $64.39 billion. Earnings per share came in at $2.95, beating estimates of $2.93.

On July 30, Microsoft reported results for the fourth fiscal quarter of fiscal year 2024 ended June 30, 2024, the company said.

The earnings data showed that Microsoft's total revenue for the fiscal fourth quarter rose 15% year-over-year to $64.73 billion, beating expectations of $64.39 billion. Net income rose 10 percent year-over-year to $22.04 billion. Earnings per share came in at $2.95, beating estimates of $2.93.

Cloud business slows

Although both revenue and earnings per share exceeded Wall Street analysts' expectations, looking specifically at business units, Microsoft's much-anticipated Intelligent Cloud division grew less than the market expected in the fiscal quarter.

Revenue for the Intelligent Cloud division, which includes Azure, Windows Server, Nuance and GitHub, came in at $28.52 billion, below analysts' expectations of $28.68 billion. Operating profit came in at $12.859 billion, up from $10.526 billion a year earlier.

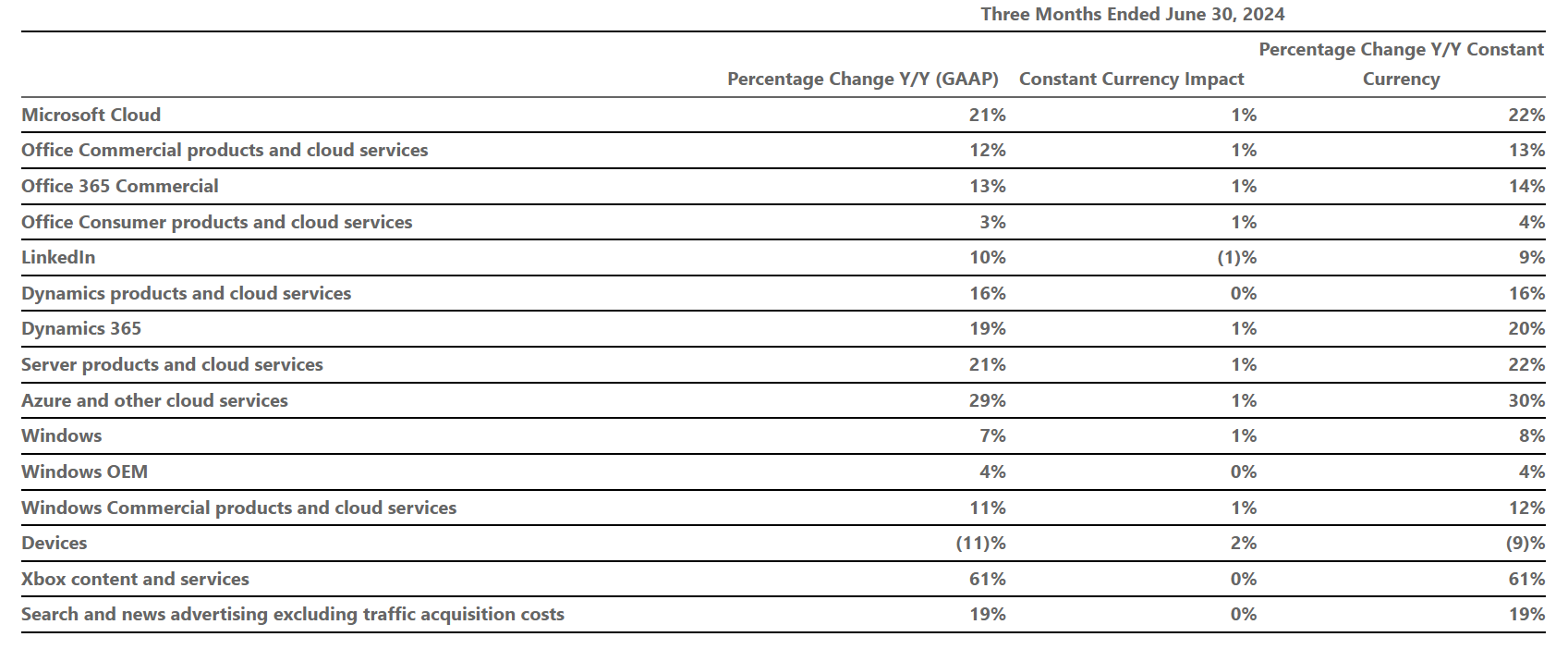

Within the division, Azure and other cloud services recorded year-over-year growth of 29%, below expectations of 30.6% and slower than the 31% growth rate in the previous fiscal quarter. The underperformance of the cloud business, especially Azure, has been the center of attention.

Microsoft reported that artificial intelligence contributed about 8 percentage points of Azure's 29 percent increase, up from 7 percentage points in the previous fiscal quarter.

CFO Amy Hood said on a conference call with analysts on Tuesday that Azure growth will continue to slow in the next fiscal quarter, but investments in data centers and servers will allow the company to leverage demand and accelerate Azure growth in the second half of fiscal 2025.

In addition to the weaker-than-expected growth rate at this stage, the guidance given by Microsoft for Azure on its part also disappointed Wall Street analysts.Hood also said on the conference call that Microsoft's year-over-year Azure business revenue growth rate is expected to be in the range of 28 to 29 percent in the first quarter of fiscal 2025, with an acceleration of revenue growth rates expected in the second half of the fiscal year. This compares to analysts' average expectation of 30.6 percent year-over-year growth in Microsoft's Azure revenue for the first quarter of fiscal 2025, according to analyst firm StreetAccount.

Microsoft's shares were down 7% after hours at one point due to the slowdown in its cloud business, before the decline narrowed to about 3%.

In contrast, Microsoft's other two main divisions - Productivity and Business Processes and More Personal Computing - both performed well.

The Productivity and Business Processes segment (which includes products such as Office, LinkedIn, and Dynamics) recorded an 11 percent year-over-year increase in revenue to $20.32 billion in its fiscal fourth quarter.

The more personal computing business (which includes the Windows operating system, devices, and gaming, among other businesses) beat expectations with a 14% year-over-year increase in revenue to $15.9 billion. The division's growth was largely due to increased sales of personal computers brought about by the recovery of the PC market. According to research firm IDC, the PC market grew 3.0% year-on-year in the second quarter of this year, the second consecutive quarter of growth.

In addition, it is worth noting that after the announcement of Microsoft's earnings report, Morgan Stanley cut Microsoft's target price from $520 to $506, and investment bank D.A. DAVIDSON also cut its target price to $475.

Huge investment raises concerns

In order not to fall behind in the artificial intelligence race, Microsoft has dropped a lot of money on infrastructure such as data centers.

According to the earnings report, Microsoft's capital expenditures (including server leases, etc.) jumped to $19 billion in the fourth fiscal quarter, up from $14 billion in the previous quarter, and also recorded a whopping 77.6% year-over-year increase. Cloud and AI-related spending accounted for almost all of that spending. For the entire fiscal year 2024, Microsoft's capital expenditures total $55.7 billion.

That number will increase in fiscal 2025, Hood said on the conference call. She noted, however, that the spending is necessary to support the demand on the AI services side, and that land and data centers are long-term assets that may not pay off for 15 years or more.

CEO Satya Nadella also said that Microsoft knows how to manage capital spending to build long-term assets. It will add equipment and increase the scale of data training as soon as it sees a signal of demand. "It's more about seizing opportunities," he said.

Rishi Jaluria of Royal Bank of Canada Capital Markets said, "I do think we could see a 'hole' in Microsoft's ability to monetize their AI investments and that their capex will grow faster than their revenue. " But at the same time, he also said that while it will take time to monetize AI investments, Microsoft has had experience with this kind of capex expansion (e.g., the expansion of Azure, Office, and X-Box), and he expressed confidence in CEO Nadella.

It's worth noting that the same sharp rise in capex is also being seen at Google's parent company, Alphabet. alphabet's earnings report last week showed that in the second quarter, the company's capex was a whopping $13.19 billion, almost double the $6.9 billion it spent in the same period a year ago. alphabet's stock price fell more than 5 percent last week.

Investors are increasingly worried that it will take longer than expected for the tech giants to see returns on their AI investments. As a result, shares of several companies that have yet to report earnings and have invested heavily in AI have fallen after hours.

Amazon and Meta, which are scheduled to report results on Wednesday, both fell nearly 1 percent, while Apple, which is scheduled to report results on Thursday, fell 0.5 percent.

Daniel Morgan, senior portfolio manager at Synovus Trust, said, "Wall Street doesn't have a lot of patience. They see you spending billions of dollars and they want to see revenues increase as well."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.