U.S. revises down Q1 GDP annualized growth rate due to imports and inventory

Data shows that the decrease in imports dragged down first-quarter economic growth by more than 1 percentage point, while the reduction in business inventories dragged it down by nearly 0.5 percentage points.

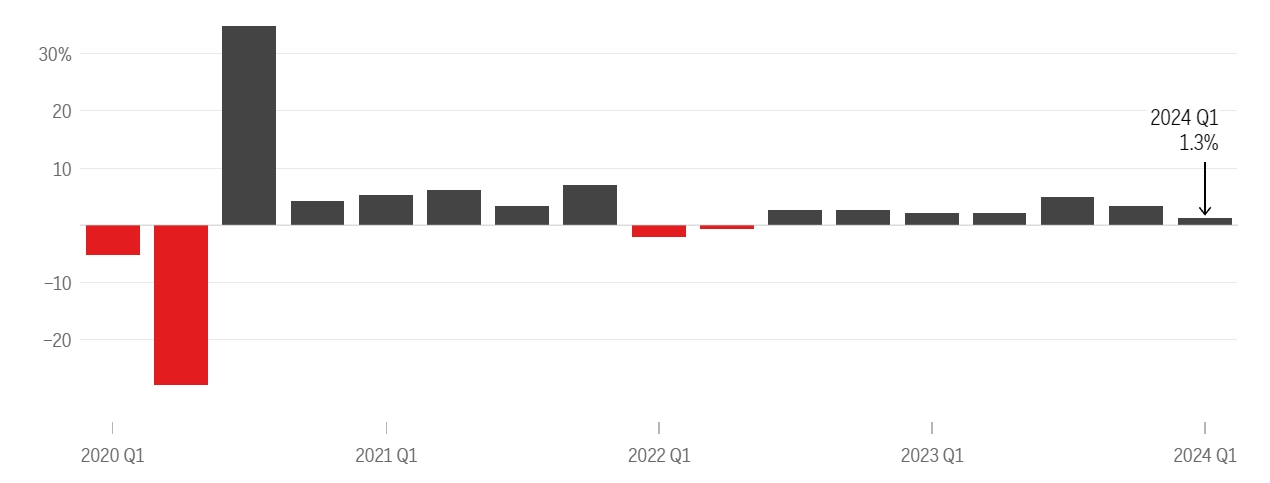

On May 30th, the United States released the revised GDP figures for the first quarter. The data showed that the revised annualized quarterly growth rate of the U.S. real GDP for the first quarter was 1.3%, lower than the initial estimate of 1.6%, marking the weakest quarterly growth since the spring of 2022.

The decline in the data was mainly due to two factors: a surge in imports and a reduction in business inventories, both of which typically fluctuate within the quarterly range. The data indicated that the decrease in imports dragged down economic growth by more than 1 percentage point in the first quarter, while the reduction in commercial inventories dragged it down by nearly 0.5 percentage points.

In addition, U.S. consumer spending was also not optimistic, falling from the initial data of 2.5% to 2.0%, and this figure drives over 70% of the U.S. economy. Among these, spending on goods such as appliances and furniture fell at an annual rate of 1.9%, the largest quarterly decline since 2021.

The services sector, which performed better, still grew healthily at a rate of 3.9%, the highest since mid-2021. Driven by housing, software, and R&D, U.S. business investment growth added more than 1 percentage point to the annual economic growth rate for the first quarter.

Many signs indicate that under high interest rates, the U.S. economy has begun to weaken, with more and more Americans falling behind on credit card bills. Hiring is slowing, and companies are posting fewer job vacancies. More companies, including Target, McDonald's, and Burger King, are emphasizing discounts or cheaper offers to attract cash-strapped consumers.

In terms of inflation, the Fed's preferred measure, the revised annualized quarterly rate of the U.S. Q1 PCE Price Index, recorded 3.3%, slightly below the initial forecast of 3.4%. Excluding food and energy, the revised annualized quarterly rate of the U.S. Q1 Core PCE Price Index recorded 3.6%, also below the previous forecast of 3.7%.

After the data was released, the dollar immediately came under pressure. Market sentiment for rate cuts rose, with traders increasing bets on rate cuts in September and December.

Bill Adams, Chief Economist at Comerica Bank, believes that the impact of the Fed's tight interest rate policy is clearly visible in the first-quarter GDP report. He particularly noted that the purchase of long-term durable goods is declining sharply.

Rubeela Farooqi, Chief U.S. Economist at High Frequency Economics, also said that the Fed's delay in cutting rates to address persistent inflation could negatively impact consumption and economic growth trajectories in the coming quarters.

However, some institutions believe that the Fed's anti-inflation path is "not yet stable."

Commentary suggests that although the overall consumer price increase in the U.S. slowed in April, inflation rates in four major metropolitan areas rose to their highest levels in a year or more. In April, the CPI in the Philadelphia area rose 4.1% year-over-year, St. Louis rose 4%, and both New York and San Francisco rose 3.8%, all higher than the national average.

Fidelity Securities stated that according to past experience, it generally takes 2-3 instances of data decline for the Fed to act, so the market is just one step ahead. Previously, there was excessive betting on rate hikes, and now as long as the data does not exceed expectations, it is a good thing, leading to some correction.

Jason Pride, Director of Investment Strategy and Research at Glenmede, said that the April inflation data laid the preliminary foundation for the Fed to cut rates later this year but did not put the Fed on the path to start cutting rates immediately. Several more reports are needed to gain more confidence.

Invesco believes that based on Powell's recent remarks, the Fed may announce the first rate cut in September. However, if the anti-inflation process continues in May and June, the Fed may act earlier than the market expects and start cutting rates in July. If inflation proves more stubborn than expected, the Fed may also delay rate cuts beyond September.

Regarding this data, Chicago Fed President Austan Goolsbee acknowledged that he was pleased to see inflation slow down in April but noted that it was still higher than in the second half of last year. He believes there is further room for inflation to decline and hopes to see more such reports before supporting rate cuts.

The report released yesterday is the second of three estimates by the Fed on first-quarter economic growth. On July 25th local time, the U.S. Department of Commerce will release the first estimate of the second quarter's economic performance. According to the Atlanta Fed's forecasting tool, U.S. economic growth in the second quarter is expected to reach 3.5%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.