uSMART gold teaching | 3 most cost-effective methods of gold

After successfully applying for the USMART securities account, you can start trading as long as you remit real funds to participate in investment opportunities in global securities markets and financial derivatives.。This article demonstrates the Singapore Bank eGIRO, Wise and bank wire transfer three ways to enter the gold uSMART, and also lists the entry and exit fees and precautions, followed by doing can easily deposit funds to start investing!

After successfully applying for an Infront uSMART account, you only need to remit real funds to start trading, participate in global markets and financial services opportunities。

This article shares with you the complete process of uSMART gold deposit, the whole process of using uSMART APP online operation, with a multi-graphic hand part to take you once to get the gold deposit process, and finally the chromosome selected the most economical and convenient way of gold deposit, quickly look down!

▍ How to get into gold uSMART?

uSMART opens branch in Singapore to handle Southeast Asia business。The accounts registered by users in Xinma are all launched by uSMART Securities Singapore, managed by the Singapore branch, and the funds are mainly dispatched by the Bank of Singapore.。

uSMART currently has six main methods of deposit, namely eGIRO deposit, Paynow deposit, FAST deposit, Wise deposit, BigPay deposit, and bank wire deposit.。However, depending on the deposit to cash, only partial deposits can be used。

Currencies supported for transfer to users include USD, SGD, HKD。

Chairman of SGD:

- Online transfer

- Current Amount

- quickly

- Essentials

- Big payment

- Bank Wire Transfer (Telegraphic Transfer)

Deposit in other currencies (USD USD and HKD):

- Bank Wire Transfer (Telegraphic Transfer)

- Essentials

- Big payment

Note that uSMART does not accept cheques for deposit。

○ uSMART deposit method and cost comparison

uSMART bank account balance of 10,000,000 yuan, uSMART balance out of 100,000 cubic feet, equivalent to 100,000 yuan;.

The following is a summary of uSMART's deposit methods, support deposit to account currency, fees and arrival speed for easy reference and comparison.。

SGD (SGD)

| deposit currency | Deposit method | Arrival time | 费用 |

| Singapore Dollar (SGD) | Online transfer | Inside | 0 |

| Current Amount | 1 working day | 0 | |

| quickly | 1 working day | 0 | |

| Essentials | Depending on the situation | FEES FLOATING, TO BE DETERMINED BY WISE | |

| Big payment | Look at the speed of BigPay arrival. | Fees Floating, Set up by BigPay | |

| Current | 1 to 3 working days | Interbank Offered Rate |

US Dollar (USD) and Hong Kong Dollar (HKD)

| deposit currency | Deposit method | Arrival time | 费用 |

| US Dollar (USD) / Hong Kong Dollar (HKD) | Current | 1 to 3 working days | Fees fluctuate, ranging from approximately RM30 to RM100, depending on the actual bank charges. |

| Essentials | Depending on the situation | FEES FLOATING, TO BE DETERMINED BY WISE | |

| Big payment | Look at the speed of BigPay arrival. | Fees Floating, Set up by BigPay |

○ Which deposit method should be selected?

Remittance of SGD through the Bank of Singapore, fastest arrival (measured eGIRO is almost seconds to arrive) lowest cost (0 fees)。Assuming that you have a Singapore bank account, it is recommended that you give priority to using the Singapore Bank to remit SGD, and then transfer to USD or HKD through the uSMART built-in currency exchange function.。

No Singapore bank account, expect to consider using Wise or BigPay for deposit。Measured Wise to remit, arrive in US dollars, arrive in about 3 hours。In terms of fees, Wise charges lower fees than bank wire transfers because Wise international remittances do not need to cross transit banks, plus currency conversion rates are calculated at the mid-market rate (Mid-Market Rate), which is more favorable.。

If you are not in a hurry to make a deposit, consider these bank wire transfer (wire transfer) fees.。

Yingli Securities Official Exchange Group

If you want to get the latest offers, professional advice and event notifications for the first time, you are welcome to add our Yingli official group.。

▍ uSMART deposit matters needing attention

You can deposit money only after you have successfully opened an account.。

uSMART has no minimum or maximum evasion of deposit。

uSMART does not charge any fees at the time of deposit, but the use of bank wire transfer (Telegraphic Transfer, TT) or uSMART cooperation of third-party payment platform to top up the deposit, payment requires a specific fee。

In order to prevent money laundering activities, uSMART does not accept third-party deposits.。All deposit and withdrawal accounts must have the same name, otherwise the bank account name used for the transfer, the bank account name to which the remittance is made, and the request must have the same name as the uSMART account name.。

▍ uSMART into the gold process of teaching (multi figure)

Next, we will further teach and explain in detail three ways to encapsulate uSMART accounts in multi-graphic form, namely:

- Deposit RMB: Bank of Singapore

- eGIRO into the gold dollar: wise into the gold

- Deposit USD: Bank Wire Transfer (Telegraphic Transfer)

You can deposit gold through uSMART official website or uSMART APP. The following teaching will focus on uSMART APP and Chinese interface. You can complete the deposit action in about 5 minutes.。You can switch to Simplified Chinese or Chinese at any time。

The method is to click "Me" > "Settings" > "Language" > "Select the desired language"。

▍ eGIRO deposit process

- Deposit currency (example): SGD

- Name of shareholder: Bank account in Singapore

- Legal fees: $0

- Arrival time: within a few minutes

uSMART Securities Singapore's fund allocation is mainly based on Singapore banks, so the advantage of using Singapore banks to deposit funds is that they can be free of fees and arrive quite quickly.。

If you don't have a Singapore bank account and want to use this method of deposit, just write at home early to open a Singapore bank account CIMB SG, suitable for a Singapore bank account。

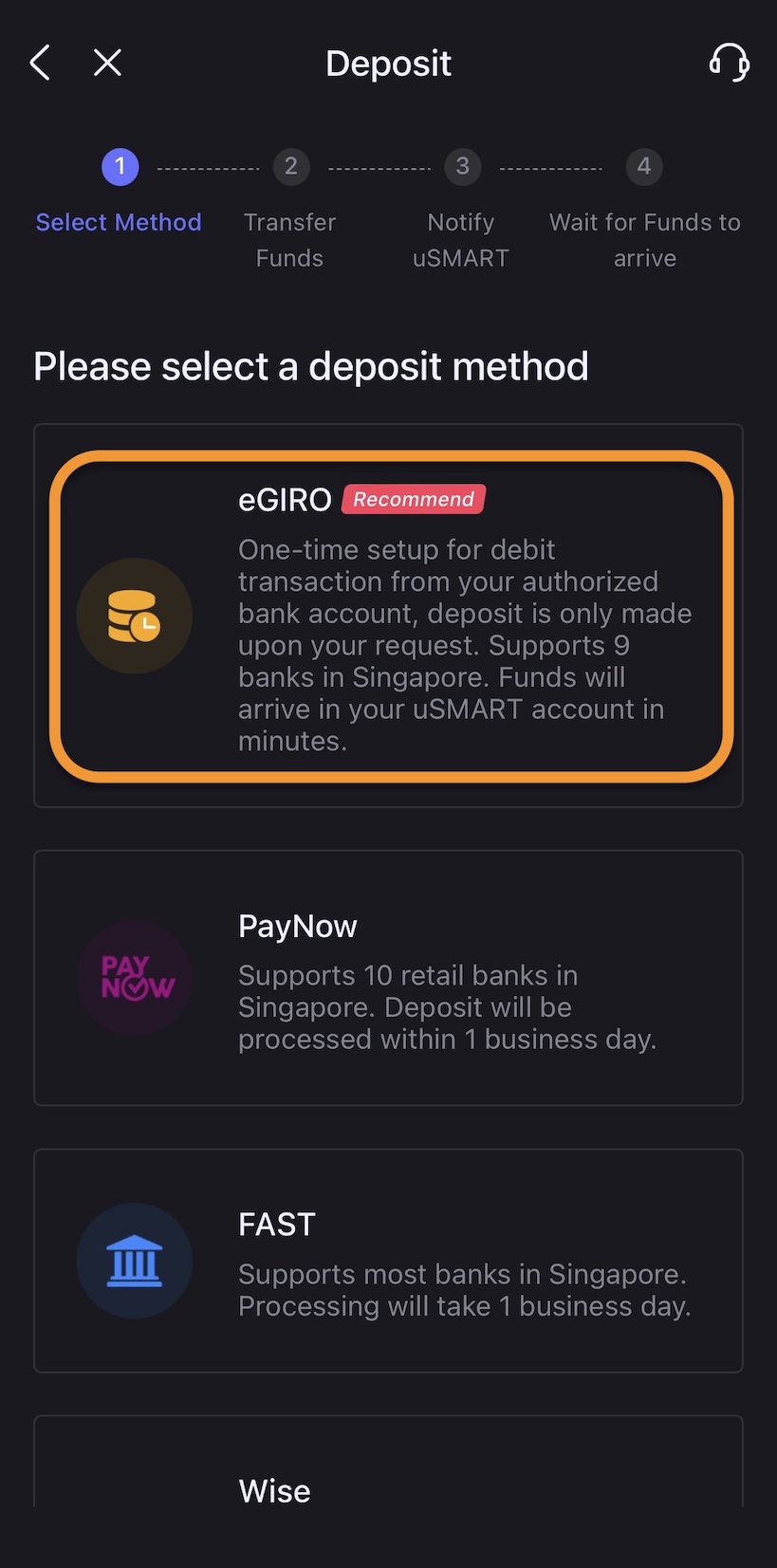

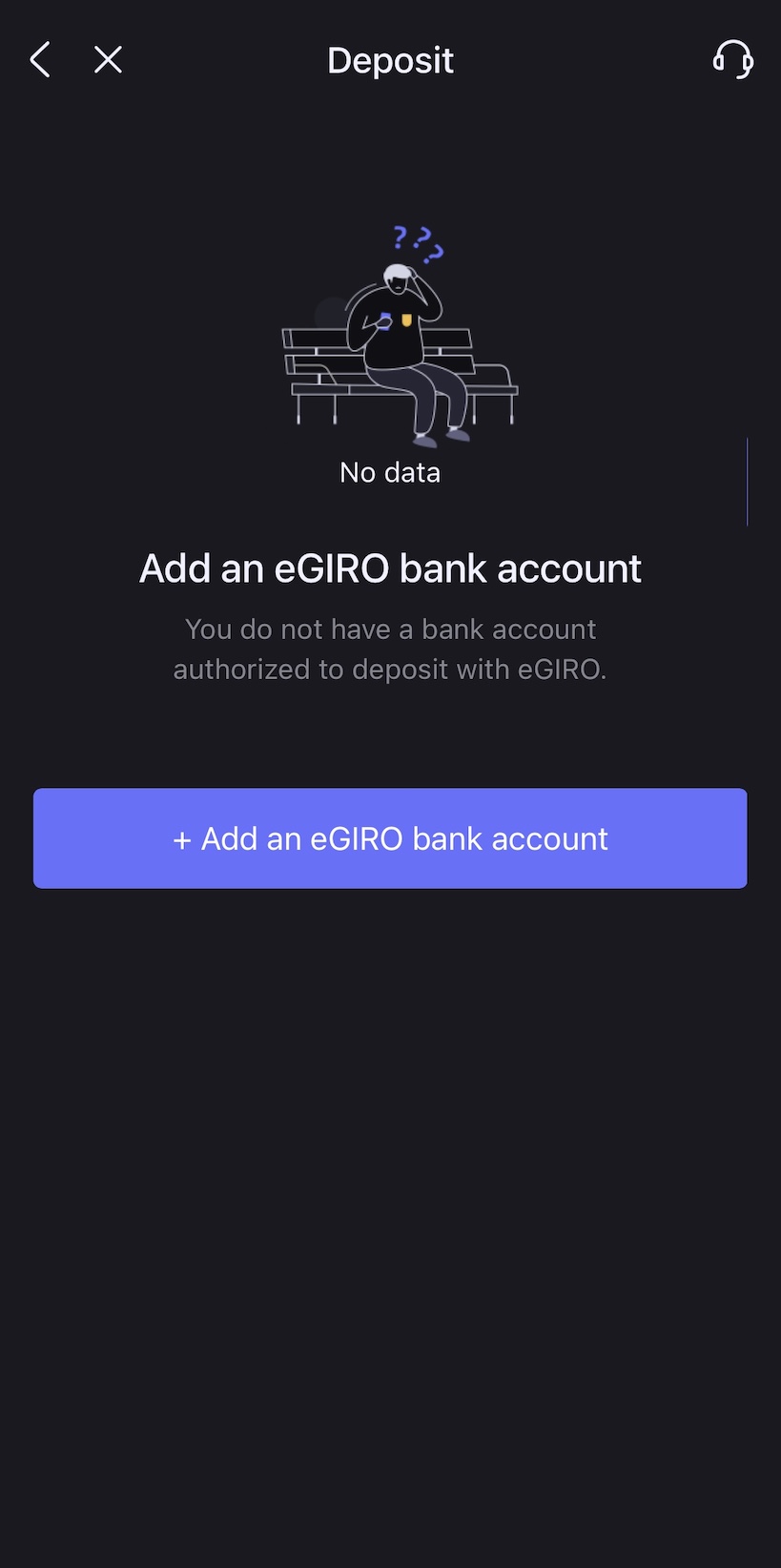

Step 1: Set up eGIRO

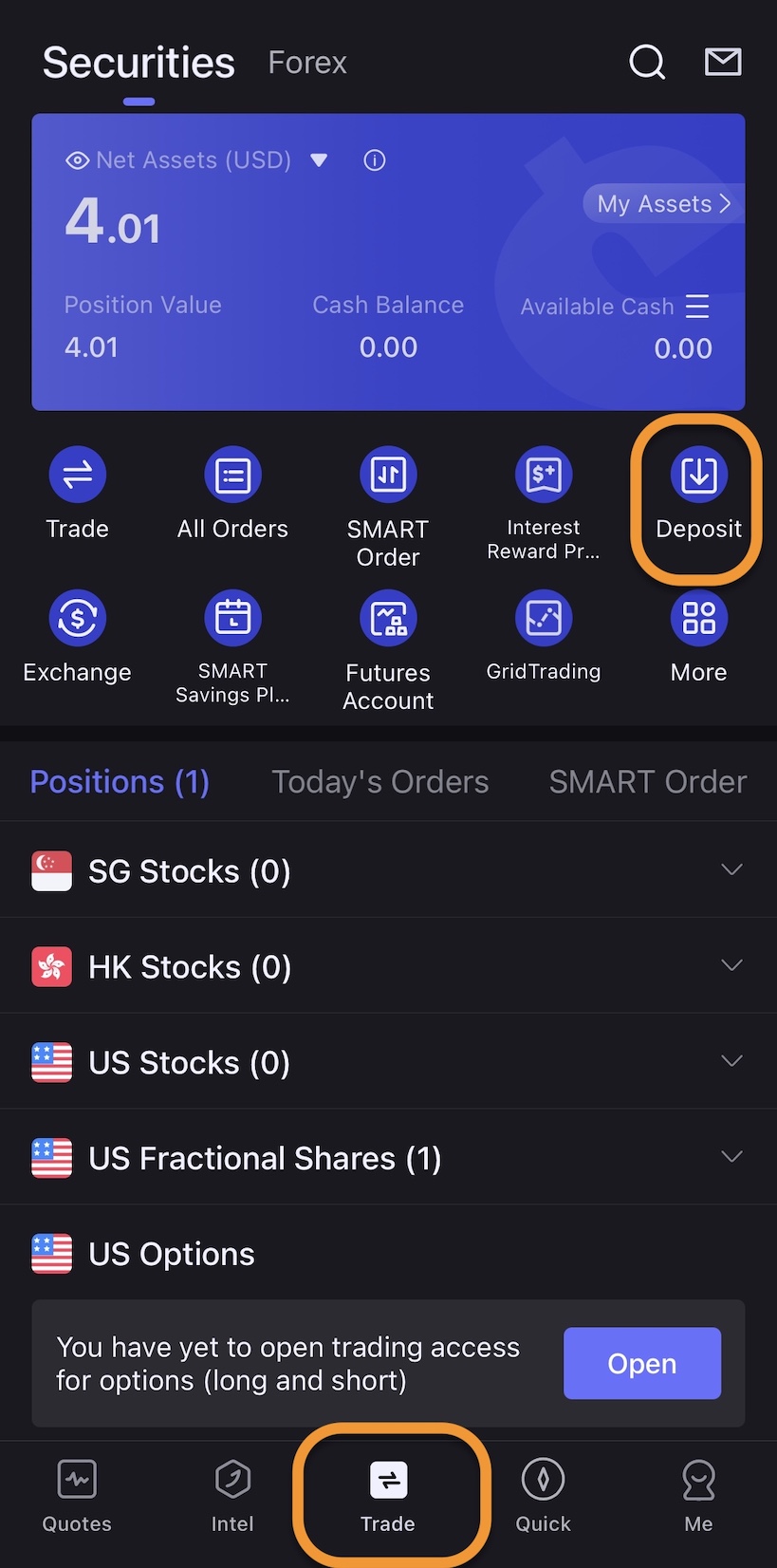

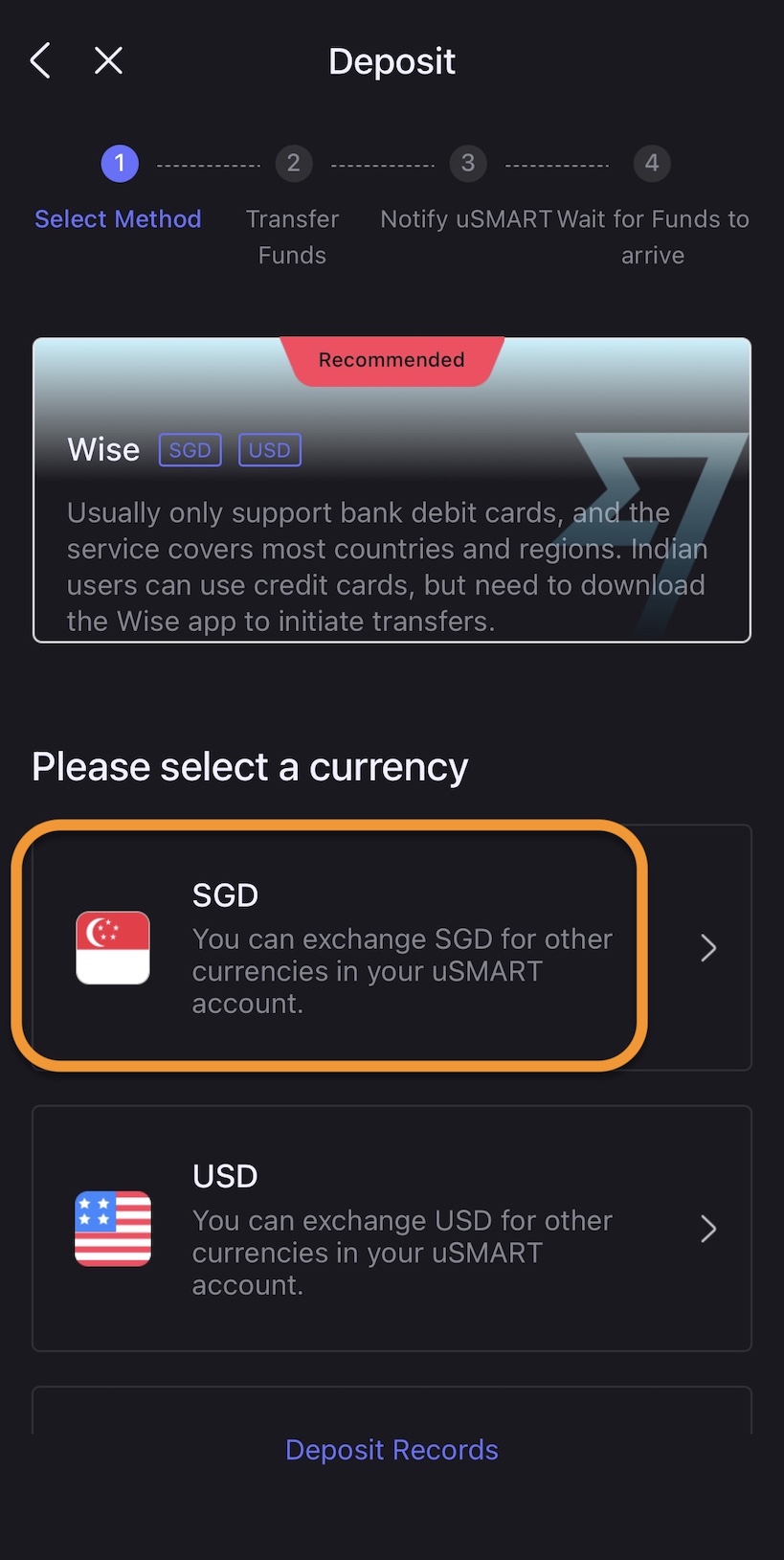

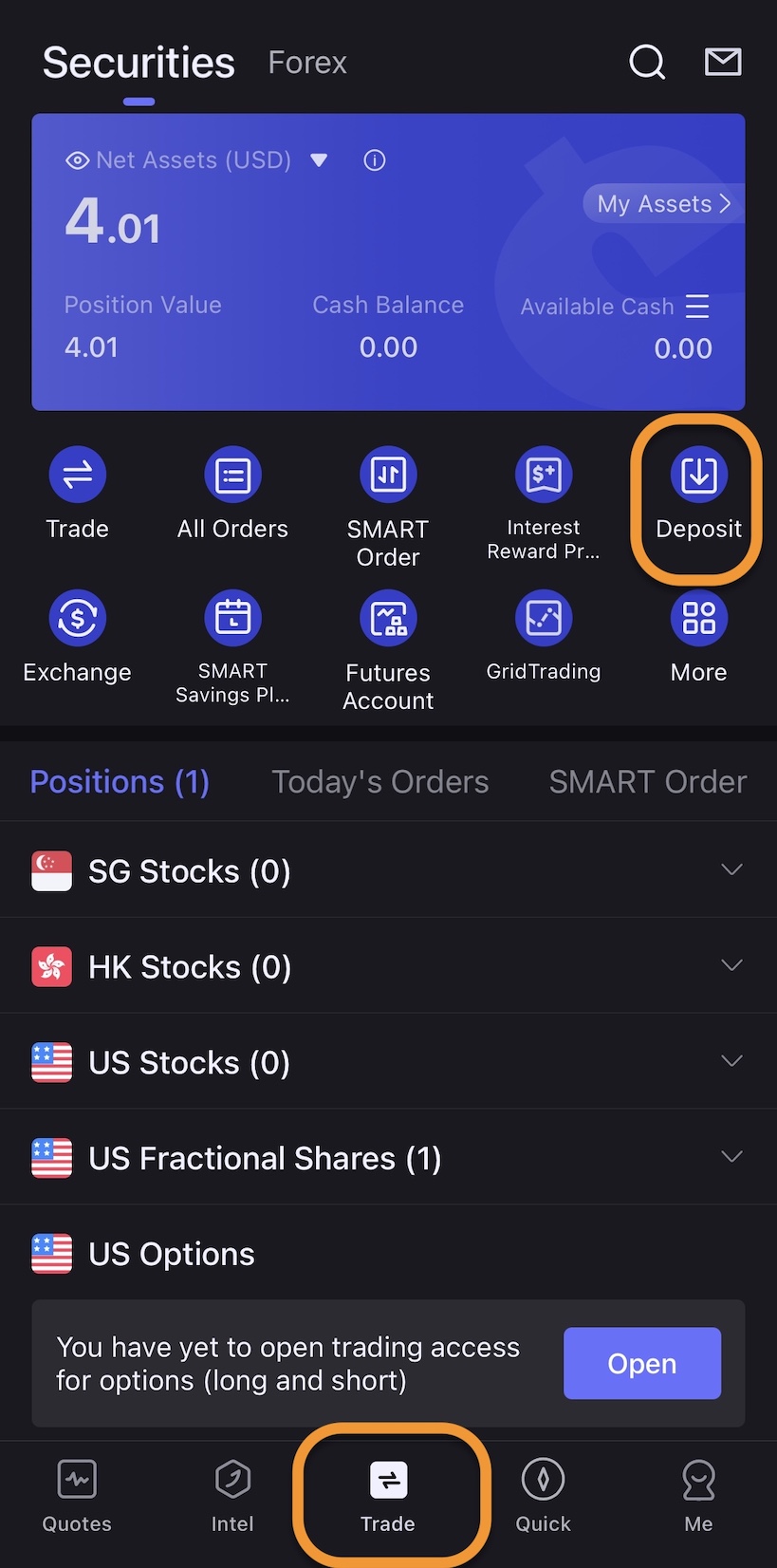

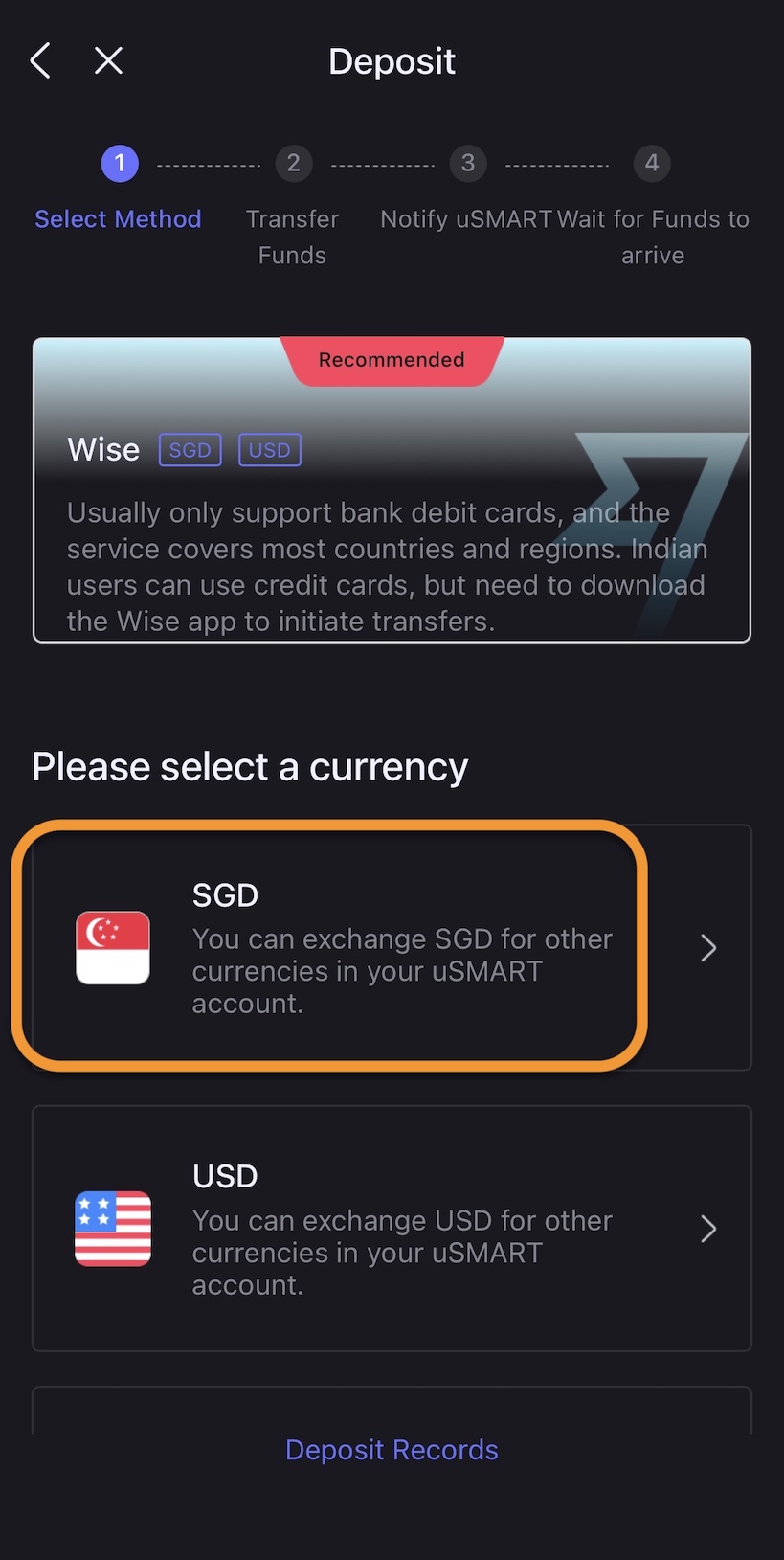

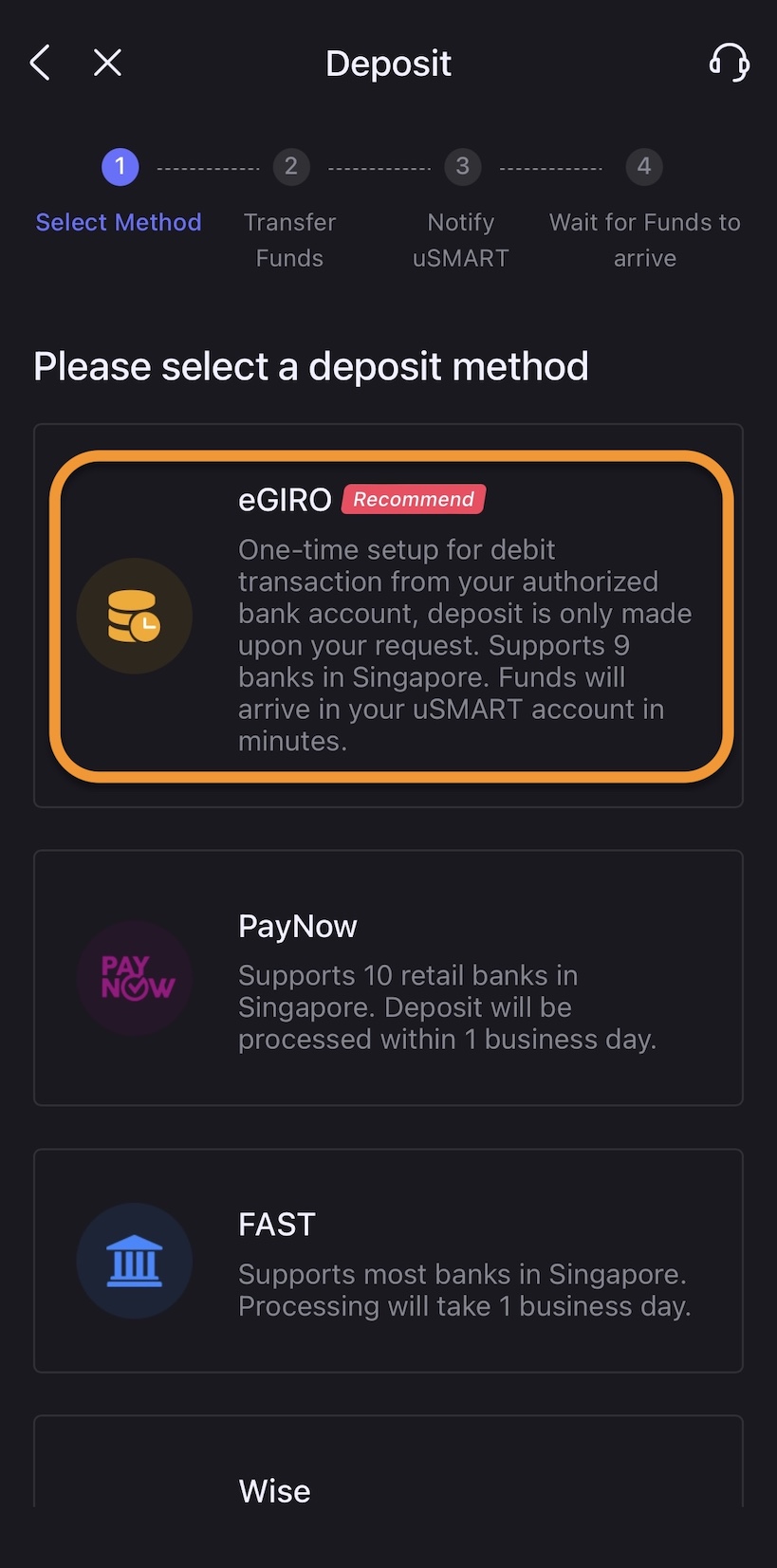

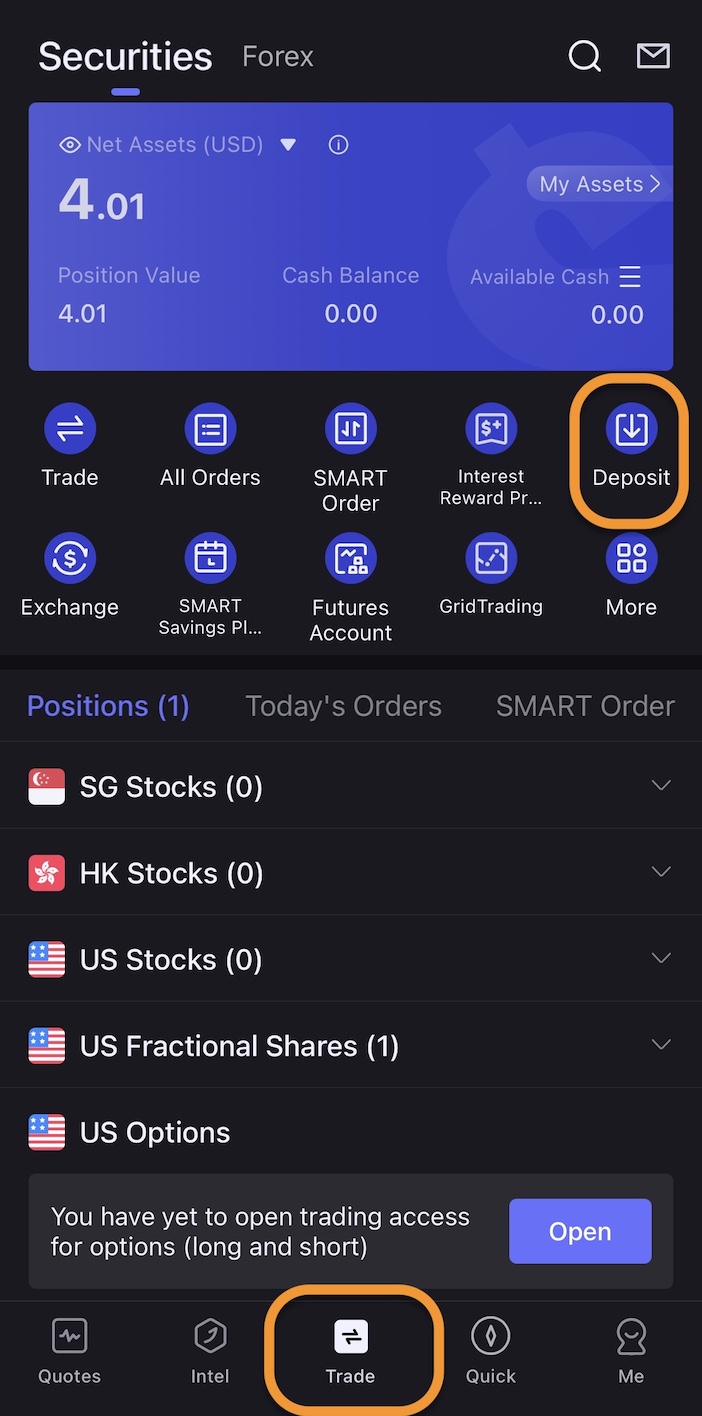

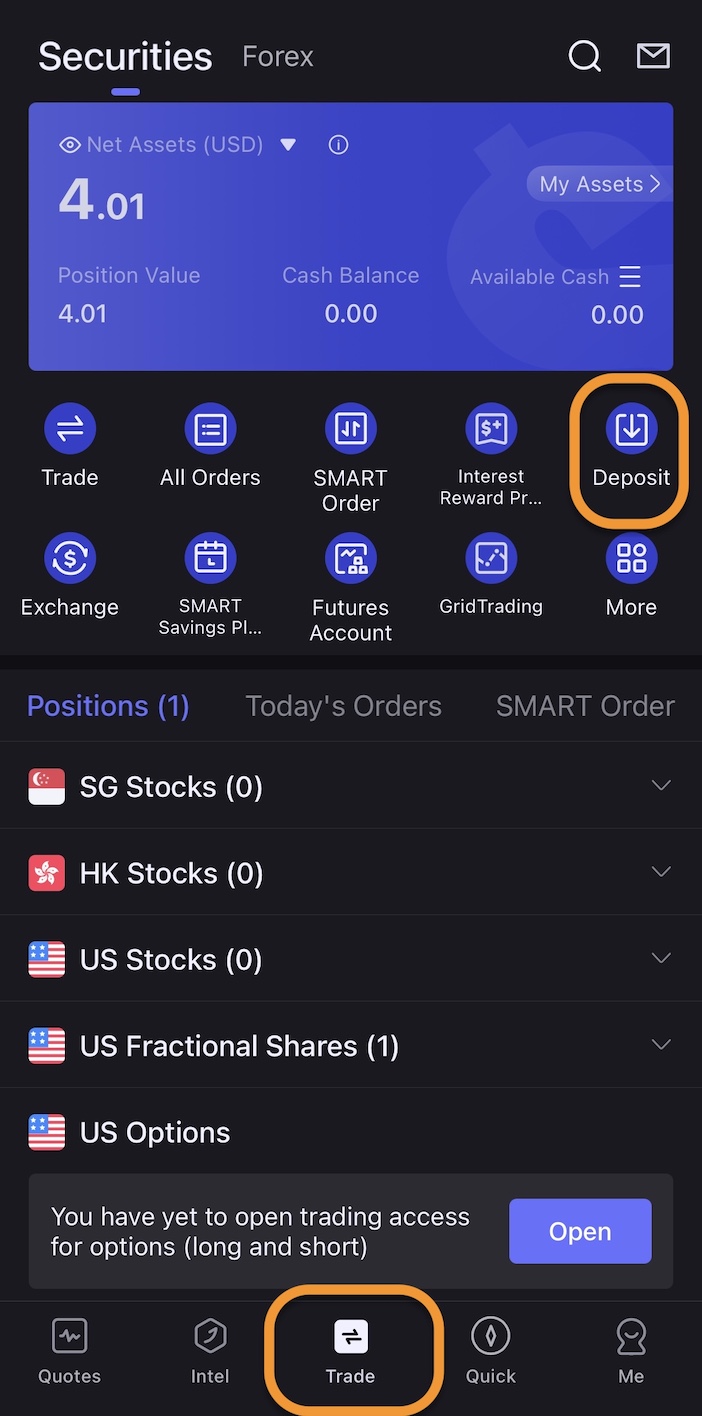

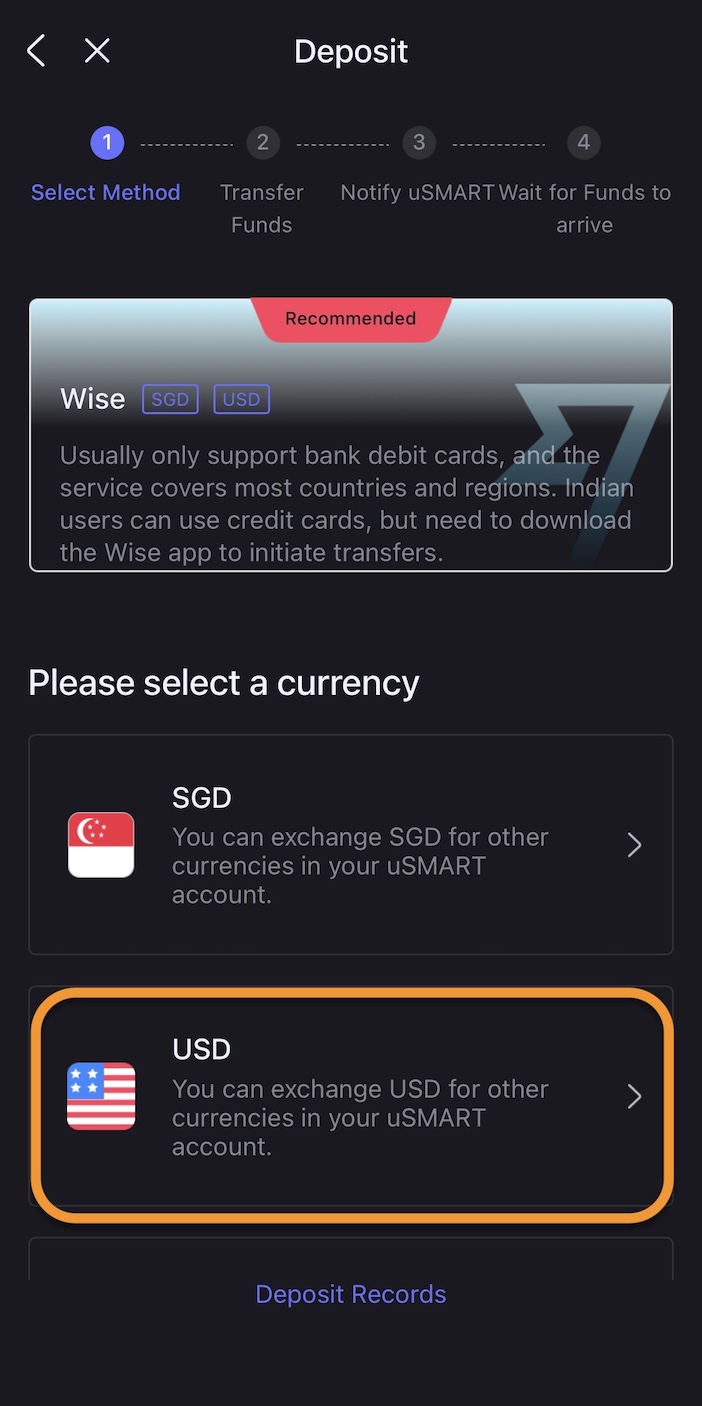

Log in to your uSMART account, click Transactions > Deposit, then select the deposit currency "SGD" (eGIRO only supports SGD), and then select the deposit method "eGIRO"。

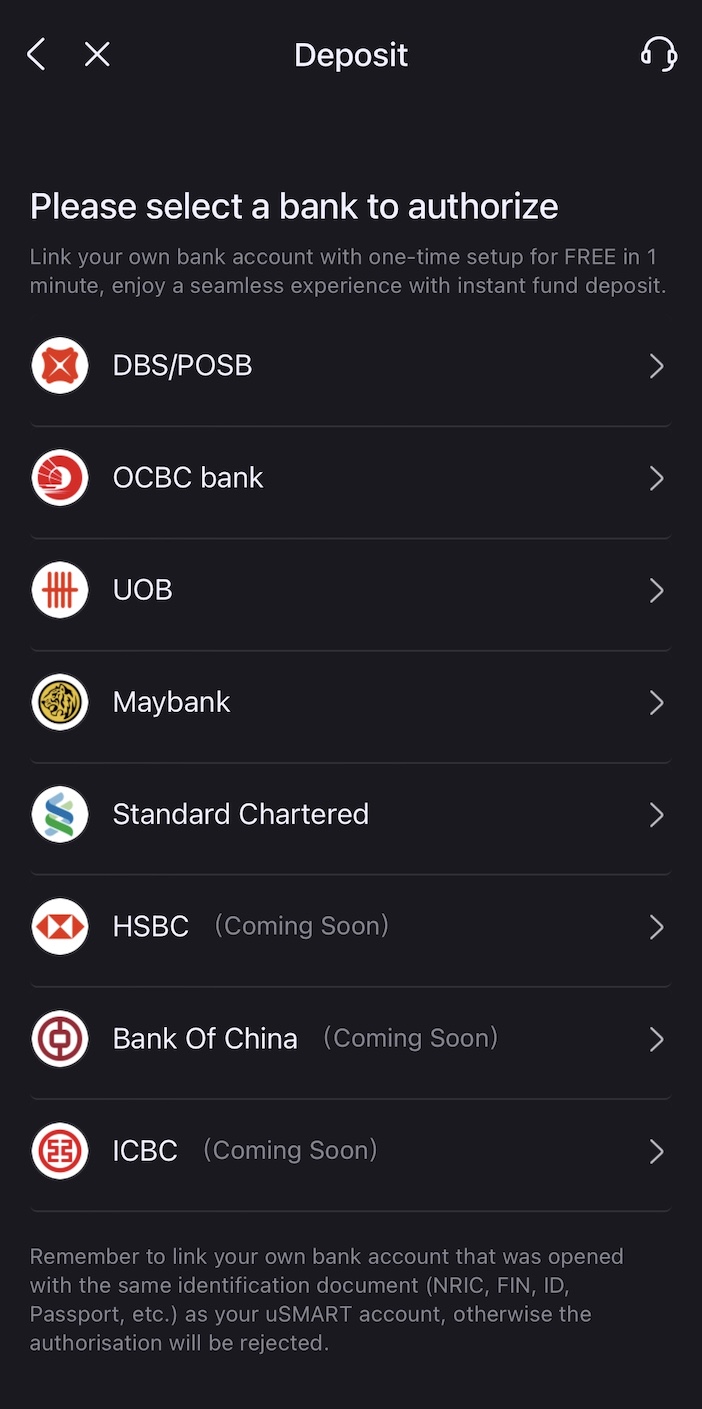

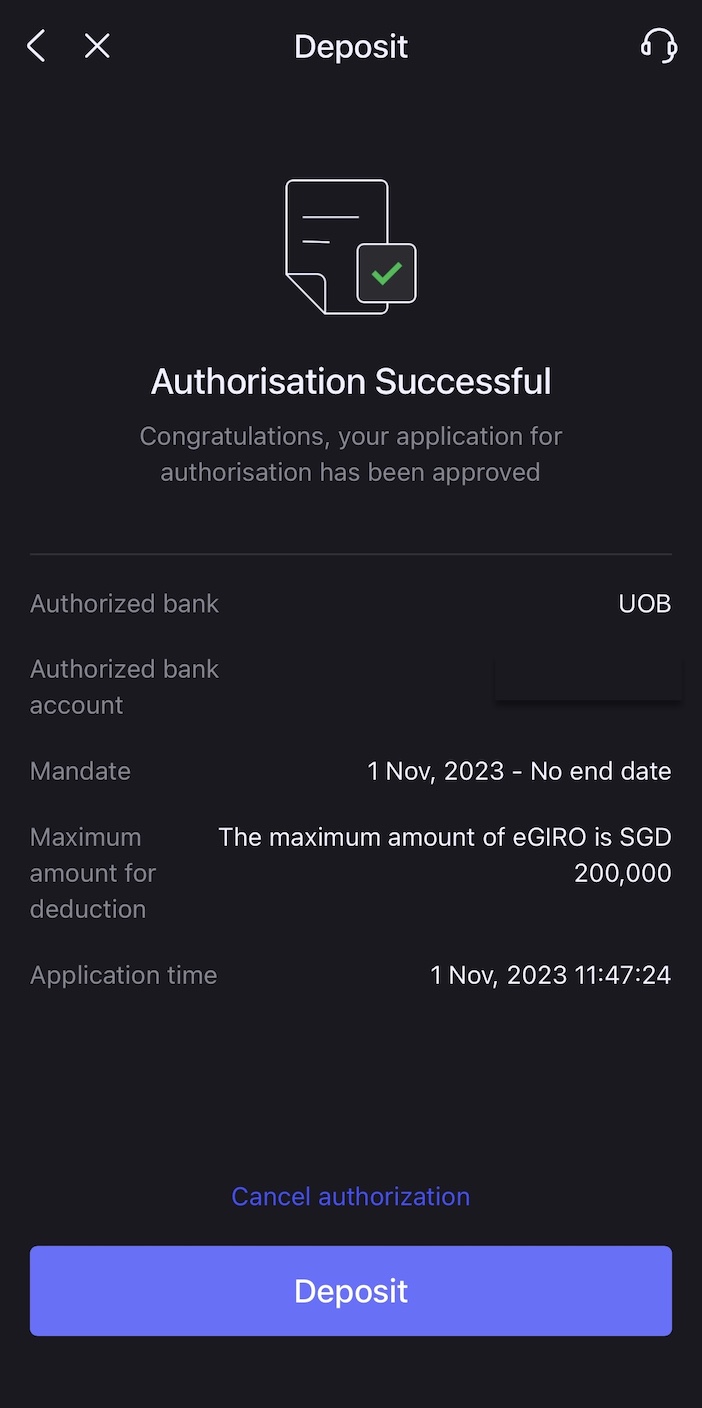

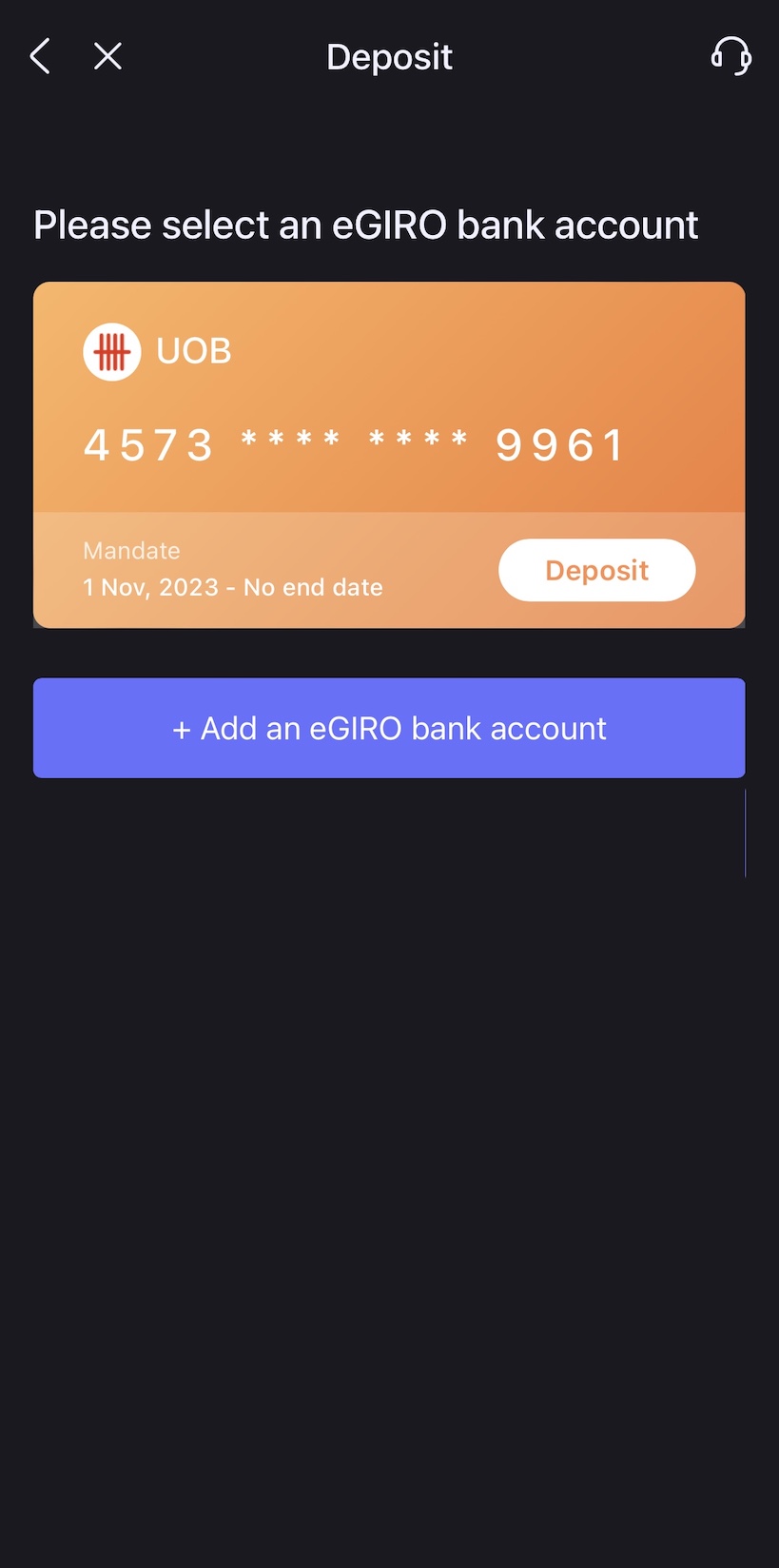

Click "Add eGIRO Bank Account" to add an eGIRO bank account, then select the eGIRO authorized bank and follow the bank's instructions to set up eGIRO。

Step 2: By eGIRO Credit Card

Click Transaction > Deposit > Select Deposit Currency "SGD" > Select Deposit Method "eGIRO" Same。

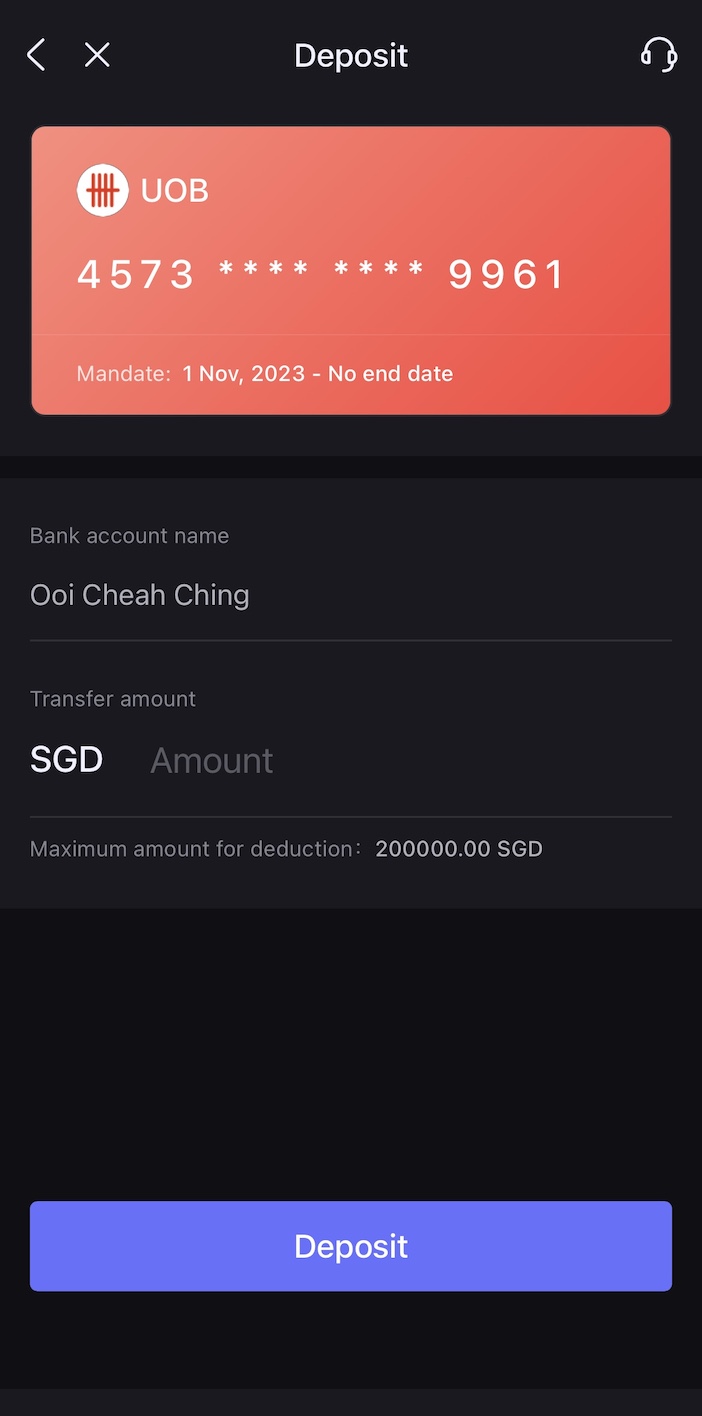

Select which Singapore bank account to transfer eGIRO。

Enter the deposit amount and click "Deposit"。Note that a single deposit is up to SGD 20,000。

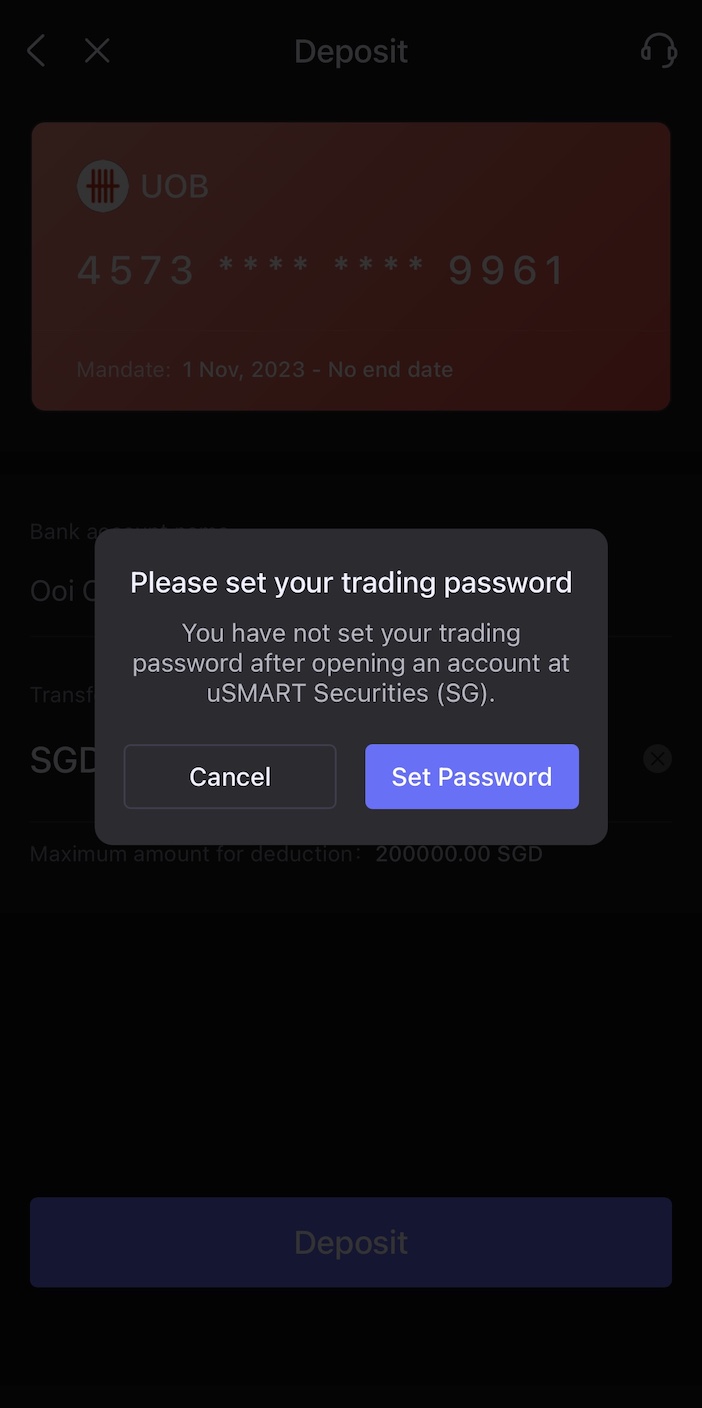

If you are the first deposit, the system will pop up to set the "transaction password transaction password" prompt window, set the password to complete the eGIRO transfer。

○ eGIRO deposit measurement

The team measured that the eGIRO transfer was initiated at 11 a.m. and the remittance was almost seconds to。

Wise Deposit Process

- Deposit currency (example): USD

- Applicable object: established Wise account

- Handling fee: uSMART handling fee 0 yuan, Wise business wire transfer fee

- Arrival Time: displayed when posting

Wise is an internationally renowned third-party remittance platform that specializes in cross-border remittances and features a peer-to-peer (Peer-to-peer) medium-to-peer arrangement for the scheduling of international funds.。The exchange rate is calculated using the important market rate (Mid-Market Rate), which is more favorable.。

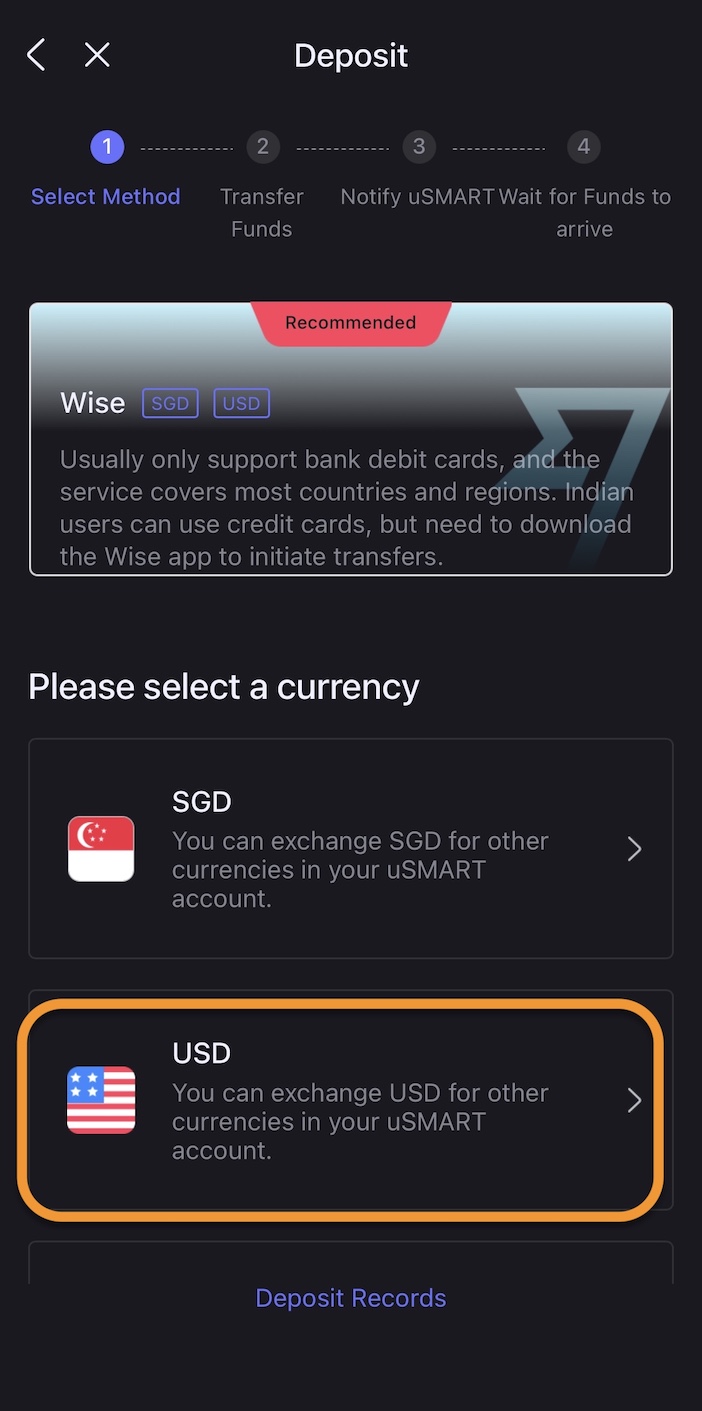

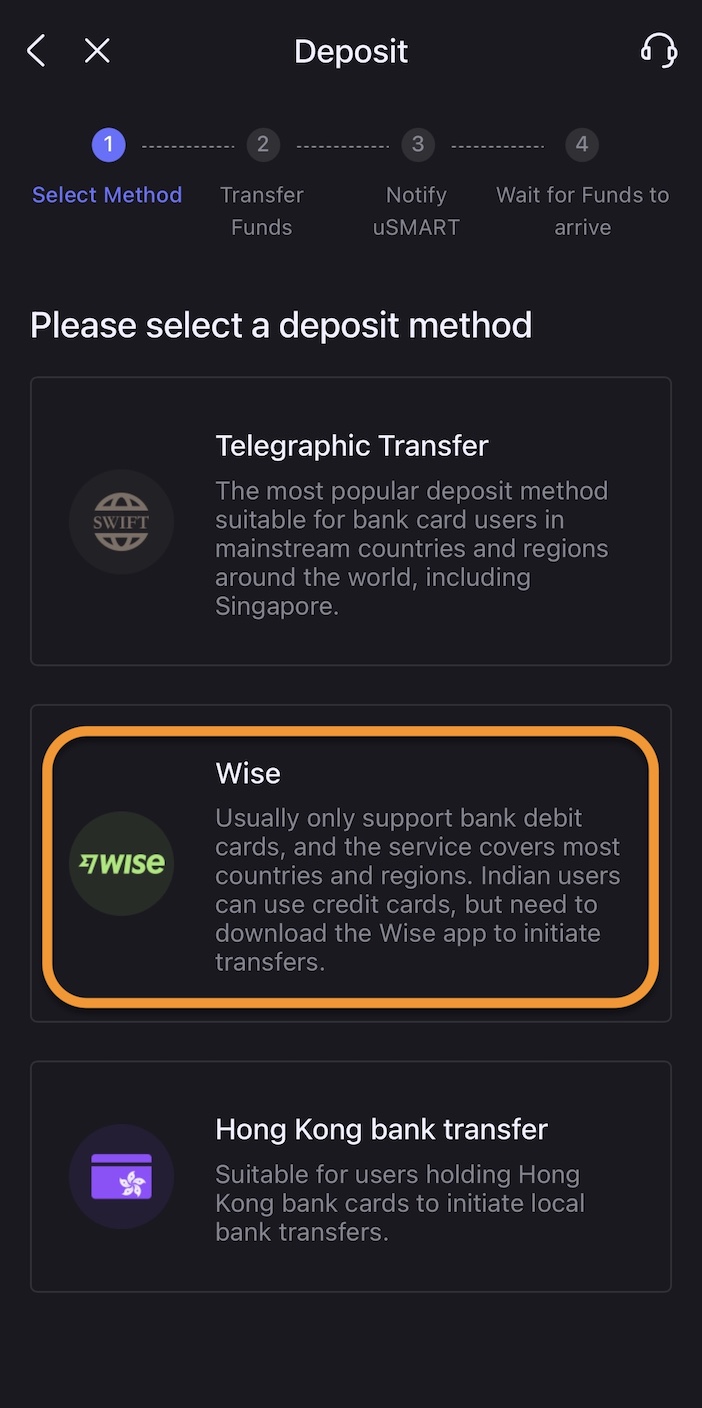

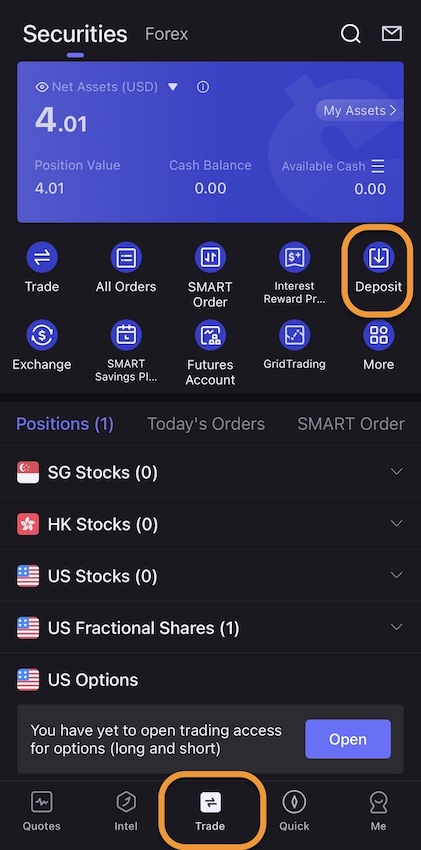

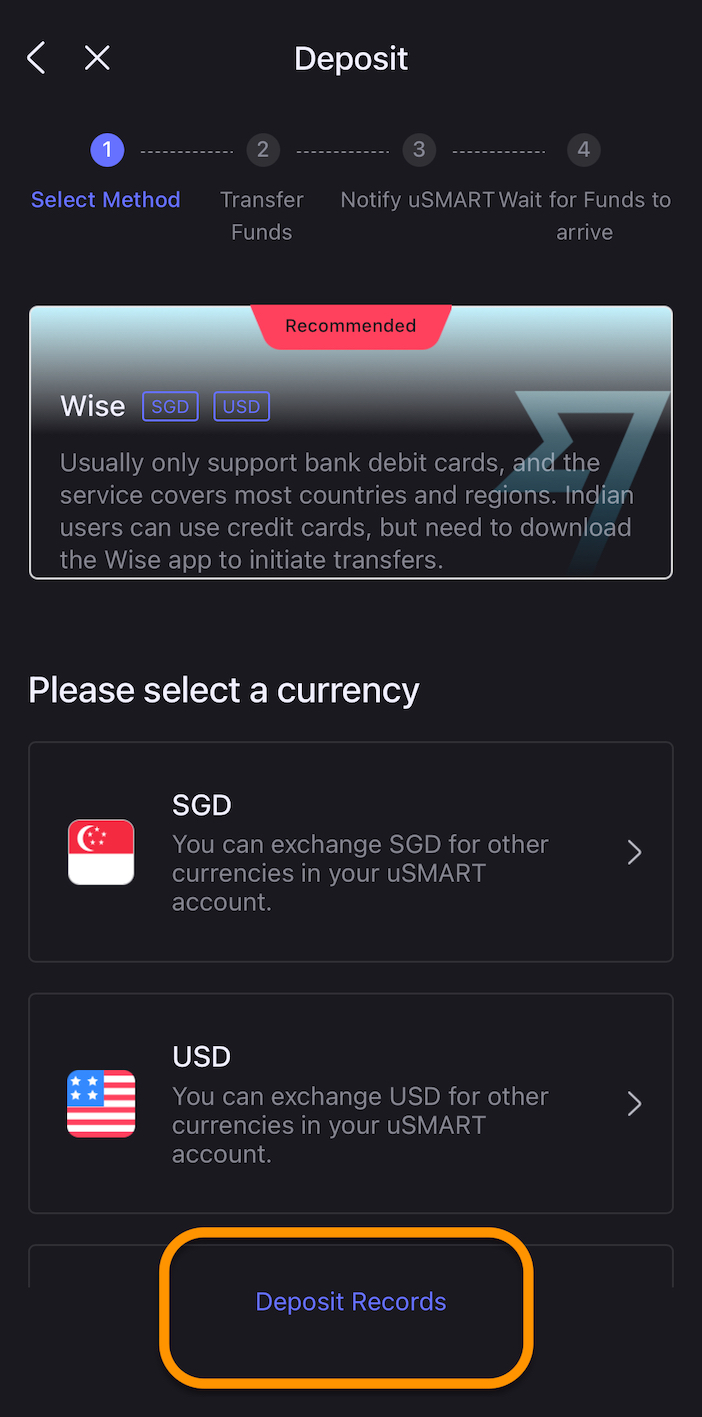

Step 1: Log in to your uSMART account and select Wise Deposit

Log in to your uSMART account, click Transactions > Recharge, then select the deposit currency "USD," and then select the deposit method "Wise"。

Or National Wise users can transfer money to JinWise accounts using banks in that country, and users in India can use credit cards to JinWise accounts.。

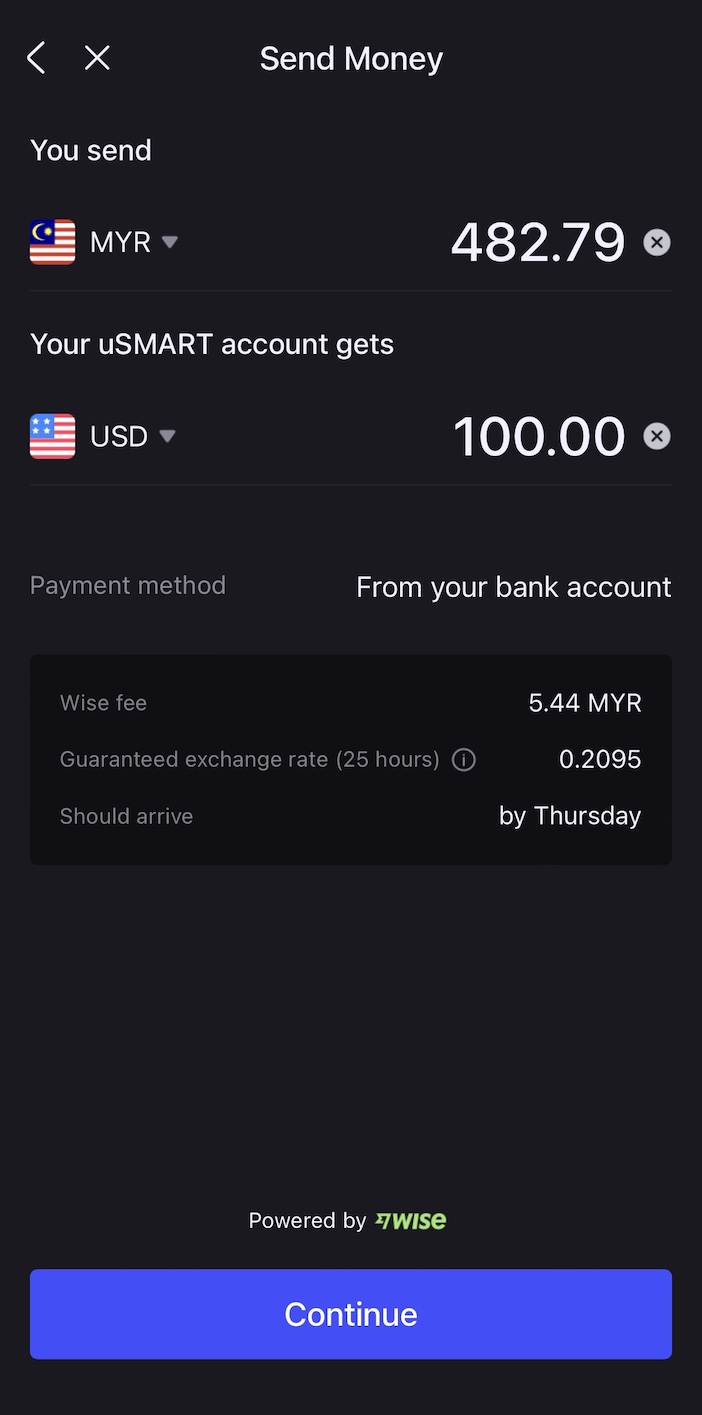

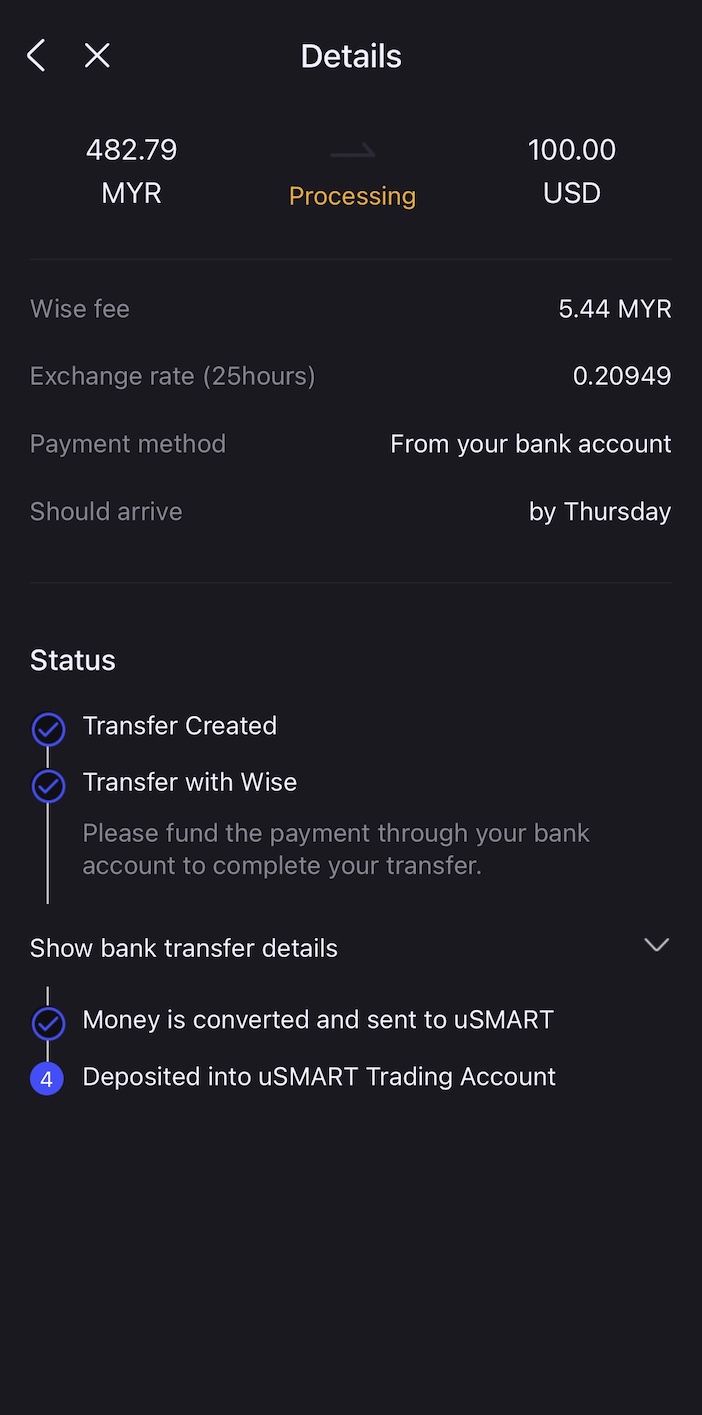

Step 2: Set the currency and amount of the deposit.

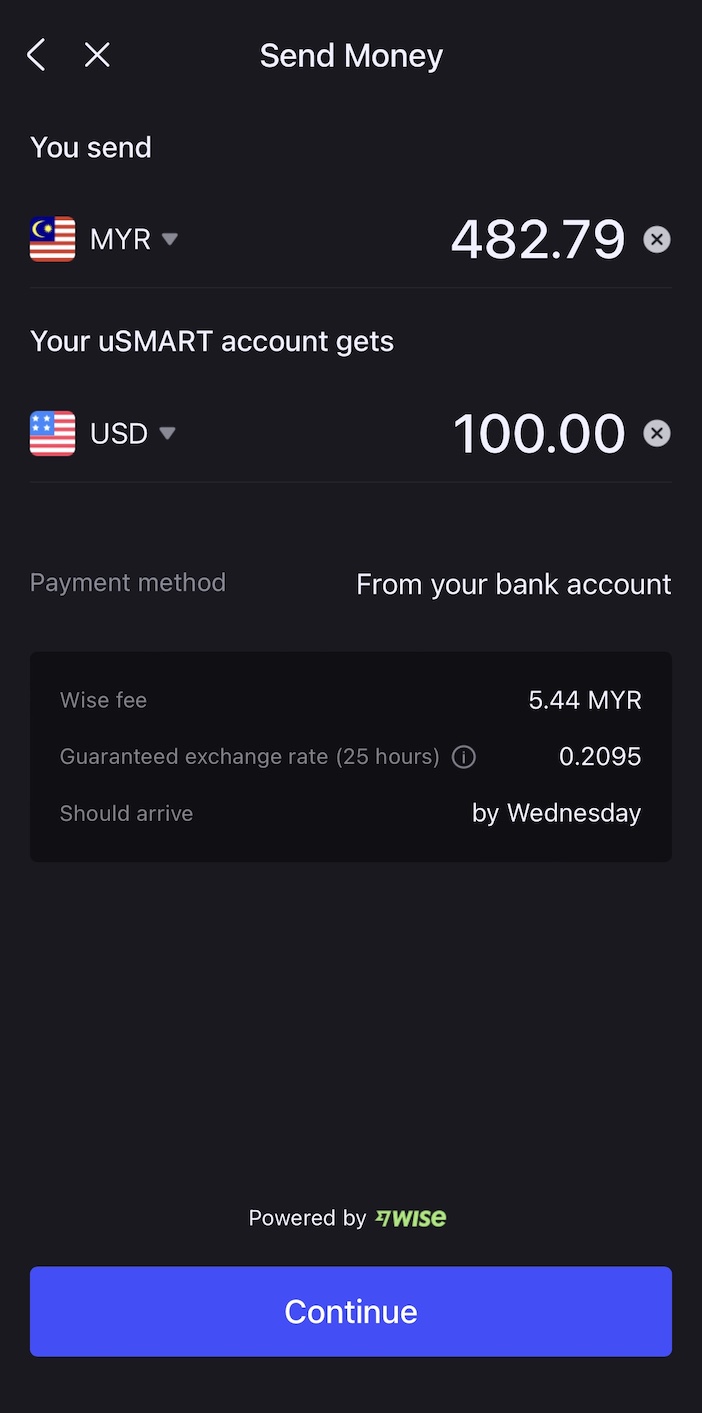

Select the currency and amount to use for this round。Currently support Wise payment currency: Manhattan (MYR), Hong Kong dollar (HKD), Singapore dollar (SGD), US dollar (USD), rupee (IDR), Australian dollar (AUD), New Zealand dollar (NZD), euro (EUR)。

Here we choose "MYR"。The final account currency for uSMART securities accounts is the United States dollar (USD)。

The system will automatically display the cost of the cash deposit account, the fixed exchange rate, and the time required.。

Click Continue to go to the next step。

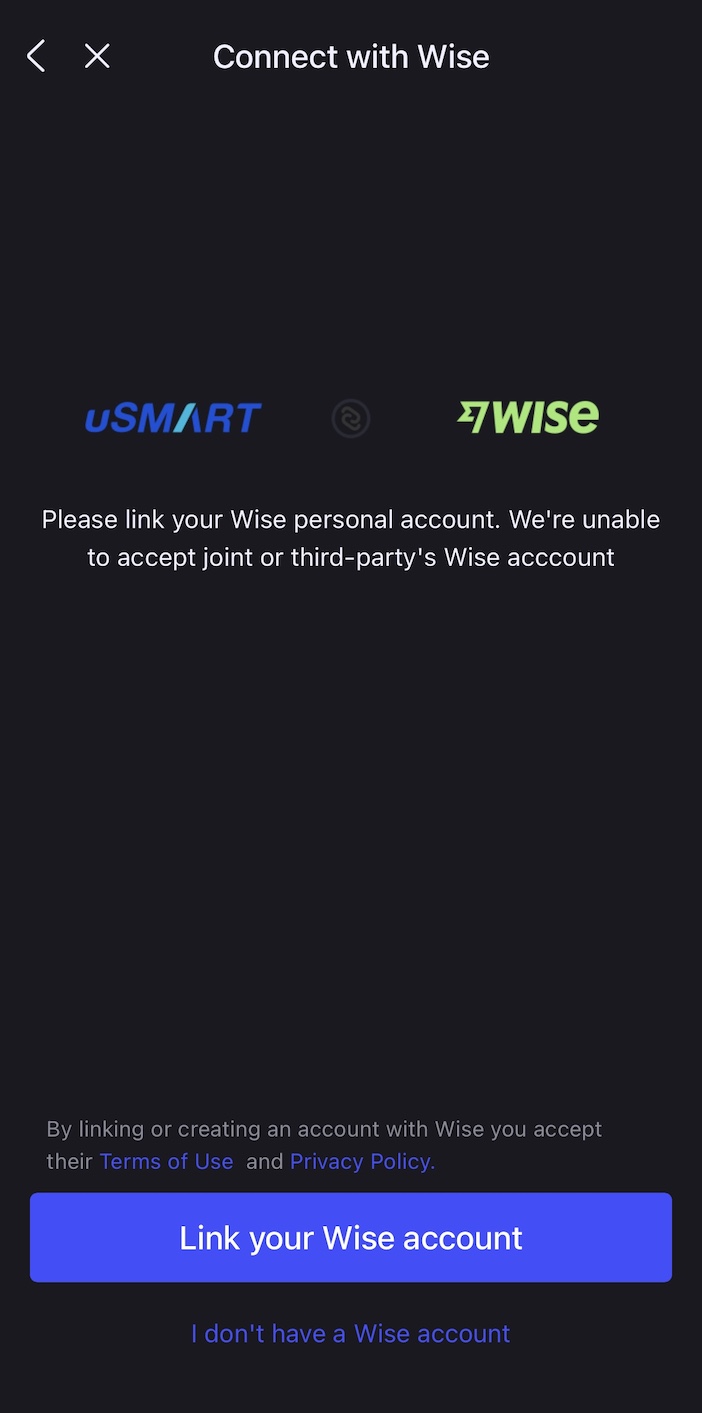

Step 3: Bind the Wise account (you must do it for the first time)

For the first time, you need to bind a Wise account to a uSMART account.。Click "Link your Wise account" to confirm the binding of your Wise account, the system will jump to the Wise login page, enter your email and password, login account。

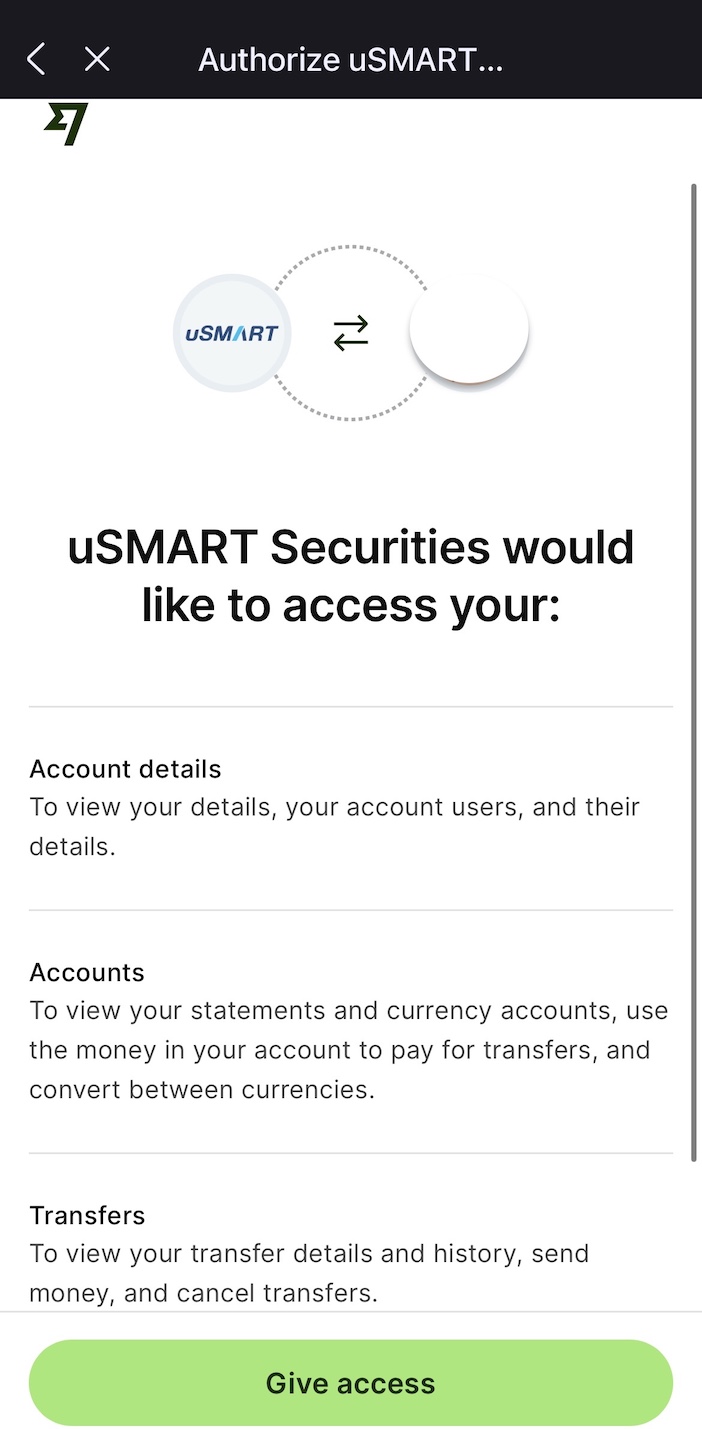

Wise asks if you confirm binding uSMART securities and agrees to allow uSMART to access your Wise account information, use balances, foreign currency account balance payment transfers, etc.。Click "Grant Access"。

After the binding is completed, the system will automatically jump to the Wise deposit page of uSMART。

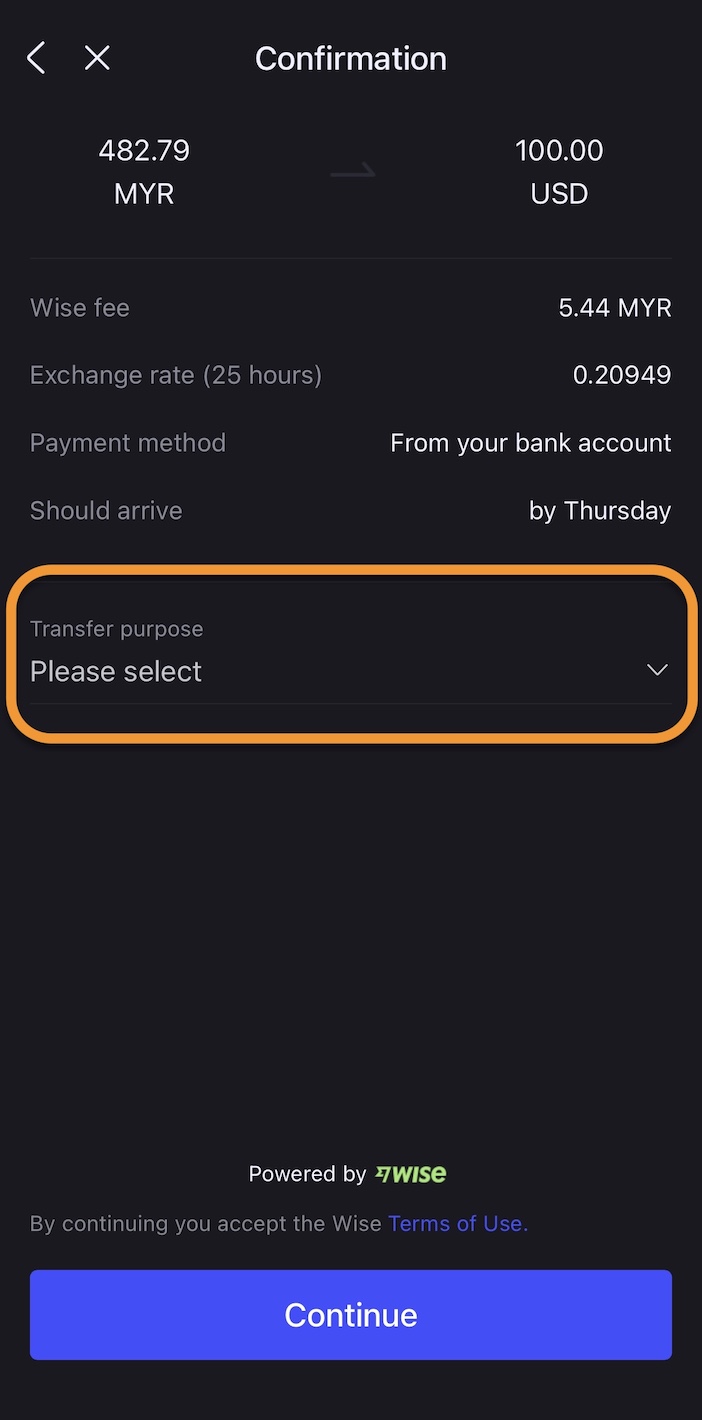

Step 4: Confirm the deposit information

After confirming the currency and amount of the deposit, click Continue。Continue to select the transfer purpose of this remittance purpose, and then click "continue"。

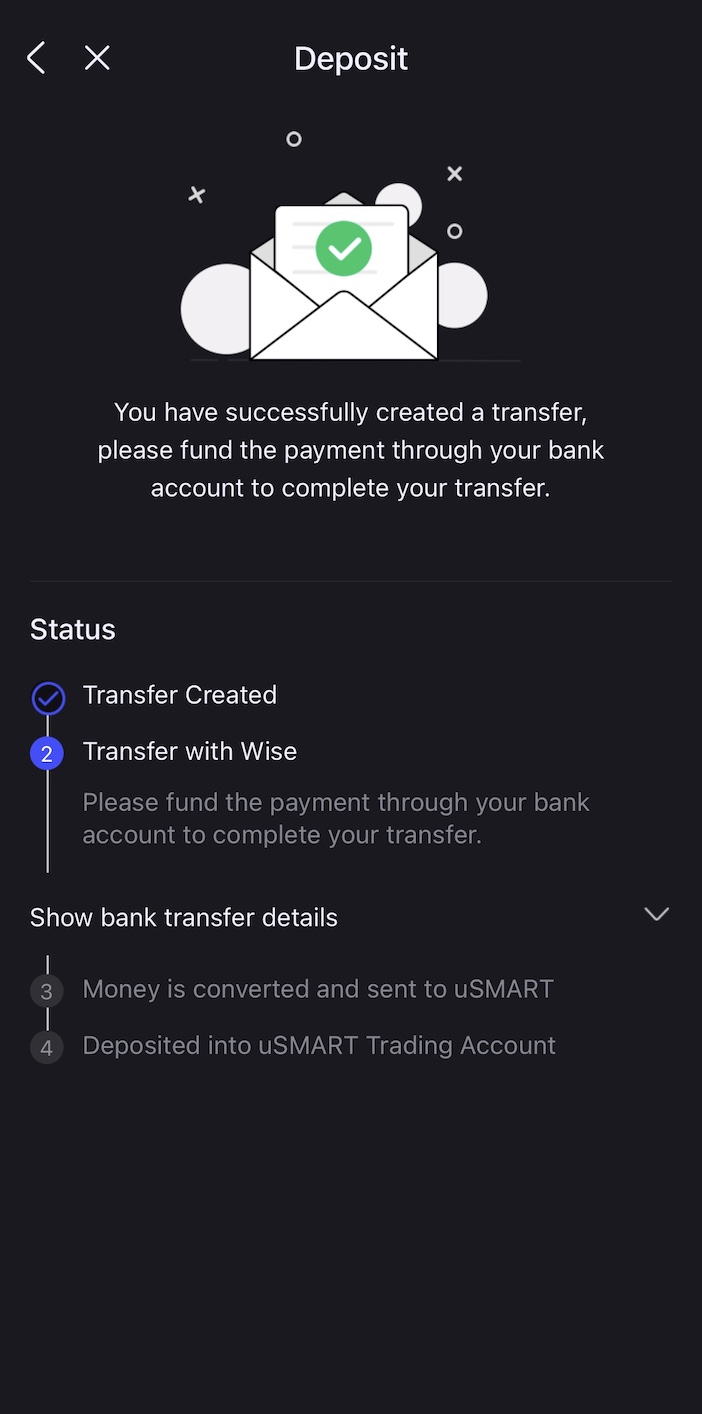

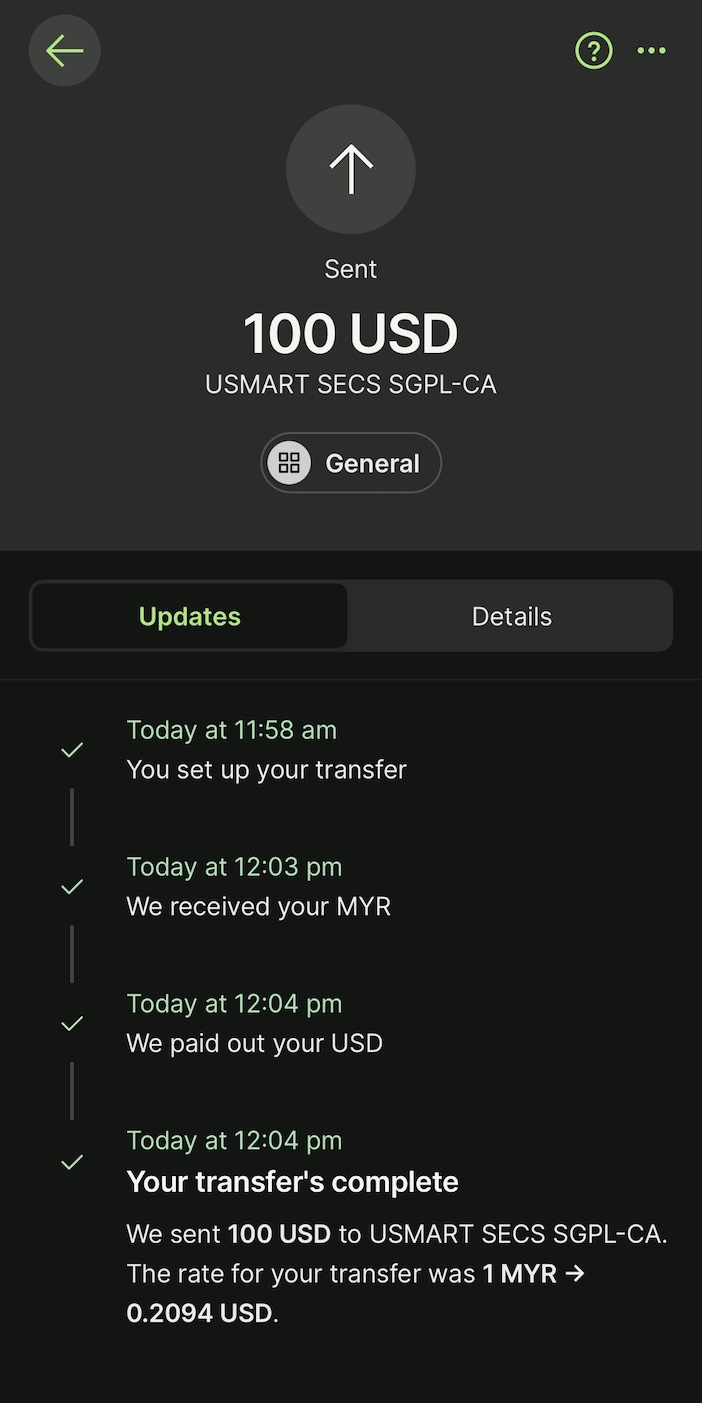

Step 5: Get daily information about Wise

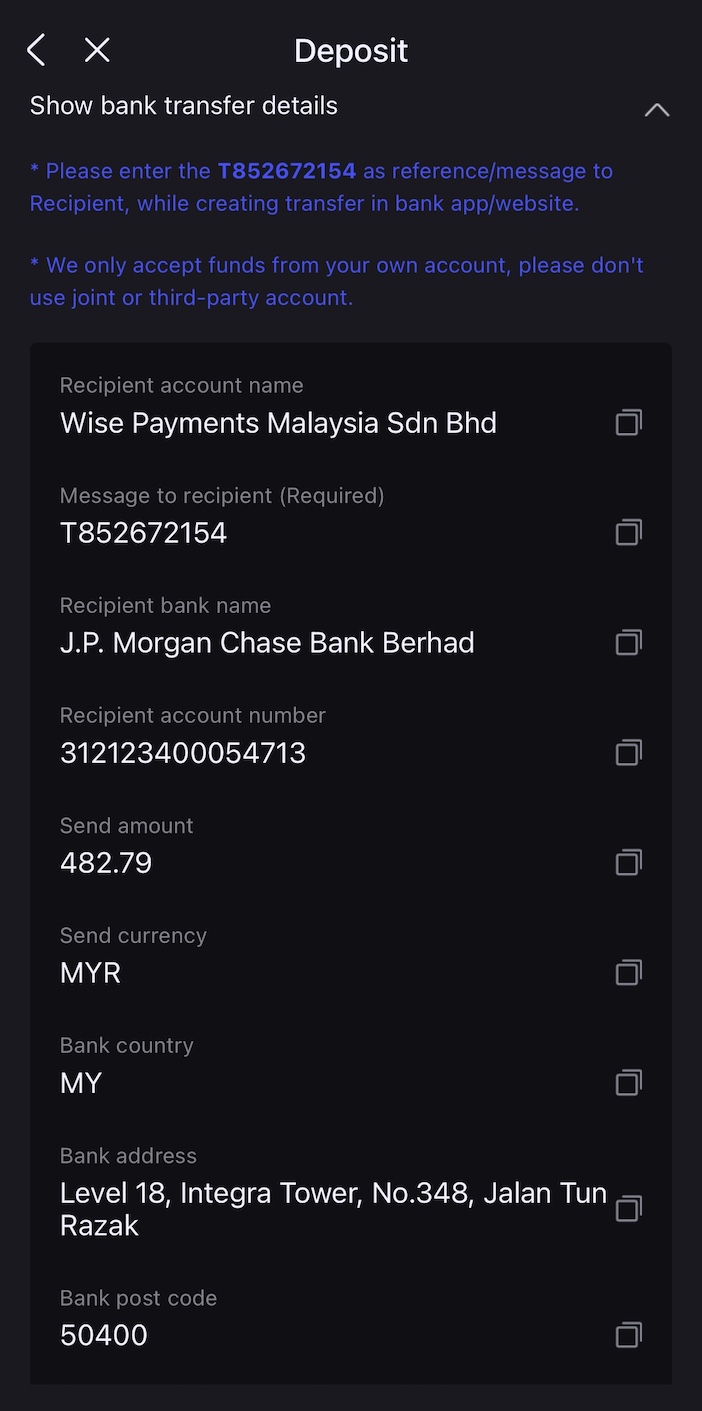

Next, it will show that the routing system has been successfully created (Transfer Created), and display the bank receipt information of Wise Malaysia.。

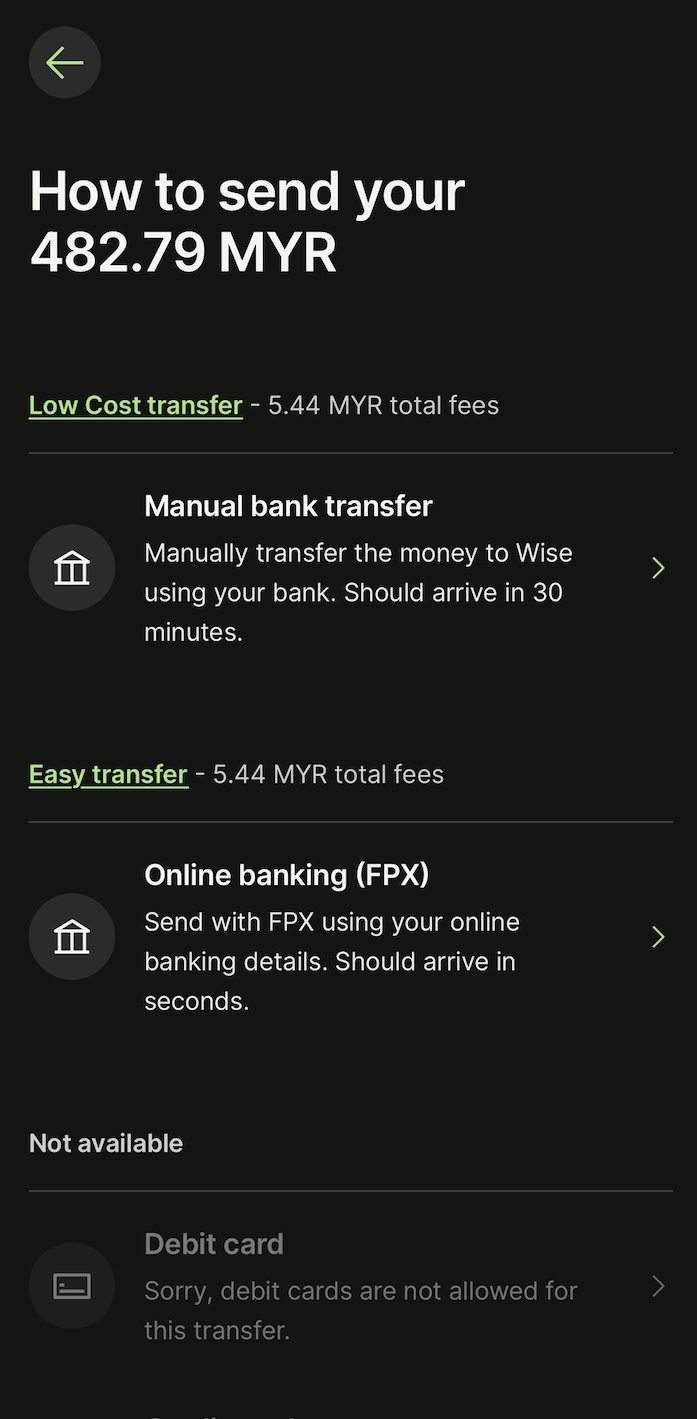

You can choose to transfer funds to Wise Malaysia's bank account from your personal bank account, just like the usual bank transfer to other banks, to complete the process of Wise deposit;

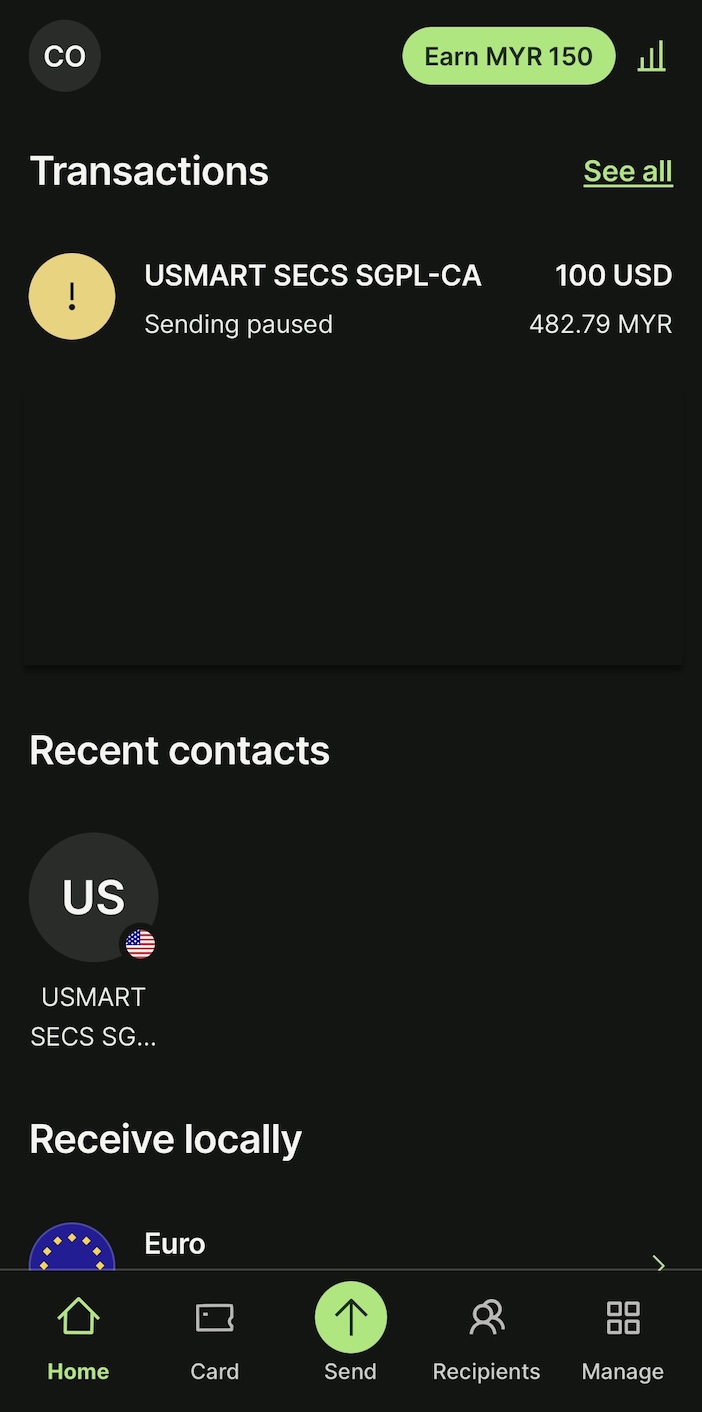

Or log in to your Wise account, select uSMART transaction (transaction status is send suspended) in the transaction list, and then transfer MYR funds to Wise Malaysia's bank account according to Wise's instructions (the process is the same as bank transfer)。

After the remittance, the system will convert the money received at this time into MYR funds to be remitted to USD and deposited into your uSMART securities account.。

Message to the payee: a postscript to the payee, which is used by uSMART for auditing and reference to the tightness of the account, so be sure to fill in the reference to the payee of the transfer.。

Step 6: Wait for the deposit and receive notification

After transfer, wait for funds to be deposited into uSMART account。After the deposit is paid, uSMART will issue an alert.。

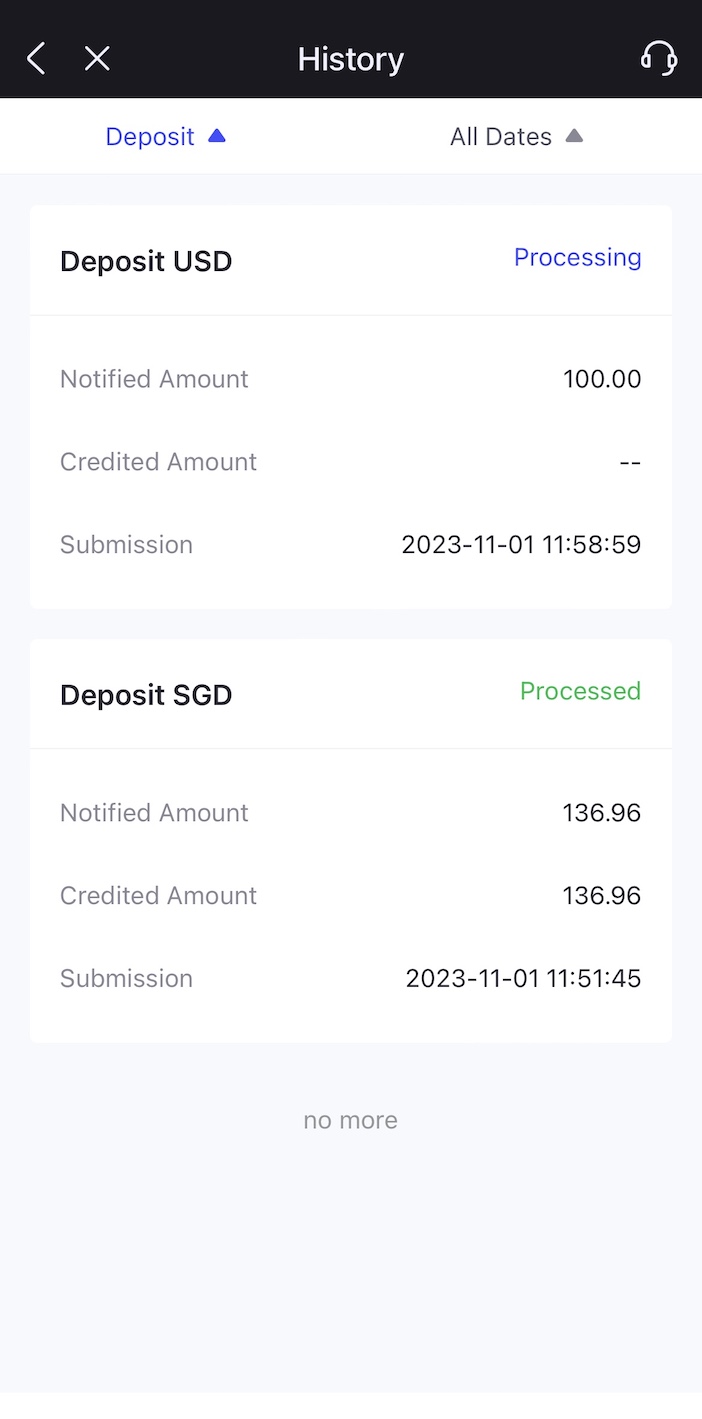

View funds to details in Transactions > Deposits > Deposit Records。

○ Smart deposit measurement

The actual measurement initiated the smart deposit at 12 noon and received the notice of successful deposit at 3 pm that day.。

▍ Bank of Malaysia international wire transfer (TT) deposit process

- Deposit currency (example): USD

- Applicable object: with Singapore bank account

- Handling fee: uSMART handling fee 0 yuan, remittance bank, transit bank handling fee

- Arrival time: 1 to 3 working days

If you want to choose to transfer money through Wise, you can also use the method of bank transfer to enter the uSMART account. This method is cheap and convenient. After all, the bank account amount is relatively large, so if you want to use bank transfer in Singapore or Hong Kong, then You can transfer money directly to a bank in Singapore or Hong Kong without paying any fees。

Select any Malaysian bank for online banking (Internet Banking) or wire transfer to the bank's counter / cabinet (ATM)。uSMART will not charge any fees, except for remittance banks (Bank of Malaysia), transit banks, and receiving banks.。

The domestic remittance fee of the remittance bank includes service fee (commission), post and electricity fee (telegraph fee), etc.。China transfer bank, overseas collection bank is not necessarily.。

For example, Maybank charges a service fee of RM10 and other G'OUR charges USD 30 for simple wire transfer.。And these fees are calculated on a per-view basis and do not adjust to the size of the wire transfer amount。In other words, wire transfers RM1,000 and RM10,000 So, if you want to save on wire transfer fees, it is recommended to increase the amount of each wire transfer to minimize investment costs。

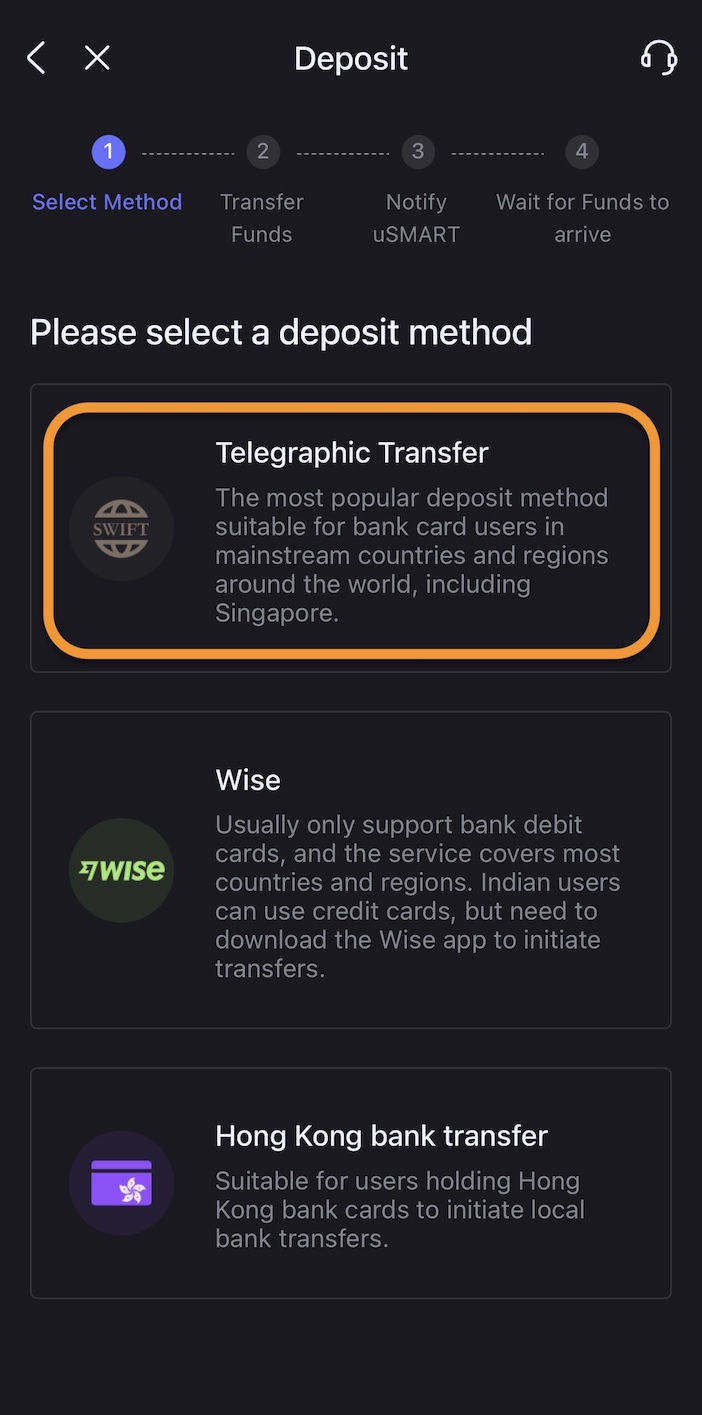

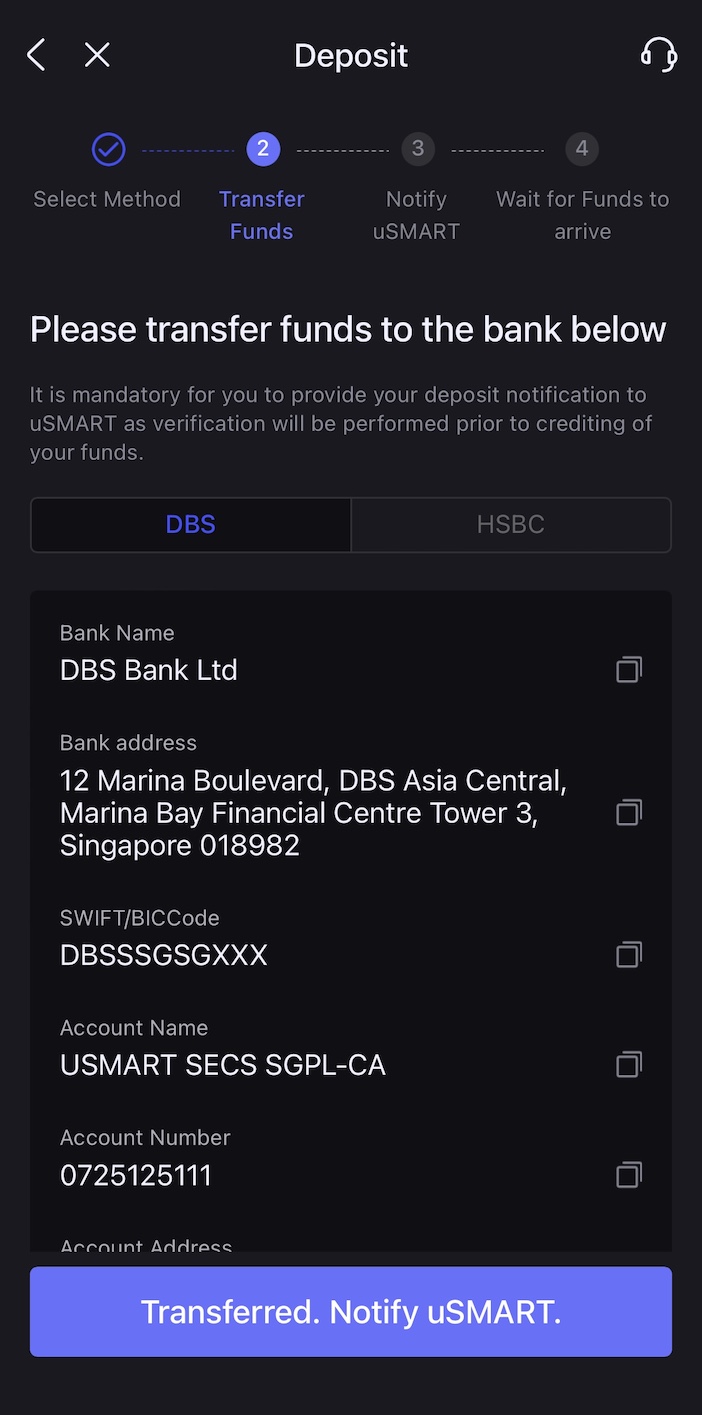

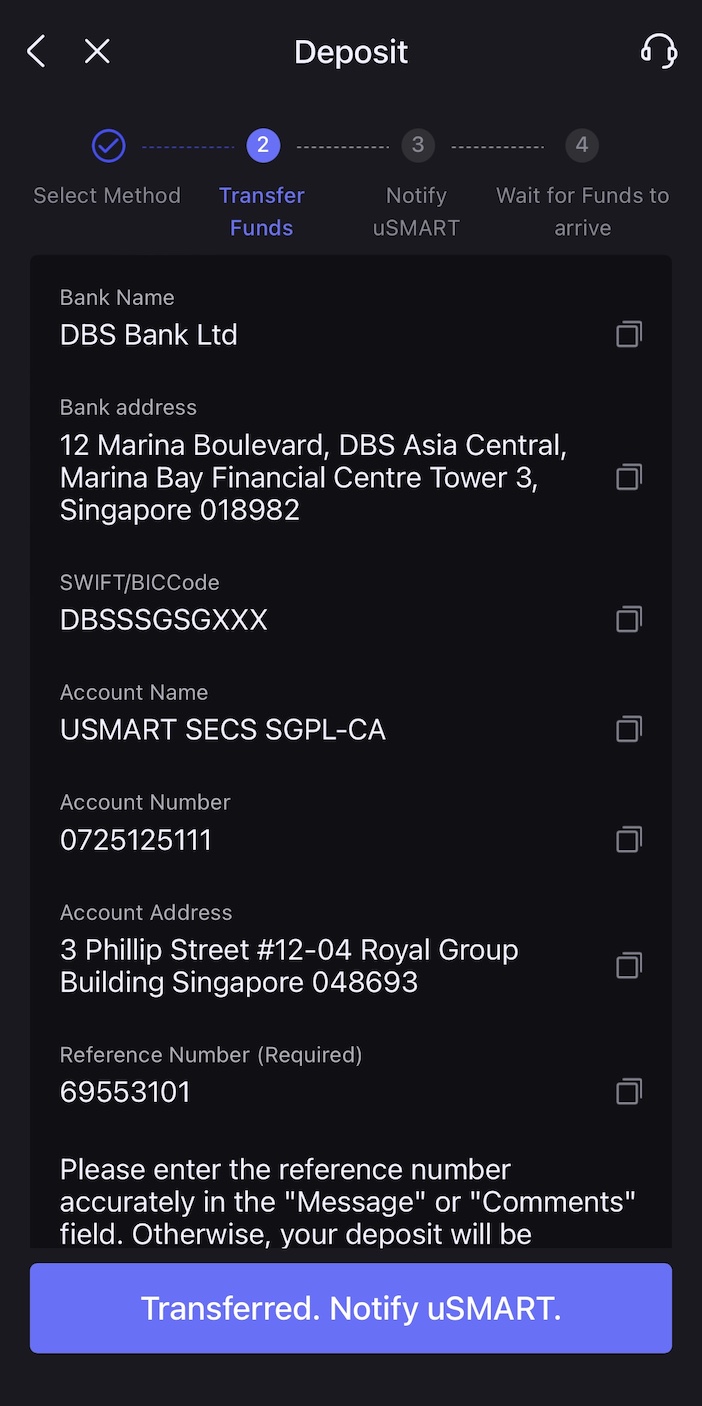

Step 1: Log in to the uSMART account and select the electricity transfer deposit

Log in to your uSMART account, click Transactions > Deposit, then select the deposit currency "USD," and then select the deposit method "Wire Transfer"。

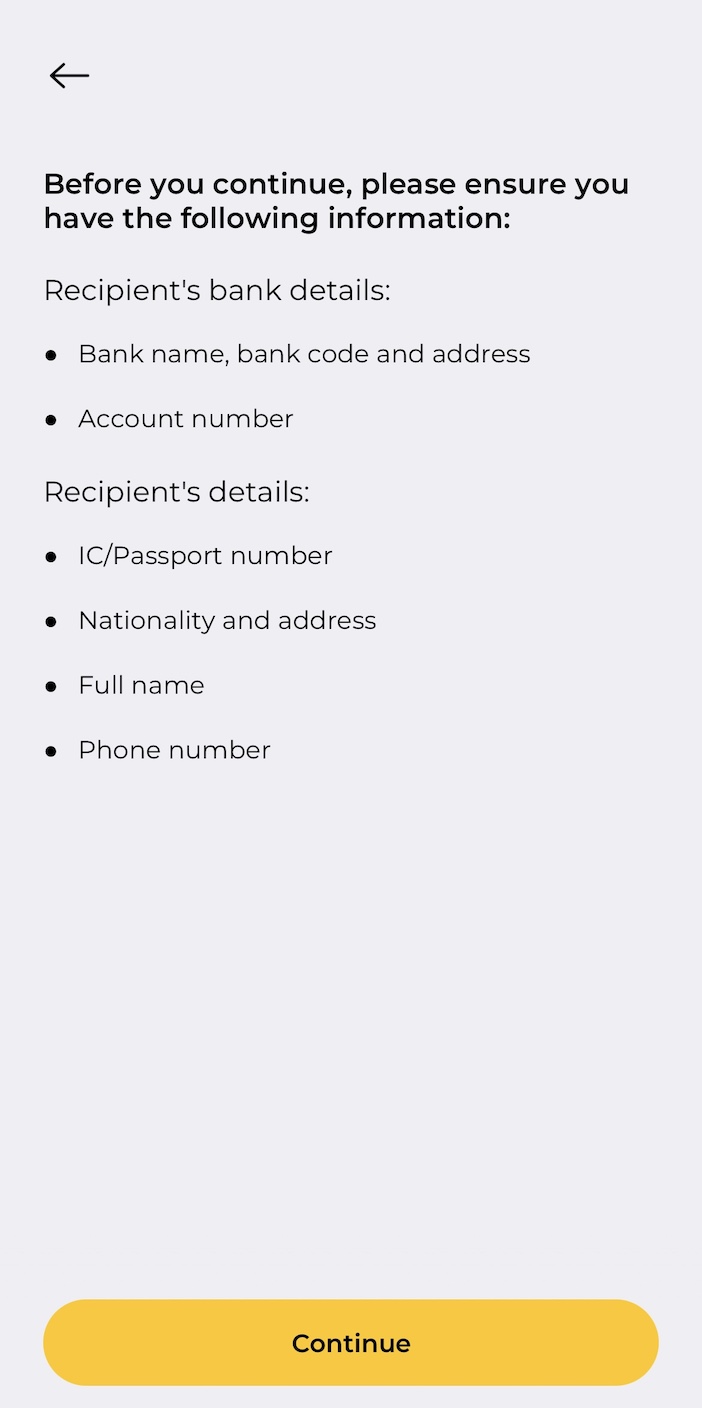

Step 2: Get wire transfer information

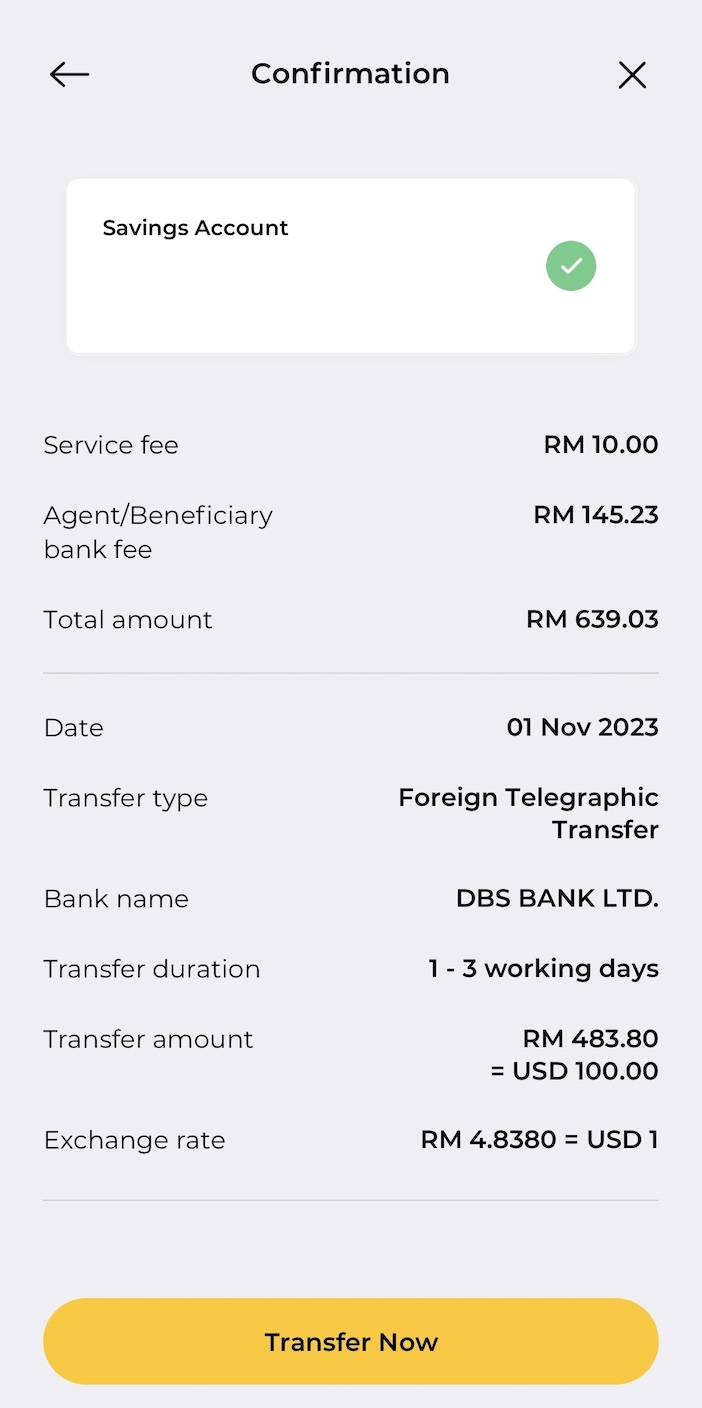

Next is the bank receipt information of the uSMART custodian, DBS DBS Bank and HSBC HSBC.。

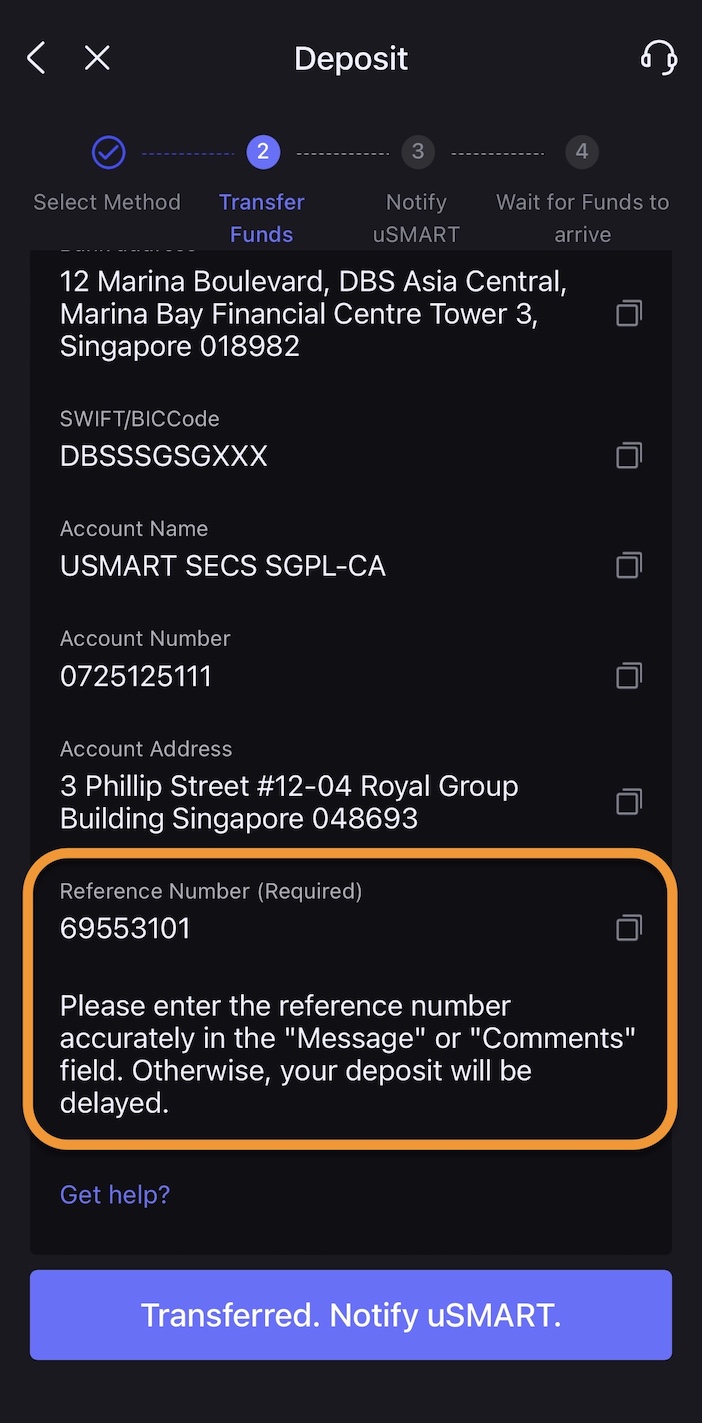

After selecting the receiving bank, the system displays detailed wire transfer information, including the receiving bank name, bank address, SWIFT code, payee name, receiving account number, company address, and transfer postscript (reference number)。These are the information that needs to be entered when making a wire transfer。

Transfer postscript (reference number): it is recommended to fill in this content in the collection reference / payment details when wire transfer, which is used by securities dealers to evaluate and reference the performance of suspicious funds.。

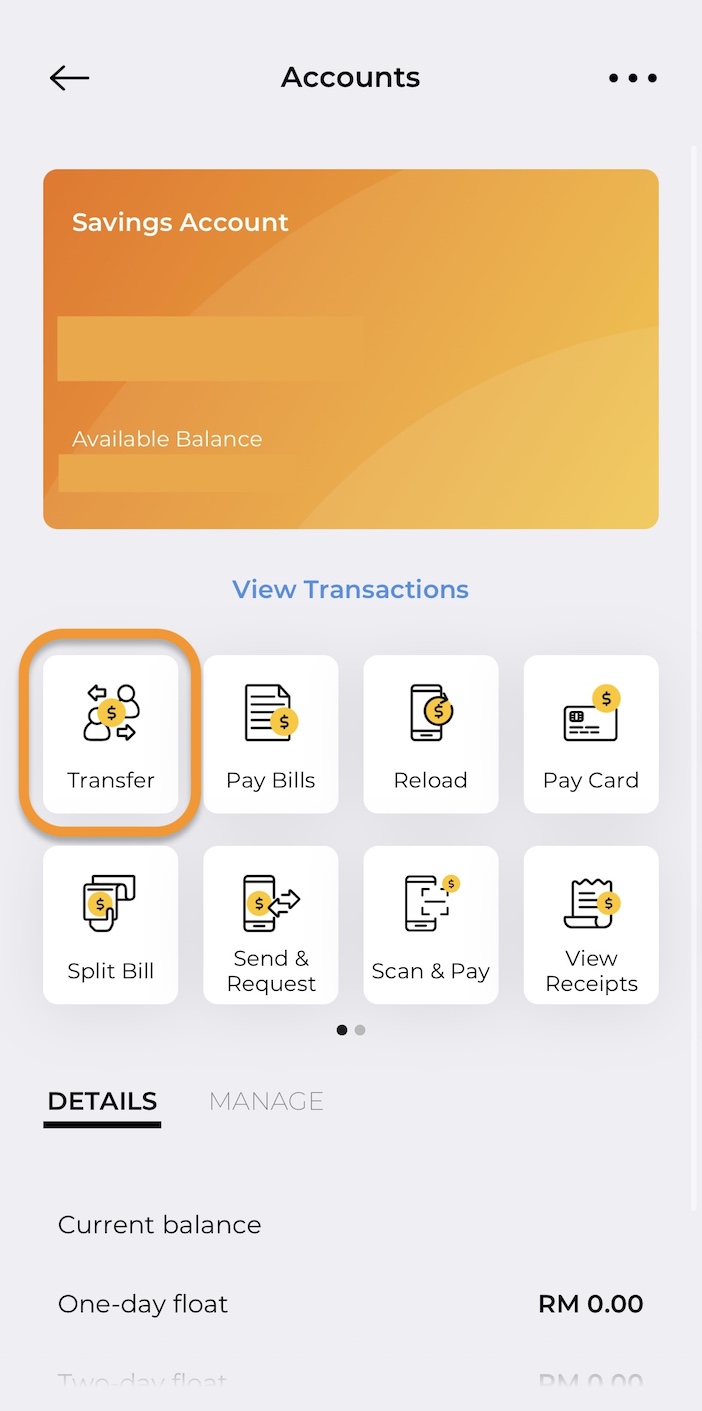

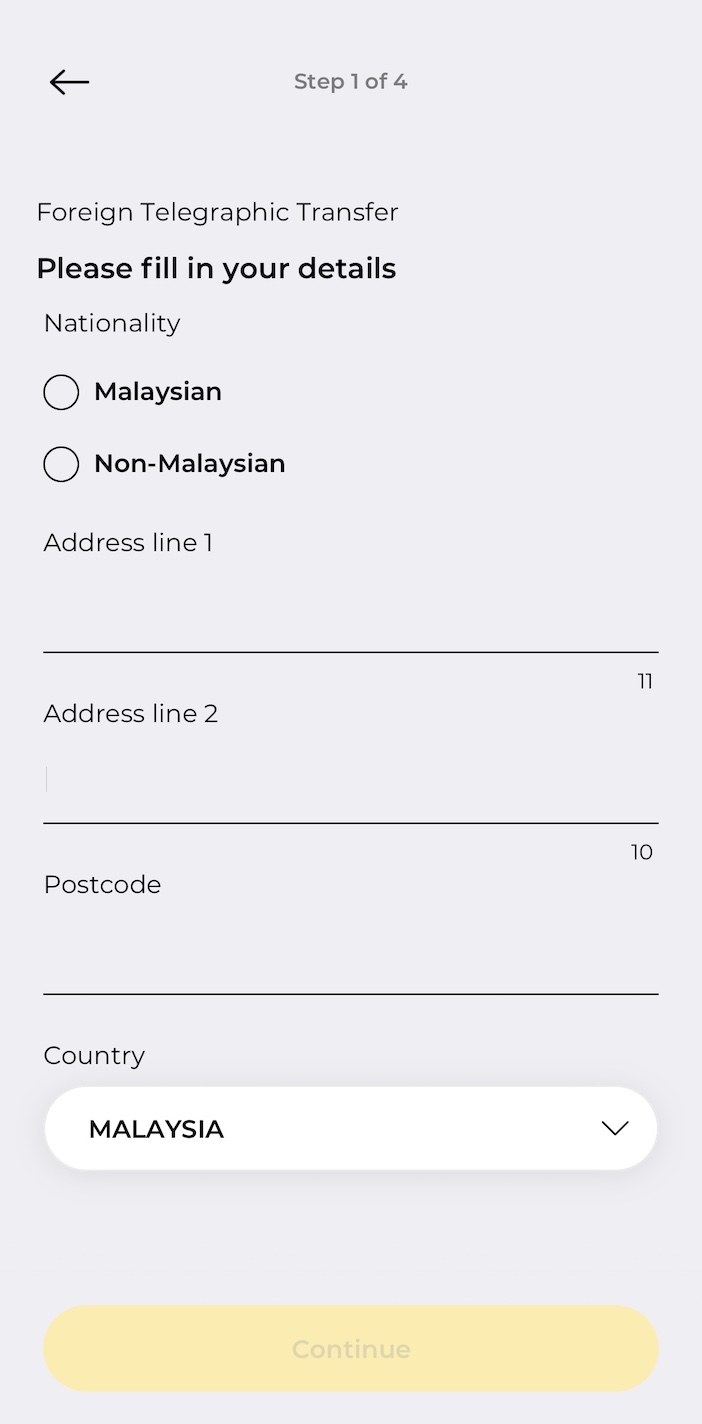

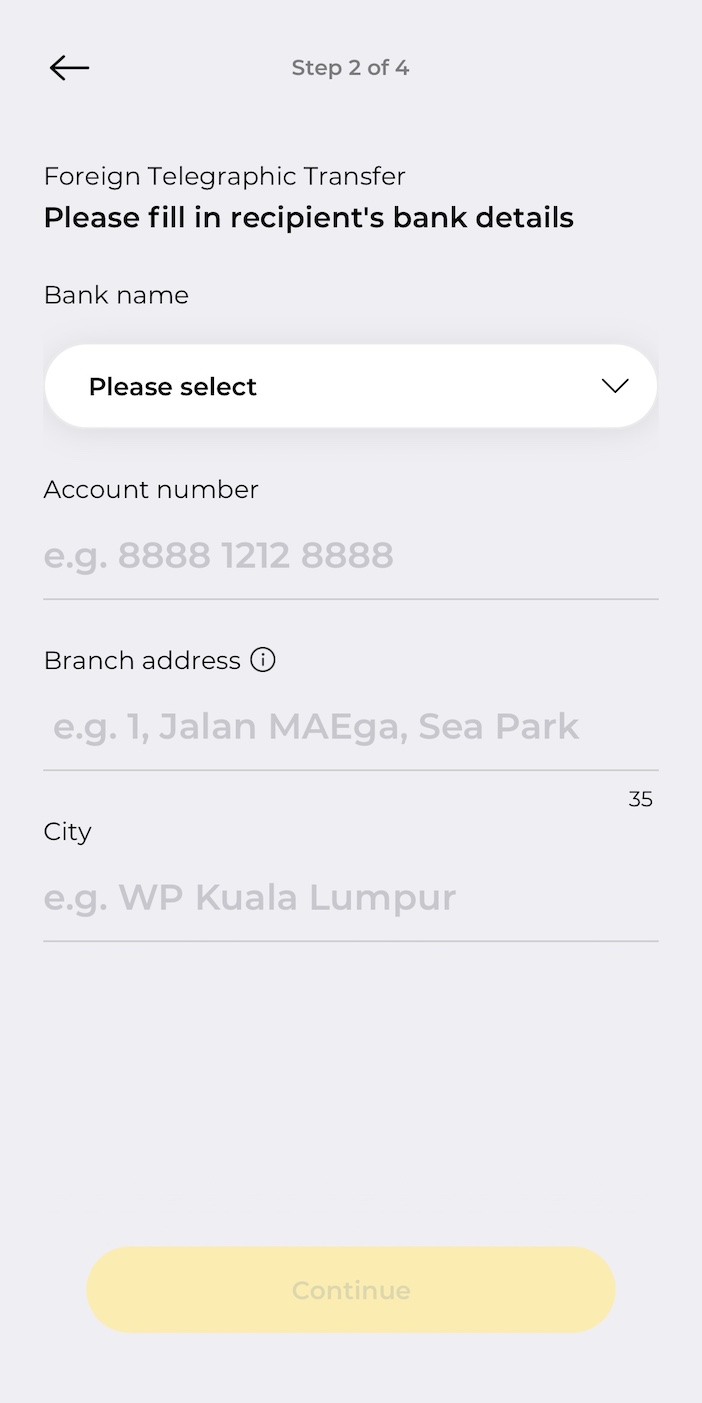

The third step: mobile version of the website

The next step is to make a wire transfer, which can be done using online banking (online banking) or at the bank's counter / teller machine (ATM).。We will demonstrate the wire transfer process using Maybank Online Banking。Other banks' wire transfer processes vary in size.。

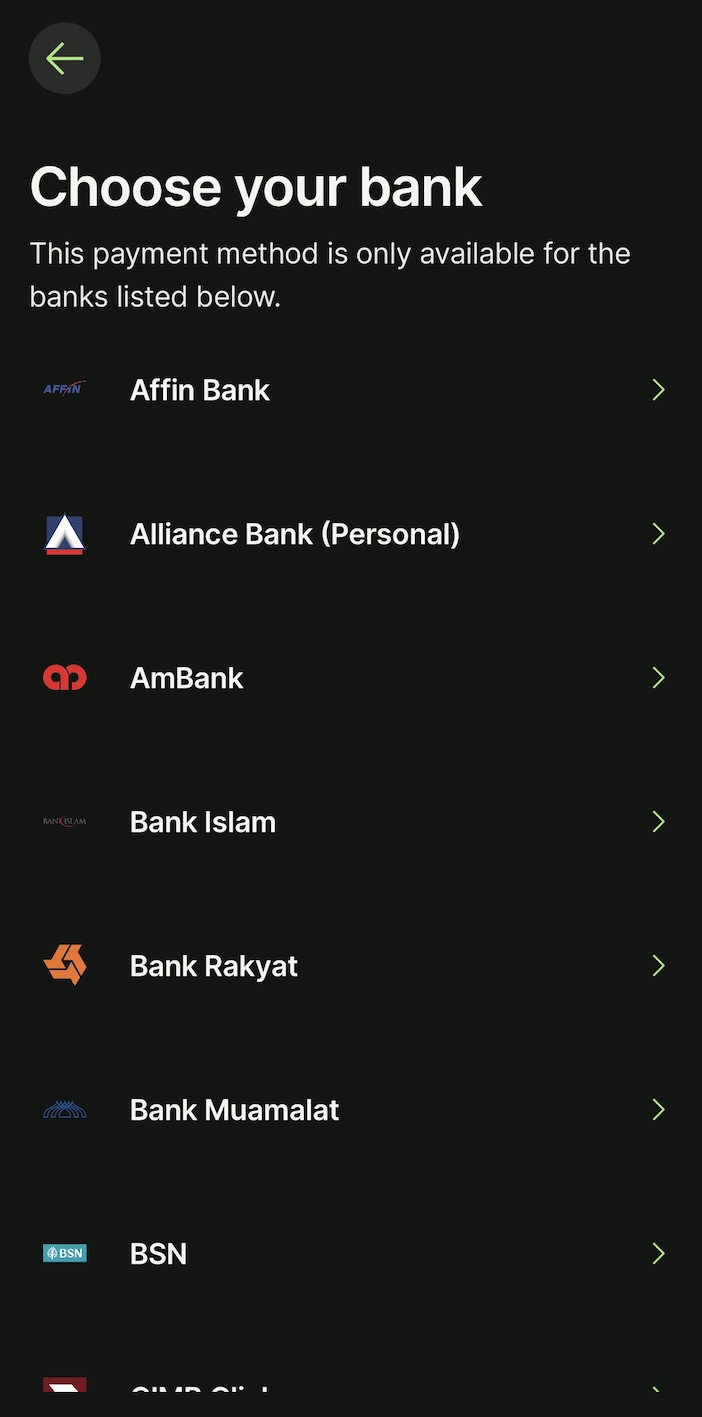

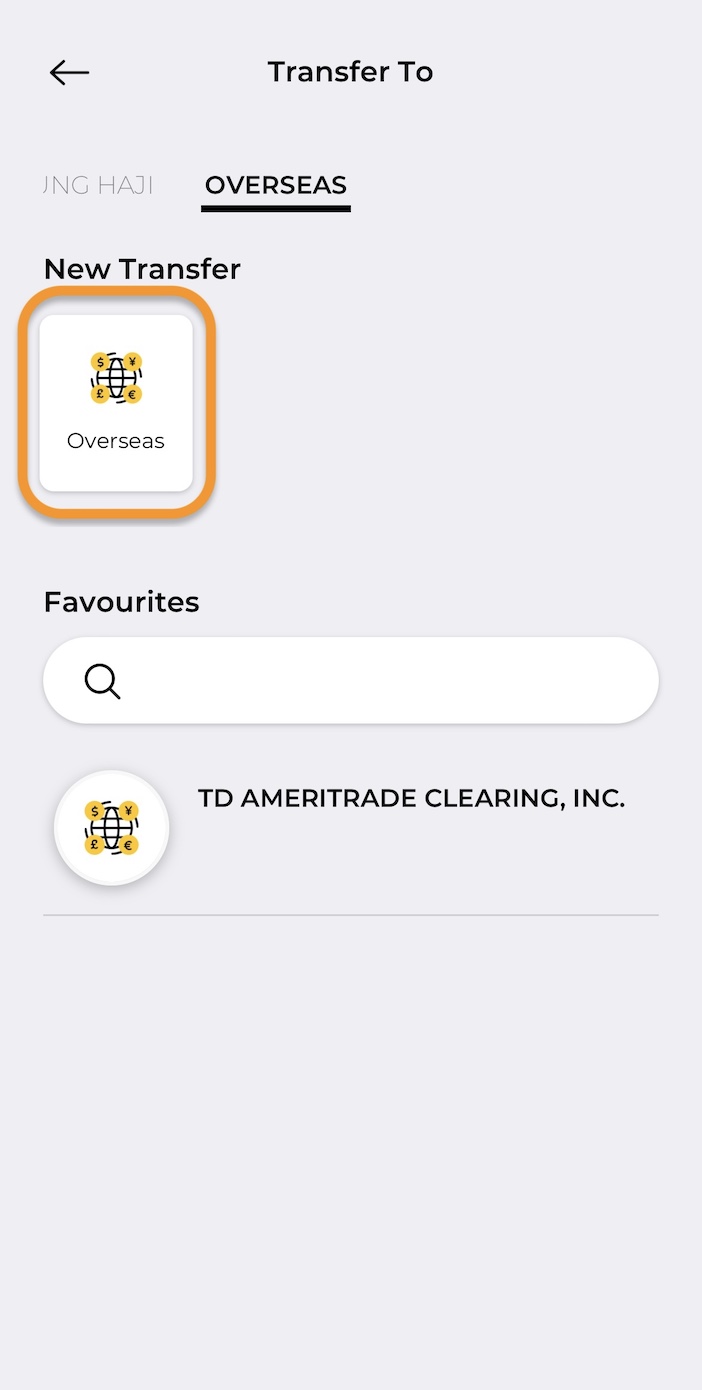

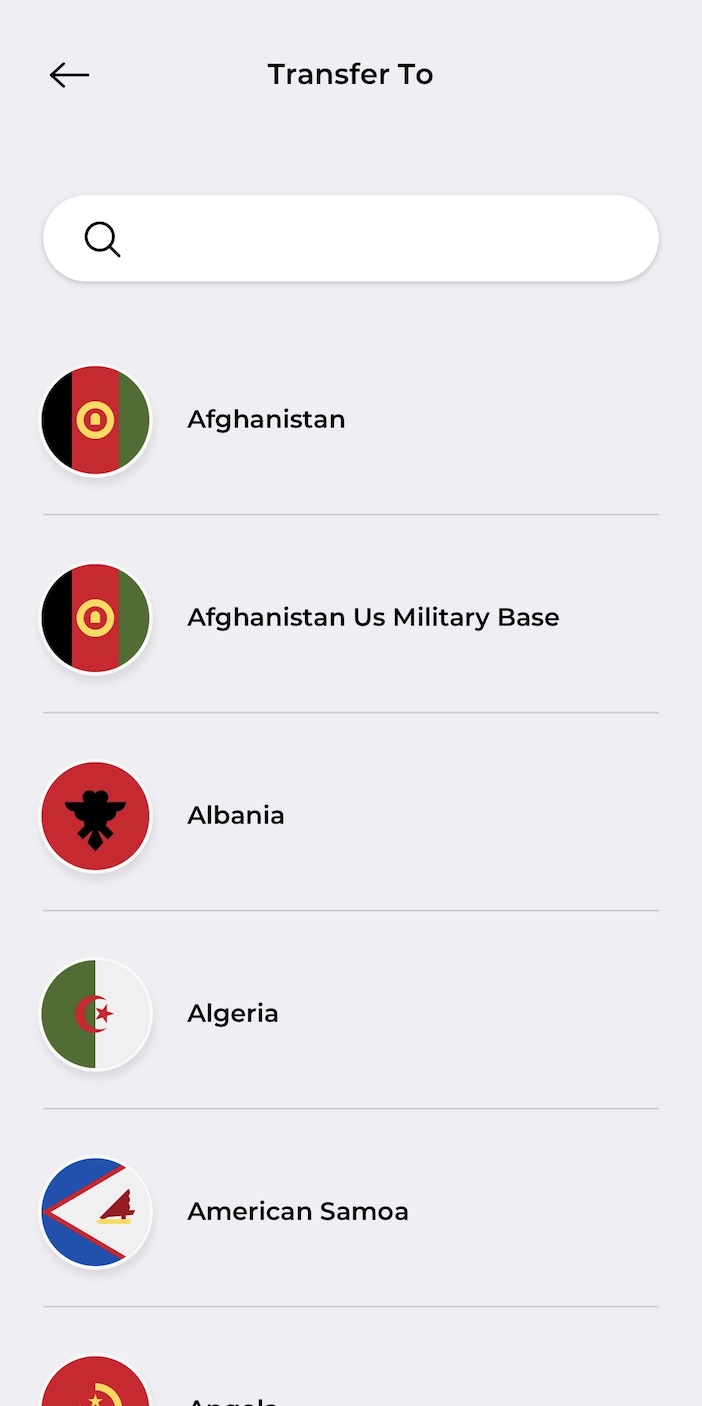

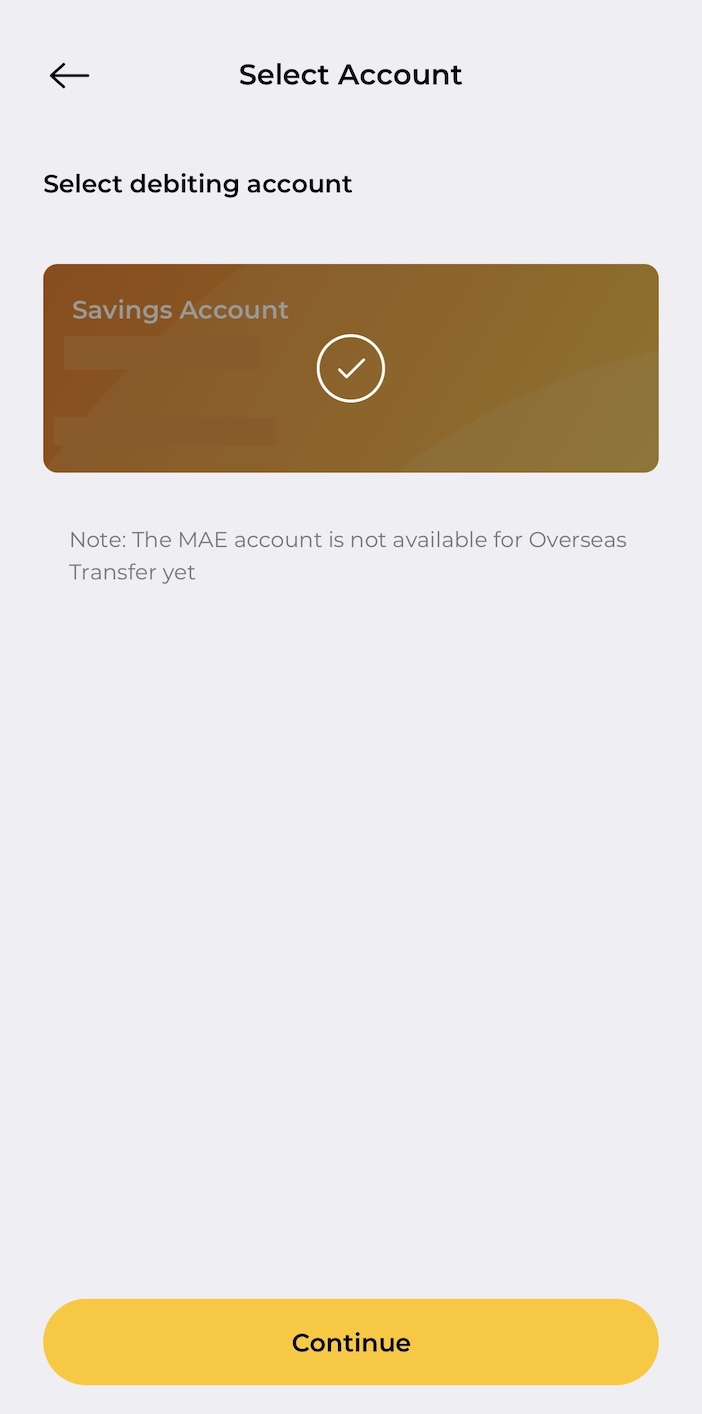

Login to Maybank Online Banking > Transfers > Overseas Remittances > To (Country: Singapore) > Select Account Select which bank account to send the wire transfer from。

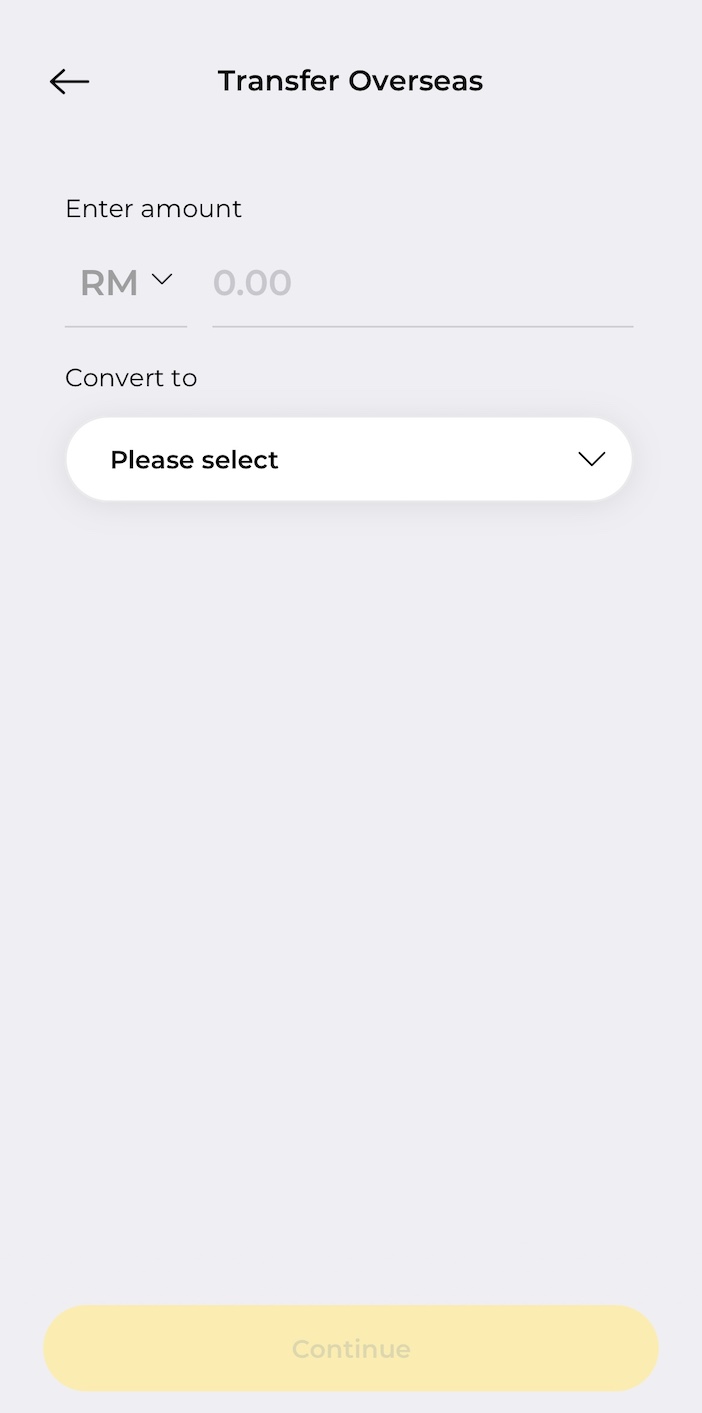

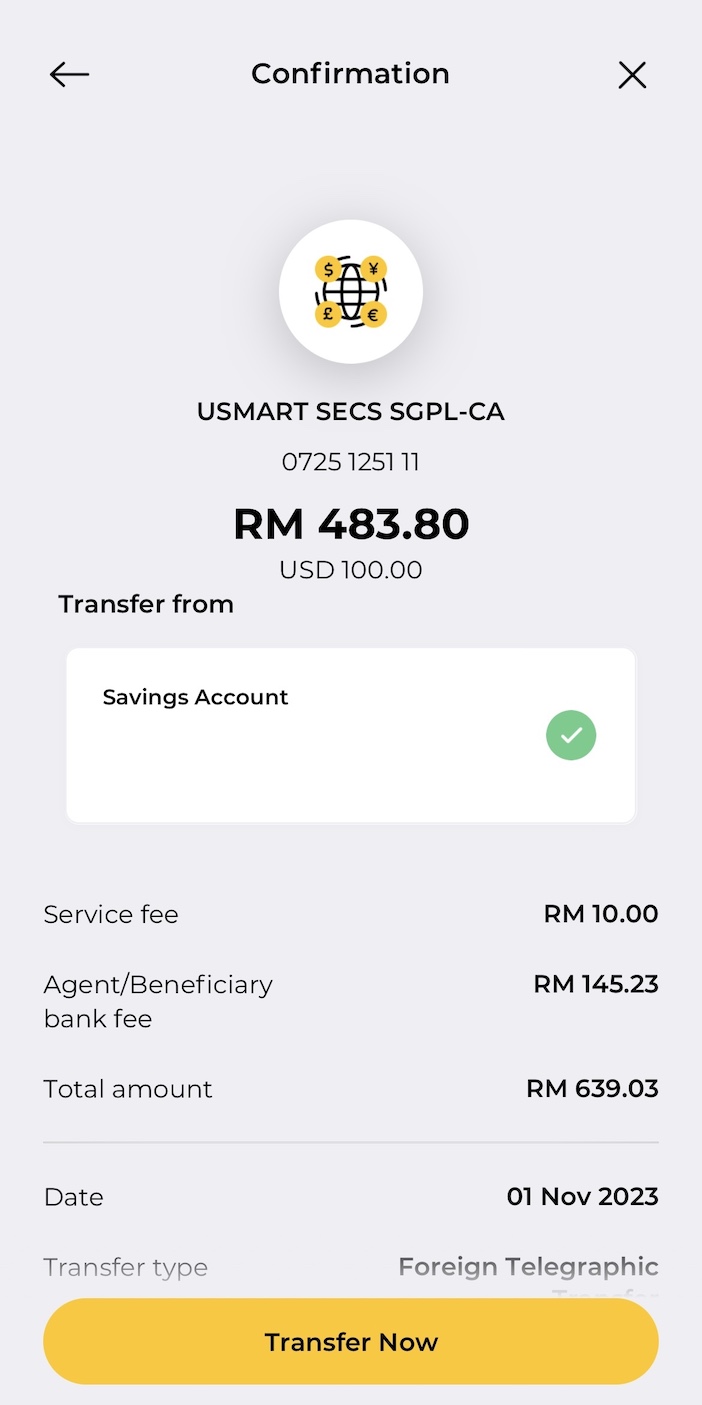

Enter the wire transfer page and set the wire transfer currency and wire transfer amount (amount)。Here we demonstrate the currency of 100 US dollars.。

The system will display the wire transfer amount and related charges。For this example, export RM483.80, to USD 100。Bank service fee RM10, subject to transfer / receiving bank fees, approximately 1 to 3 business days to account。

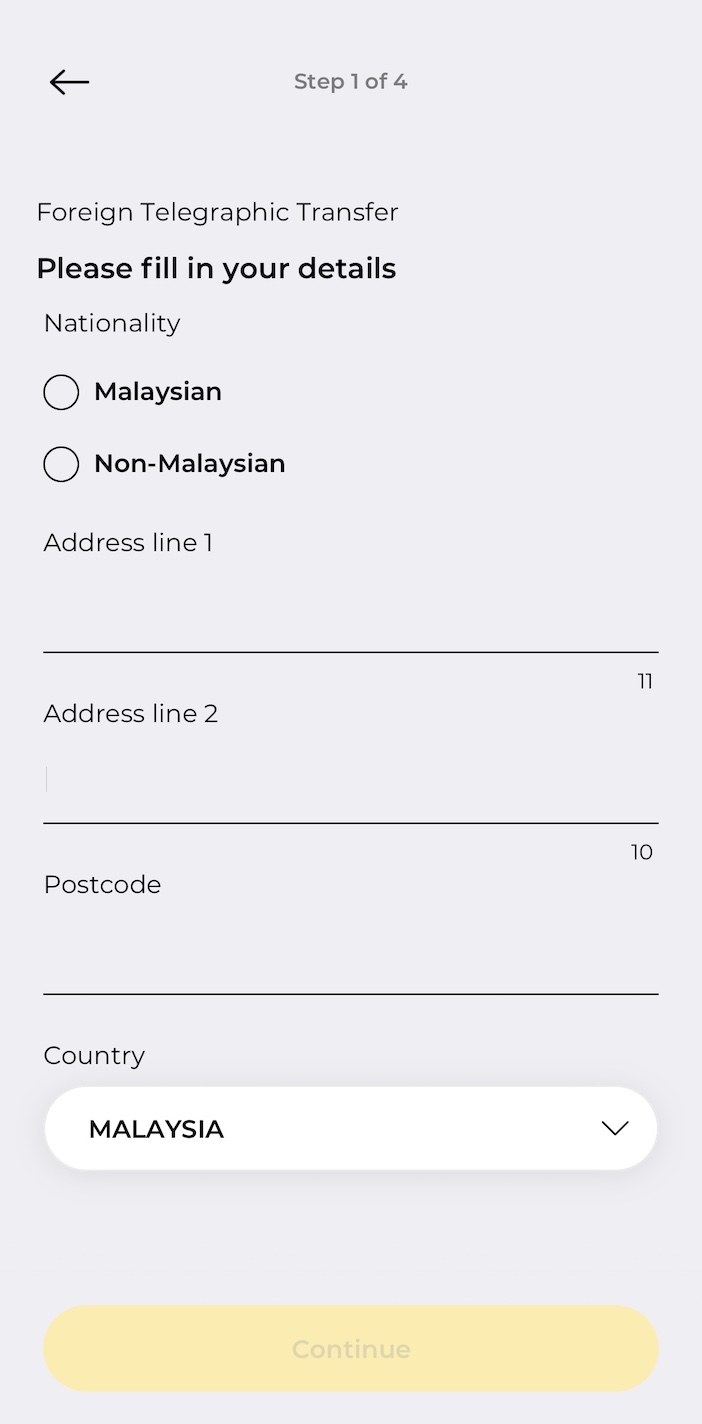

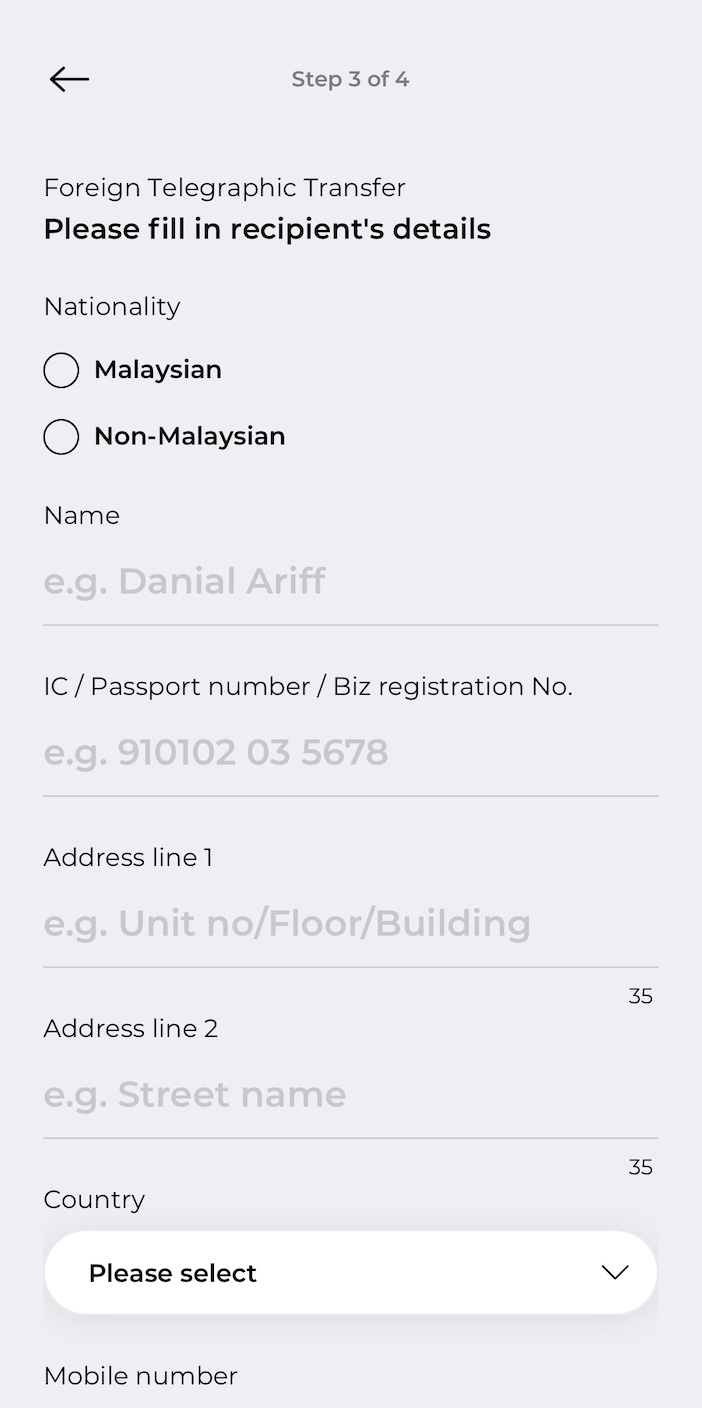

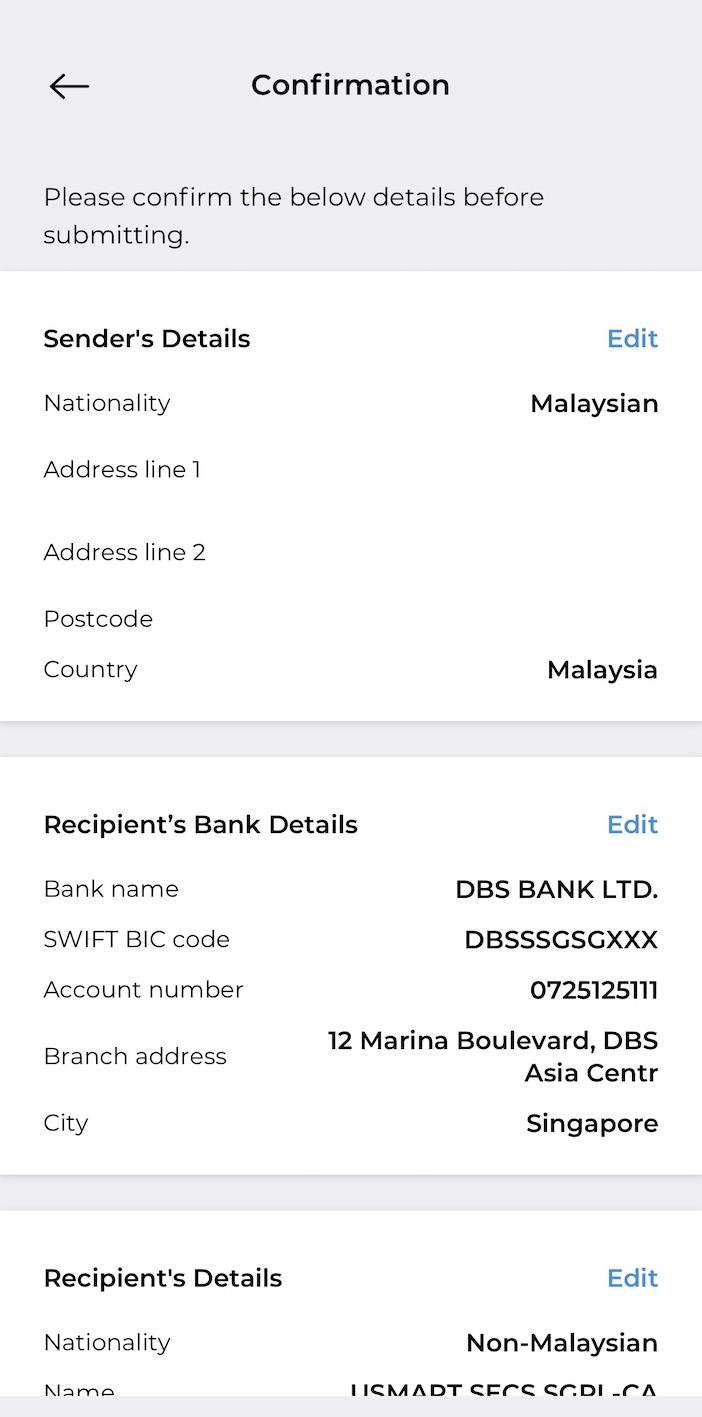

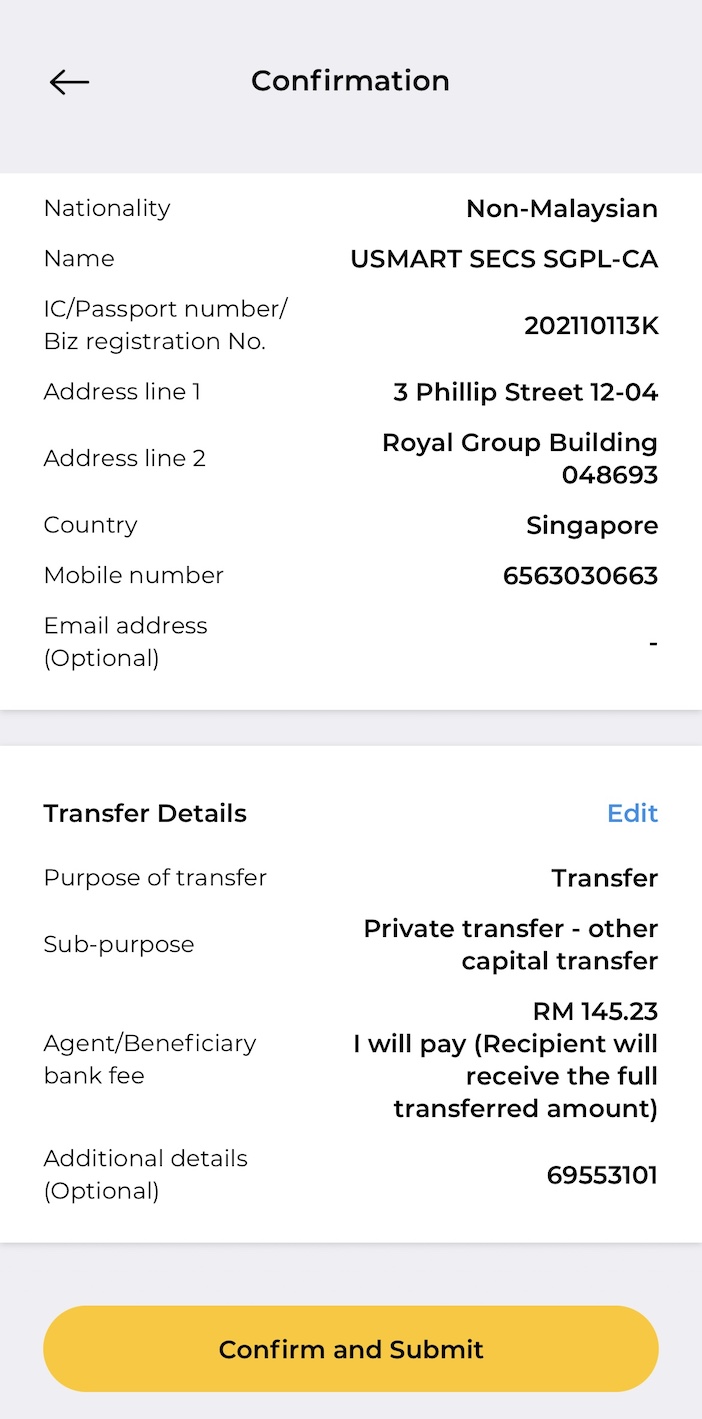

Fill in the wire transfer information, including:

- Sender (O you) information

- Receiving bank information (bank details of the payee), such as bank name, account number, etc.

- Payee information (required information), such as name, address details, etc.

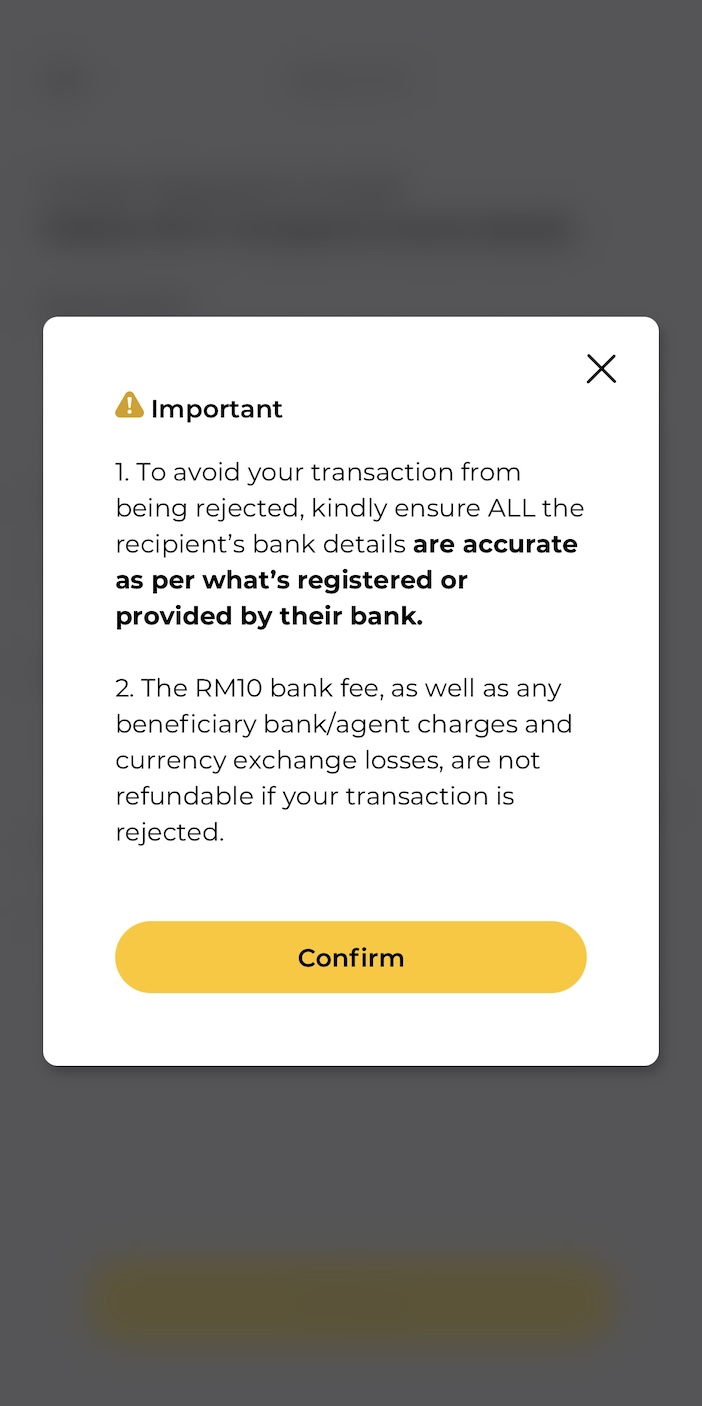

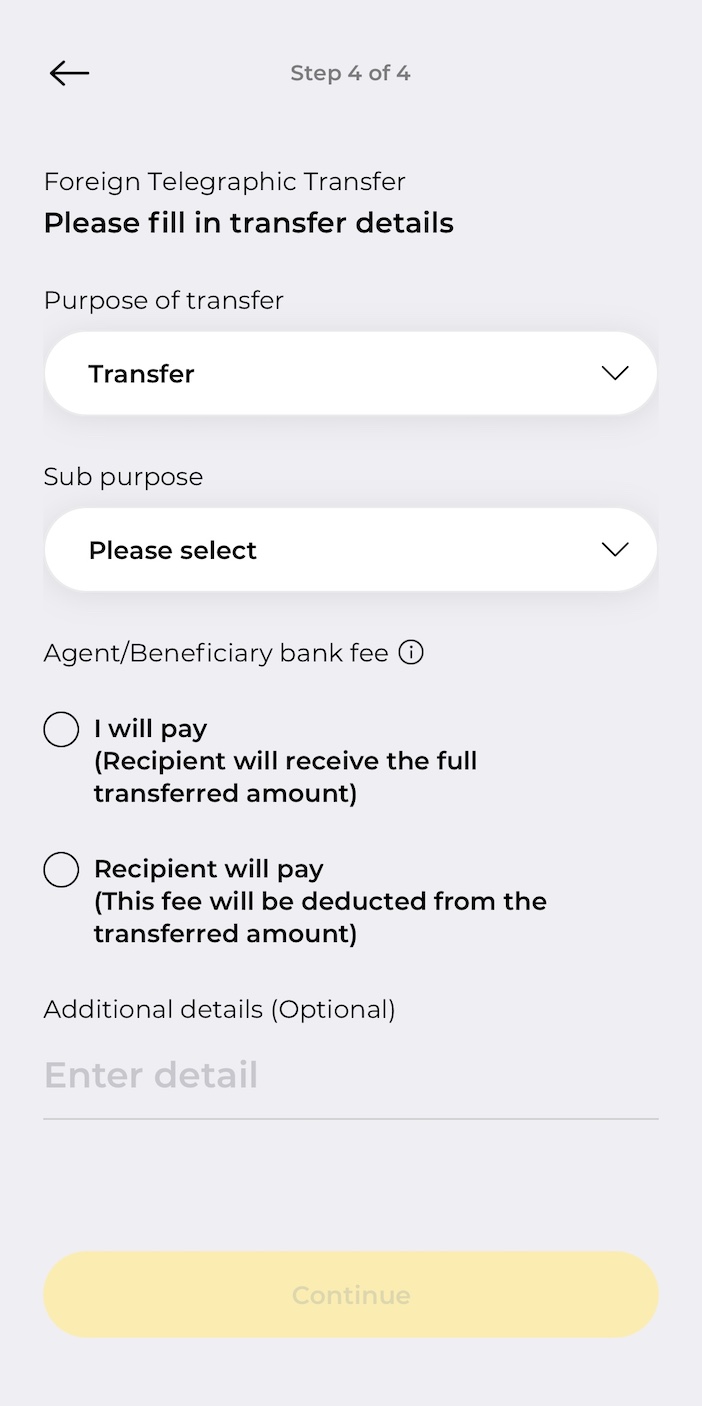

Declare the purpose of this wire transfer, such as remittance to non-nationals, payment of loans, payment of overseas investments, etc.。Also confirm that the cost of this wire transfer is paid by the sender (I will pay) or the recipient (the recipient will pay)。

In the other details column, fill in the transfer postscript for uSMART wire transfer (reference number)。

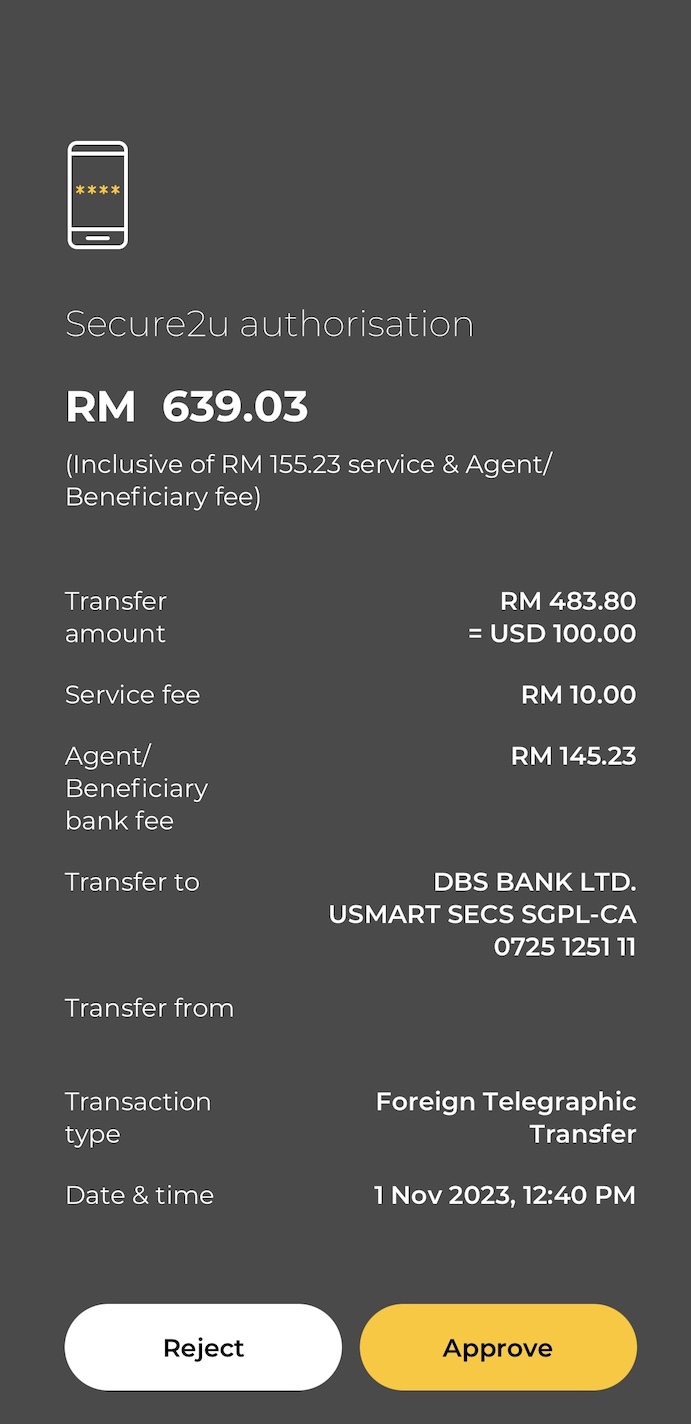

Check the wire transfer information and click "Confirm" after confirming that it is correct。

Read the relevant Rules and Conditions and click "Agree and Confirm"。

Finally, confirm the relevant wire transfer information and click "Transfer Now" to complete the wire transfer.。Remember the screenshot or download this remittance voucher (receipt)。

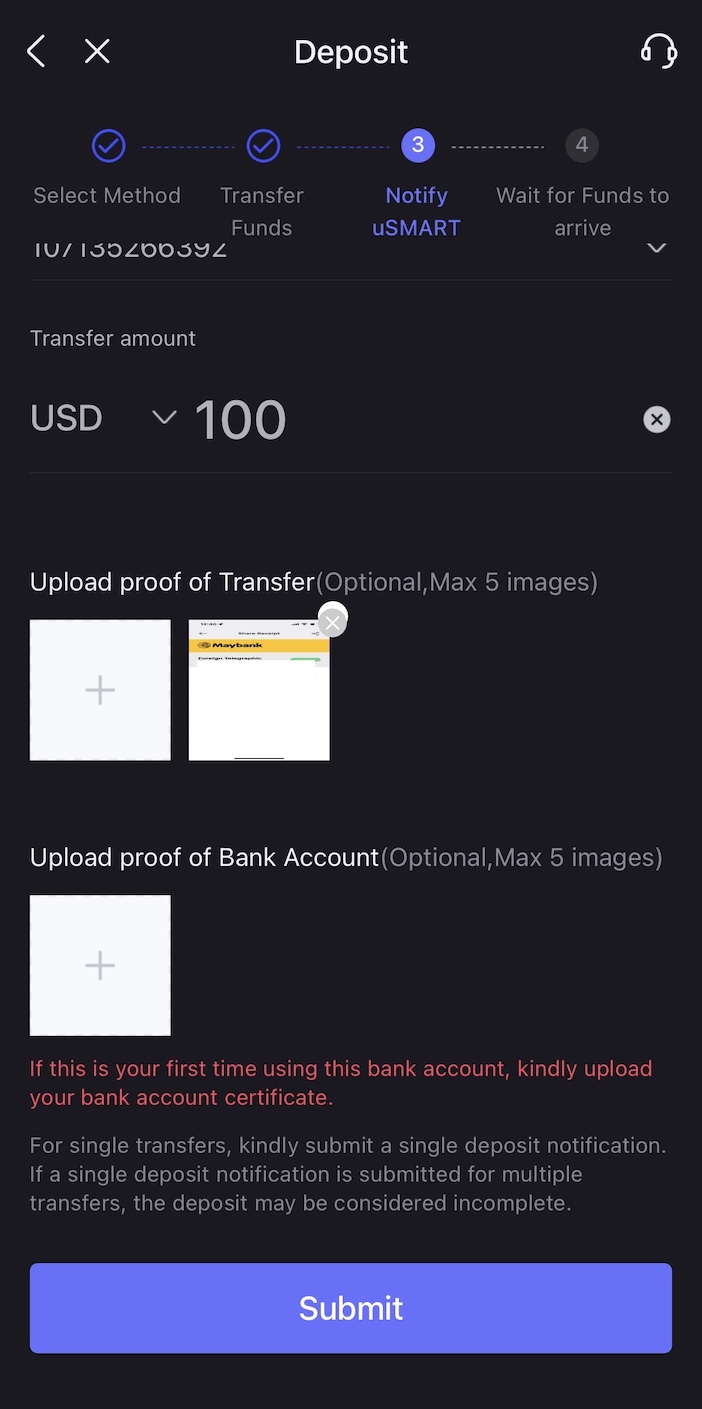

Fourth, publicly disclose fluctuations in shareholders' equity and publish annual shareholder reports

Go back to uSMART's deposit page and click on "Transferred"。Notify uSMART, upload the remittance transfer (Receipt) and fill in the remittance information, including:

1.Remittance bank account: fill in all remittance bank information

2.Remitted Currency

3。Amount remitted

4.Remittance voucher: remittance receipt (receipt)

5.Bank certificate: Bank Statement can be used, which is required for the first wire transfer using the bank account.

Finally, click "Submit" to complete the remittance and wait for the uSMART reviewer to deposit the deposit.。

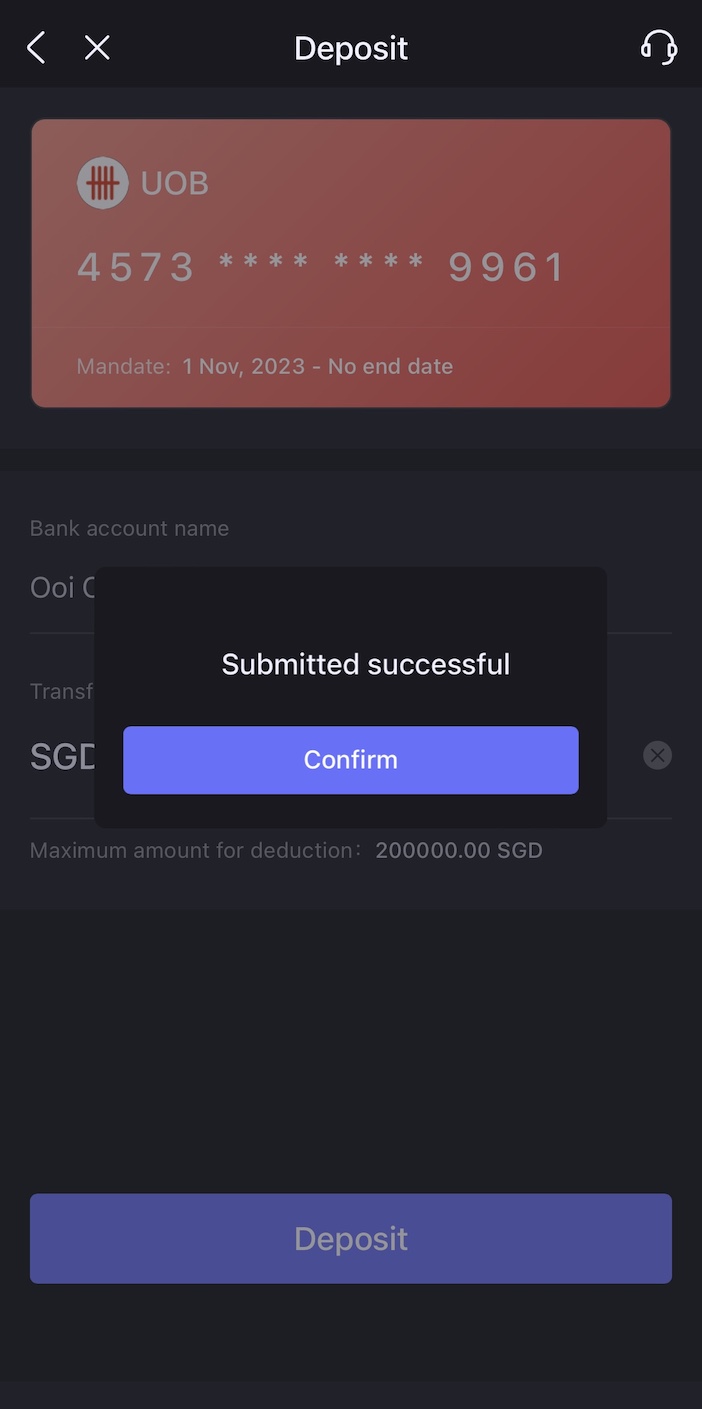

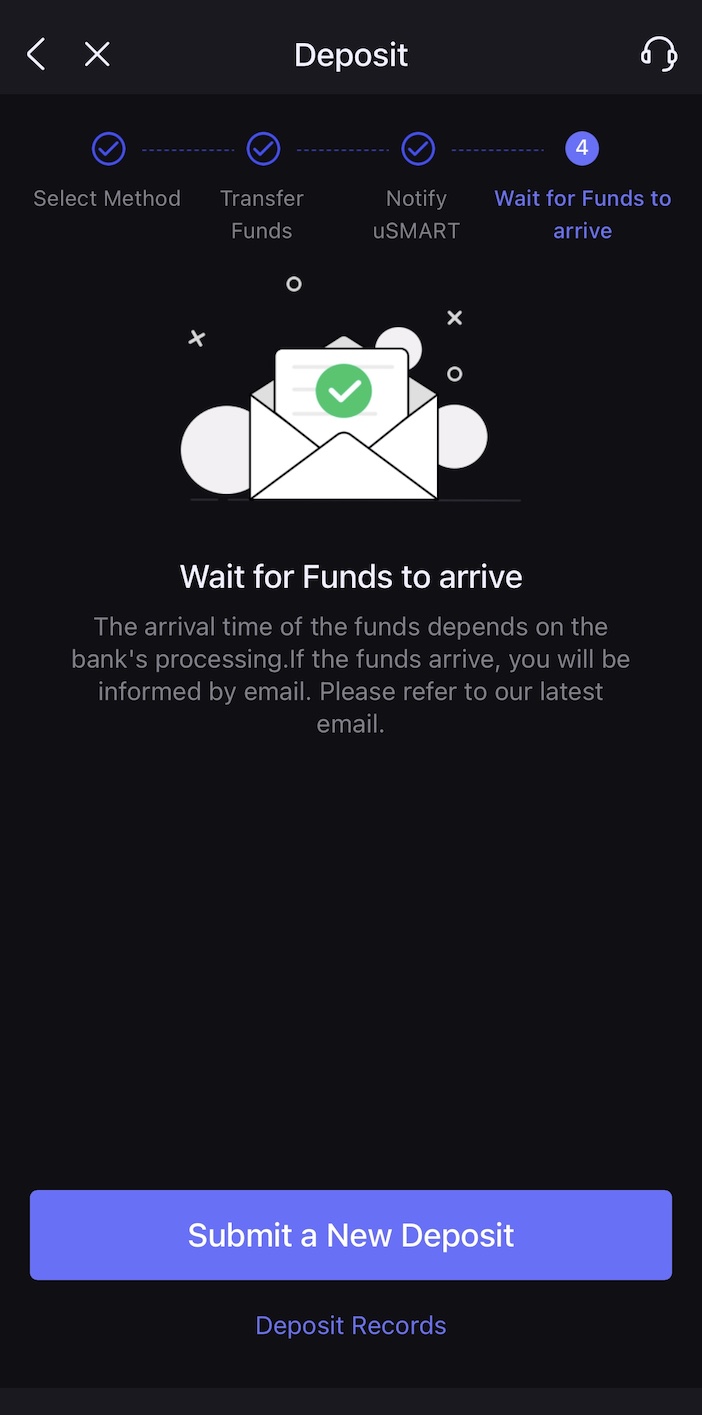

Step 5: successful deposit, received notification

The wire transfer deposit account generally takes 1 to 3 working days to arrive.。After successful deposit, you will receive uSMART notification via Bluetooth。

If you have not received the notification for more than 3 working days, you can click to enter the customer service window in the upper right corner of the gold page and ask the online customer service。

○ Electricity inward payment experiment

The actual measurement was initiated at 1: 00 p.m. and the deposit was successfully notified at 3: 00 p.m. on the same day.。

▍ uSMART 3 kinds of gold into the way measured and compared

Three methods of uSMART: eGIRO, Wise, and Telegraphic Transfer were measured, and the following is a comparison of costs and arrival speeds.

| Deposit method | Online transfer | Essentials | Current |

| deposit currency | Singapore Dollar (SGD) | US Dollar (USD) | US Dollar (USD) |

| Amount of deposit | 100 Singapore dollars | 100 USD | 100 USD |

| Actual account amount | 100 Singapore dollars | 100 USD | 100 USD |

| Deposit expenses | 0 | Intellectual Property Litigation Fees RM5.44 | Maybank Service Fee RM10, Transit Bank / Receiving Bank Fee RM145.23 |

| Actual valuation time | Within 1 minute | 3 hours | 2 hours |

| Difficulty in operation | Simply put, bank bonds | Simply put, bank bonds | More complex, need to fill in the coordinate data |

▍SUMMARY

In summary, Wise is commonly used by Malaysian users to transfer funds and deposit money, which is considered to be one of the fastest and most economical ways to deposit money.。Wise's deposit process is similar to an ordinary bank transfer, simple and easy to operate, tested, within 3 hours to deposit。

Finally, if you are looking for a faster way to deposit money, we have prepared a Singapore bank account (the following is a tutorial)。Secondly, you can transfer money from a Singapore bank to a Singapore bank account via Wise (the following is a measurement time of less than 1 minute)。Finally, you can transfer money to your Singapore bank account via uSMART Bank。

If you encounter any problems in the process of deposit, please leave a message and communicate with us。We will serve you wholeheartedly。

If you want to get the latest preferential activities, professional consultation and activity notice for the first time, you are welcome to add our Yingli official group.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.