Why gross margin is an important financial indicator?

By comparing gross margins with other companies in the same industry, investors can determine whether the company has advantages in cost control, product differentiation and brand positioning。

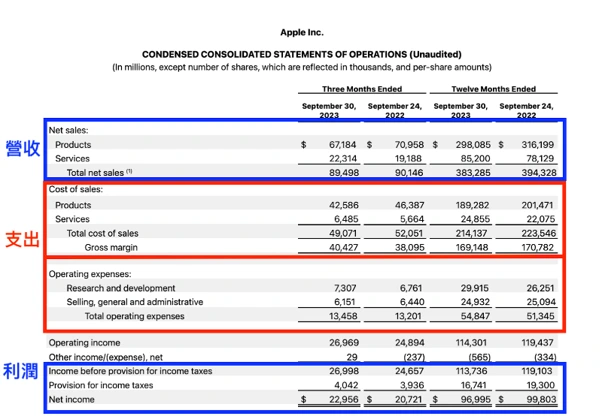

When assessing a company's financial position, it focuses on the three basic metrics of revenue (Revenue), expenses (Expenses) and profit (Profit).。

However, when reviewing the financial statements in detail, we will note that expenses are broken down into two main components: Cost of Goods Sold (COGS) and Operating Expenses (OPERATING Expenses).。

Operating costs (COGS) are critical to calculating a company's gross profit and gross margin because they directly determine the level of profit a company can earn from each sales unit。

Operating expenses, on the other hand, include other expenses incurred by the enterprise in its day-to-day operations, such as sales and marketing, management expenses, rent and utility expenses, reflecting the efficiency of the enterprise's expenses and its overall financial health.。

Through this division, the financial statements not only provide an important basis for the management of the company in making business decisions, but also enable investors to more accurately assess the company's overall financial position and fully understand the profitability and operational efficiency of the company.

What is Gross Profit??

Gross profit (Gross Profit) refers to the income obtained after deducting operating costs (COGS) from the operating income (Revenue) of the enterprise.。

High gross margin usually means that the enterprise can effectively create higher profits, but also reflects the effect of cost control.。Gross profit decreases when the cost of the product or service sold by the business increases。

-

Formula for calculating gross profit

Gross Profit = Revenue - Cost of Operations (COGS)

Revenue (Revenue) is the total revenue a business receives from the sale of products or the provision of services.。

Operating costs (COGS) include the direct costs of selling products, such as labor costs, raw material costs, production costs, etc.。

It should be noted that other costs that are not directly incurred from product sales are operating expenses (Operating Expenses), such as advertising and marketing expenses, research and development expenses, office expenses, etc.。

For example, suppose you own a snack bar and earn $30,000 in a month, and the total cost of raw materials such as flour, eggs, and sugar is $15,000, and the gross profit is $30,000 minus $15,000 equals $15,000.。In addition to raw material costs, snack bars also have to bear operating expenses, such as rent, employee salaries, marketing and advertising costs, utilities, etc.。

What does Gross Profit Margin mean??

Gross margin (Gross Margin / Gross Profit Margin) is used to determine gross margin as a percentage of operating income。A high gross margin means that a company is able to retain more profit when selling a product or service.。

For example, when a business's gross margin is 80%, this means that for every $100 in revenue, $80 is gross profit after operating costs (COGS), and $20 is operating costs (COGS)。This high gross margin usually indicates that the company is able to sell a product or service at a price well above cost and has strong profitability and competitive advantage in the market.。

Conversely, when a business has a gross margin of only 10%, this means that for every $100 in revenue, only $10 is gross margin and the remaining $90 is used to cover the costs incurred in selling the product (and that figure is not yet deducted from operating costs).。Such a low gross margin may indicate a firm's weak pricing power or cost control challenges, increasing the risk of operating losses。In this case, companies may need to take steps to improve their financial health, such as reducing operating costs or increasing product prices。

Accurate gross margin analysis can help enterprises effectively specify pricing strategies and control costs, improve overall operating efficiency, and play a key role in the long-term steady growth of enterprises.。

-

Gross margin calculation formula

Gross margin = (operating income - operating costs) ÷ operating income x 100%

For example, a fast food restaurant sells a burger for $60, and the cost of producing a burger is $30, which includes bread, cutlets, eggs, lettuce, salad dressing, wrapping paper, and so on.。

Gross profit = $60 (operating income) - $30 (operating costs) = $30

Gross margin = $30 (gross profit) ÷ $60 (operating income) × 100% = 50%

Therefore, the gross profit per burger sold is $30, while the gross profit margin is 50%。

Why gross margin is an important financial indicator?

The analysis of gross margin can reveal a variety of things about the business and its operations.

-

When the company's revenue and gross margin rise at the same time.

The company performs well in controlling operating costs and has high profitability potential in terms of quality and pricing。Conversely, if a company's revenue declines but gross margins are still rising, this may indicate that the company is maintaining gross margin levels by reducing operating costs, or abandoning products with lower gross margins in favor of more profitable products。

-

When revenue increases but gross margin decreases

Enterprises may carry out price reduction promotions to increase sales.。In addition, this situation may also be due to increased market demand for products, resulting in more operating income, but at the same time by rising raw material costs, exchange rate fluctuations and other factors, so that the increase in operating costs exceeded revenue growth, resulting in a decrease in gross margin.。

-

When revenue falls but gross margin rises

Firms may have achieved higher profits by effectively reducing production costs。In addition, companies may reduce sales of low-margin products and focus instead on promoting high-margin products or services。Changes in market demand may also be a factor, as demand for high-margin products increases and demand for low-margin products decreases, while companies face a decline in total sales, gross margins have improved。

-

When a company's revenue and gross margin decline in tandem

This may be due to intense external competition or other environmental factors forcing companies to sell at lower prices and, without reducing operating costs, resulting in lower operating income and lower gross margins.。This may signal operational challenges or increased competitive pressures in the market, posing a threat to the long-term survival and profitability of the business.。

Investors can assess a company's competitive position in the market and investment attractiveness through gross margin.。By comparing gross margins with other companies in the same industry, investors can determine whether the company has advantages in cost control, product differentiation and brand positioning。If a company's gross margin is higher than the industry average, it means that the company has strong profitability potential, cost control and market competitiveness to achieve higher profitability。

What is the relationship between gross margin and net margin?

-

Net Profit and Net Profit Margin

Net profit refers to the profit actually earned by an enterprise in a financial year or quarter.。Gross profit (Gross Profit) minus operating expenses (Operating Expenses), you can calculate the net profit.。

Net profit margin, also referred to as net profit margin, is a measure of a company's net profit as a percentage of total revenue, reflecting how much of each unit of revenue a company can convert into actual profit.。

-

The relationship between gross margin and net margin

| Gross margin (Gross Profit Margin) | Net Profit Margin |

| Profit after deducting operating costs as a percentage of total revenue | Net profit after deducting all costs, expenses, interest and taxes as a percentage of total revenue |

| Primarily reflects the profitability of the business | It mainly reflects the overall operational efficiency and cost control ability of the enterprise. |

Gross margin and net margin each assess a firm's profitability from different perspectives。Gross margin focuses on the direct profitability of the product or service, while net margin covers the full range of business operations, including all fees and expenses。

A business may have a high gross margin and good profitability potential in the market。However, if the business has a heavy operating cost, interest expense and tax burden, the net interest rate may be relatively low。

Conversely, even if the company's gross margin is not particularly high, it is still possible to achieve a higher net margin by effectively controlling additional costs and expenses。

Gross margin and net margin are key indicators for analyzing the financial health of an enterprise, and these two indicators should be combined to obtain a comprehensive view of the profitability of the enterprise.

How to view a company's gross margin from earnings?

Most listed companies publish their financial reports on their official websites.。In the case of Microsoft, for example, you can check the latest and previous years' financial reports by simply logging into Microsoft's Investor Relations page。

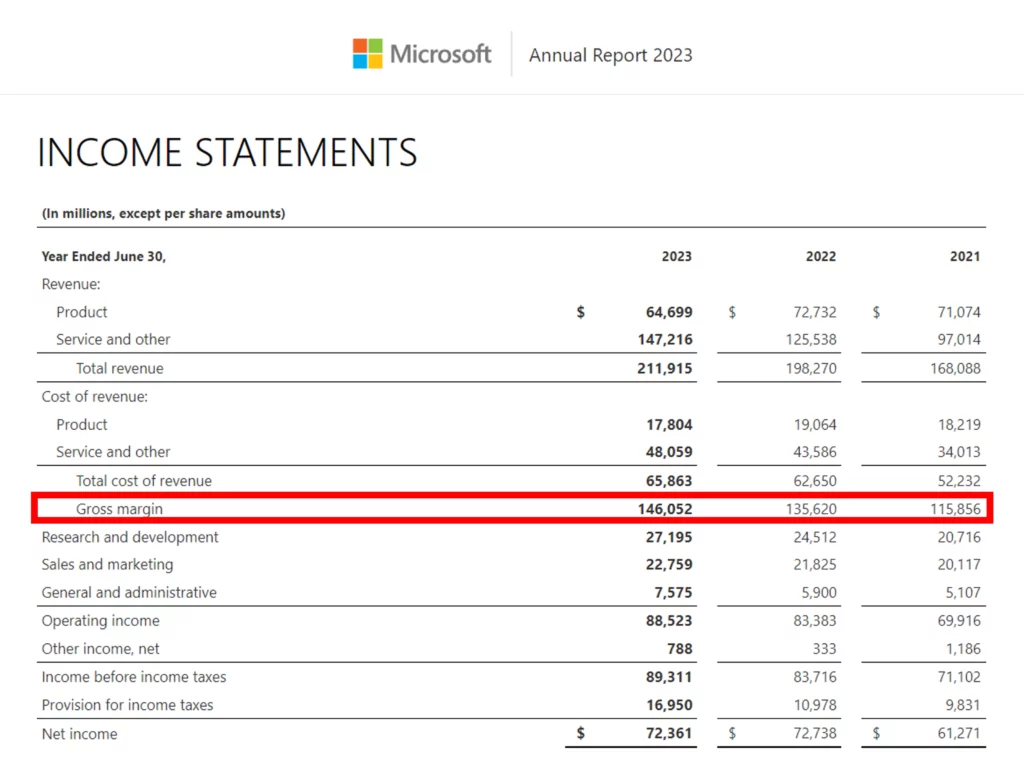

This article will take Microsoft's latest 2023 financial report as an example.。After clicking "2023 Annual Report View Online," go down to the "Income Statement" section and you can see Gross Margin。

In addition, you can also directly view the latest and previous year's gross margin through Finbox.。

How to Use Gross Margin to Evaluate a Stock?

Mainly through the following two aspects of analysis:

-

Compare gross margins in previous years

By analyzing the changes in a company's gross margin over the past few years, investors can gain a deeper understanding of how the company is doing。

Stable or rising gross margins usually indicate that the business is performing well in terms of profitability, cost management and pricing strategies, reflecting that the business has strong competitiveness and a healthy financial position, and bodes well for the stock's potential to perform well in the future.。

Conversely, if gross margins show a downward trend, this may imply that the company is facing issues such as rising costs, market pricing challenges or increased competitive pressures, which may have a negative impact on the company's long-term profitability and share price。

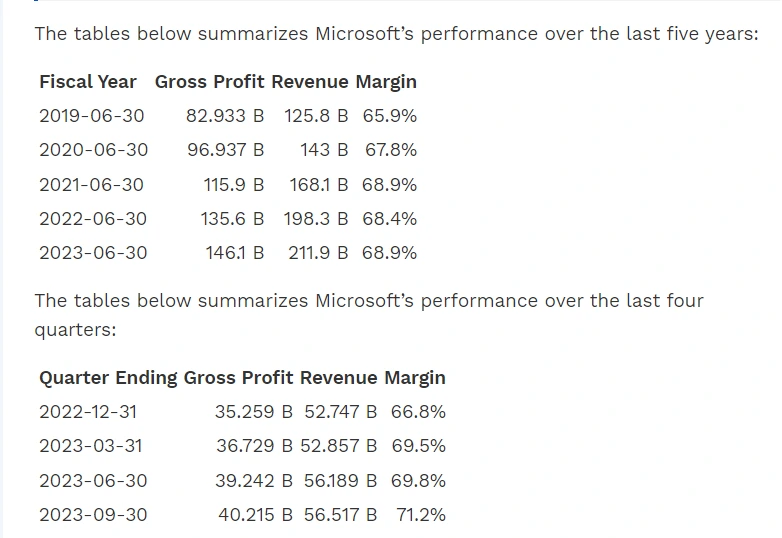

In the case of Microsoft, Microsoft's average gross margin remained at 68 during the fiscal year 2019-2023..0%。

In fiscal 2022, Microsoft's gross margin declined slightly (68.4%), a decrease of 0 compared to FY2021.8%。In several other fiscal years, however, Microsoft's gross margins have shown an upward trend.。For example, in 2019 65.Gross margin of 9% was an increase of 1% over the previous year..0%; further growth to 67 in 2020.8%, an increase of 2.9%; gross margin rises to 68 in 2021.9%, an increase of 1.7%; and in 2023, gross margin again reached 68.9%, an increase of 0.8%。

Overall, Microsoft maintained a solid gross margin growth trend over the five years, reflecting Microsoft's effective management of cost control and pricing strategies, which in turn maintained high profitability。

-

Compare gross margin with firms in the same industry

Comparing the gross profit margin of a company with the gross profit margin of other companies in the same industry is an effective way to evaluate the competitive position of the company in the industry.。

When a company's gross margin is higher than the industry average, it indicates that the company has advantages in product differentiation, brand influence, cost control or market positioning, maintains a leading position in the fierce market competition, and obtains higher profitability.。

Conversely, when a company's gross margin is below the industry average, it may mean that it is at a disadvantage in the field or is under greater competitive pressure in the market.。

As of December 2023, U.S. regional banks had the highest average gross margin (99.8%), while the U.S. auto manufacturing industry has the lowest average gross margin (10.1%)。

| 5 industries with high gross margins | Average Gross Margin |

| Banking - Regional | 99.80% |

| real estate investment trust | 92.50% |

| Mortgage financing | 92.10% |

| insurance broker | 89.20% |

| Banking - Diversification | 88.70% |

| 5 Industries with Low Gross Margin | Average Gross Margin |

| Automobile manufacturing | 10.10% |

| Production and sale of oil and natural gas | 11.30% |

| agricultural products | 13.40% |

| Papers and Paper Products | 14% |

| Food Distribution | 14.10% |

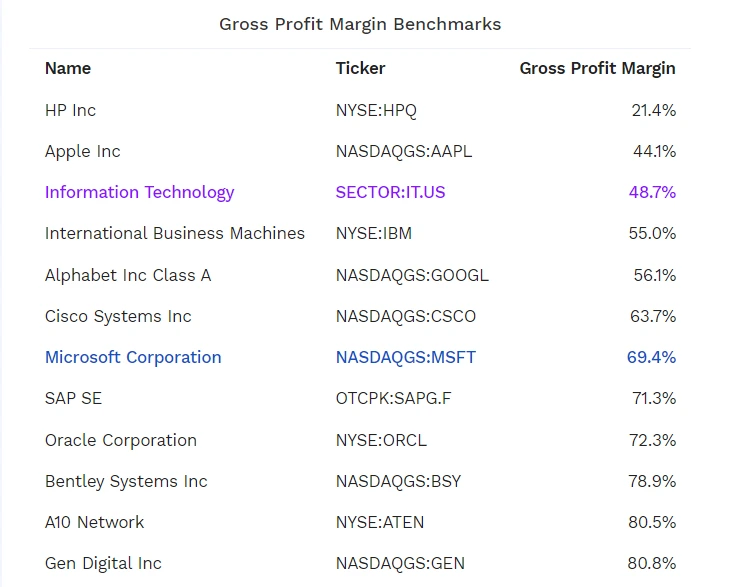

Take Microsoft (MSFT) as an example, its gross margin for the last 12 months was 69.4%, when compared to its major competitors, Microsoft performed well on the gross margin metric, but not the highest。For example, Hewlett-Packard (HP) has a gross margin of 21.4%, Apple (44).1%, Google 56.1%, while Gen Digital's gross margin is as high as 80.8%。This suggests that Microsoft is in the upper middle of the competitive tech industry.。

In addition, Microsoft's gross margin is above the IT industry average (48.7%)。Although Microsoft's gross margin is not the highest in the industry, its profitability and cost control are still better than many of its competitors in the same industry and significantly higher than the industry average, reflecting its competitive advantage in the market and solid financial performance.。

SUMMARY

Gross margin is a key tool for assessing a company's financial health, profitability and market competitiveness。It not only reflects the efficiency of the firm in terms of pricing and cost control, but also provides an in-depth display of the firm's profitability structure。Stable or gradually rising gross margin indicates that the enterprise has obvious competitive advantages in product differentiation, brand influence, cost control and market positioning.。Thus, by analyzing trends in gross margin, investors are able to assess the efficiency of a company's operations over time and can make more informed investment decisions。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.