What is the difference between the Malaysian Securities Commission (SC) and Bursa??

In Malaysia's capital markets, the Malaysian Securities and Futures Commission (SC) plays a supervisory role to ensure fair, transparent and efficient operation of the market while enhancing the competitiveness of the Malaysian capital market.。This article will introduce the SC function, let investors understand the importance of the institution, and how to find important information from the SC official website。

During the reading of financial news, you will see the words "Securities Commission Malaysia" (SC) from time to time, such as the company to go public on the Main Market (Main Market) must be approved by the SC, SC accused a company of fraudulent investors, etc., SC seems to have a pivotal weight in the capital market.。

The most sensational news of SC's recent national history was the court-martial between the company and the Sebastian Power (SERBADK), which ended with the payment of a fine by SERBADK.。

What exactly is SC??How it protects the rights and interests of investors, especially retail investors?

What is the Malaysian Securities Regulatory Commission (SC)??

SC's Chinese name is the Malaysian Securities Commission, also known as the Malaysian Securities and Futures Commission, and its full English name is Securities Commission Malaysia.。SC was established on March 1, 1993 to oversee the operation of the Malaysian capital markets, including the stock market, bond market, equity crowdfunding platform, derivatives (Derivatives), cryptocurrencies, sukuk (Sukuk), and asset management.。

In addition, SC will also urge the management of domestic listed companies to pursue good corporate governance (Corporate Governance).。

Under the Securities Commission Act 1993, SC is required to report regularly to the Minister of Finance on the progress of its work.。

In the United States, market oversight is in the hands of the Securities and Exchange Commission (SEC).。

▍ Malaysia Securities Regulatory Commission (SC) main functions and scope of supervision

-

Announces Draft Prospectus for Potential Main Board Listed Companies (Prospectus)

Whenever a private company plans to go public on the main board, it will publish a draft prospectus on the SC website in advance, explaining the company's main business, the purpose of the listing, the results of the past few years, etc.。If you plan to list on the Growth Enterprise Market (Ace Market), its draft prospectus will be posted on the official website of the Malaysia Stock Exchange (Bursa).。

-

Approving and supervising the issuance of corporate securities

Whenever a company needs to issue new shares or bonds, it needs to report to the SC in advance and obtain approval.。After issuance, the SC will also ensure that the securities are legally traded。

-

Supervision of mergers and acquisitions

Since the acquisition or privatization of a listed company will ultimately affect the value of the stock and the rights and interests of investors, SC will monitor it to ensure that the acquisition activity is carried out legally.。

-

Issuance of Capital Markets Service Licence

To legally provide securities and derivatives trading, settlement, asset management, corporate finance, investment advice, and financial planning services, you must obtain a New Capital Markets Services Licence (CMSL) and a New Capital Markets Services Representative's Licence (CMSRL) issued by SC.。The CMSL is issued to the principal, the company that provides the service, and the CMSRL is issued to the individual who provides the service on behalf of the principal.。

It is worth mentioning that for companies that provide securities and derivatives settlement services, their employees do not need to obtain a CMSRL license.。

▍ Malaysia Securities Regulatory Commission (SC) official website main information

-

Find Potential Main Board Listed Companies Draft Prospectus

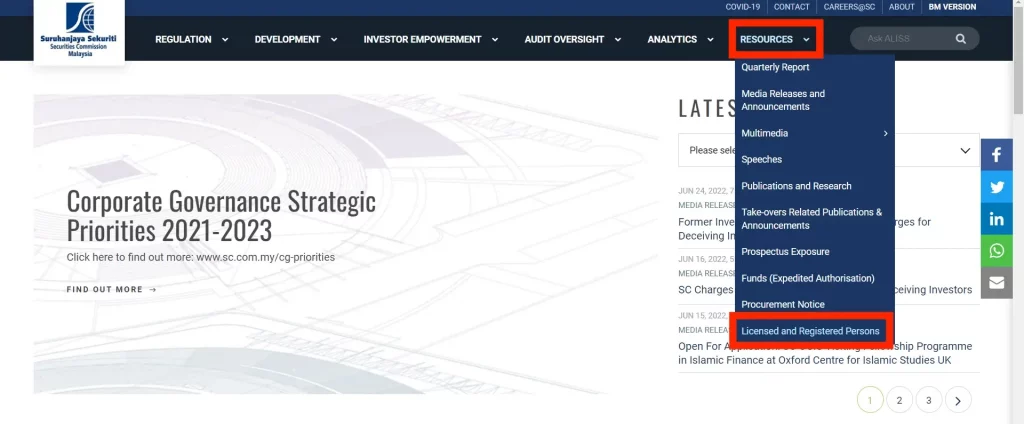

After entering the SC official website, you can go to "Resources" and click "Prospectus Exposure," and then you can see the proposed prospectus of the company planning to list on the main board.。To understand the company's business and fundamentals, read the information in the prospectus。For draft prospectuses for companies planning to list on GEM, you can go to Bursa's website。

-

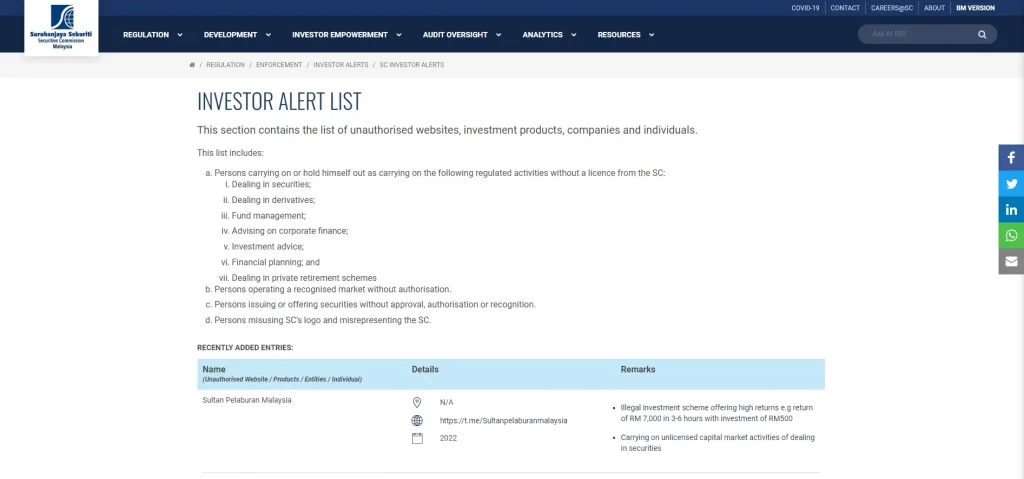

Find a list of illegal people in the capital markets

You can click "Investor Alert List" in the "Investor Empowerment" of the SC official website, and then the relevant list will appear。

The organizations or individuals on the list are all engaged in activities related to securities trading, asset management, wealth planning, or providing investment advice without the authorization of the SC.。SC publishes the relevant list in the hope that investors will be protected from fraud.。

-

View the list of licensed capital market participants

After clicking "Licensed And Registered Persons" on the "Resources" of the SC official website, the relevant list will appear, and you can see what domestic legal capital market services are available.。

-

Learn about the latest SC

You can click on SC's recent press releases through the "Latest Updates" in the upper right corner of SC's official website, including which suspected fraudsters are being charged.。

The difference between the Malaysian Securities and Exchange Commission (SC) and the Bursa Malaysia

Since SC and Bursa are both capital market regulators, many people confuse their functions or mistake them for the same institution.。But in fact, their functions are very different.。

As mentioned above, SC is the regulator of the entire Malaysian capital market, from the early issuance of securities to the later fair trading, under the SC's "eye."。

As for Bursa, it is a platform for trading and clearing securities in Malaysia and will also assist in overseeing the operation of the securities market.。

As a securities trading platform, Bursa is subject to the supervision of the SC and the Ministry of Finance.。What's more, Bursa itself is a listed horse stock company.

▍ SC recent major events: SERBADK power audit storm

Referring to the major events in SC in recent years, it is necessary to mention the SERBADK power audit storm.。

Looking back at history, in May 2021, KPMG (KPMG), then the external auditor of SERBADK, sent a message of doubt about the former's accounts.。The incident caused a huge storm for SERBADK, and its share price swooped down as a result.。

On the occasion of SERBADK's repeated shelling of KPMG, SC had come forward to shout for support for the external auditor's fearless performance of his duties and to express an independent opinion.。

By the end of December 2021, SC announced that it had obtained an arrest warrant to pursue the Director Manager and Chief Executive Officer of SERBADK, Mohamed Adukarin, and charged SERBADK with providing false financial data to BURSA.。

On 13 April 2022, the SC announced a fine of RM16 million for SERBADK and four senior officers as punishment for reporting false accounts to Bursa.。SERBADK also stated on May 12 that it had paid the relevant fines.。

Coincidentally, former SC chairman Syed Zaid Albar announced his resignation on April 28, with former Deputy Finance Minister Awang Adek Hussin taking over.。

▍ Conclusion

Although SC itself is not a listed company, as a supervisor of the domestic capital market, any of its decisions play a key role in the development and smoothness of the market.。If investors want to understand the development of the market, do not ignore the move of SC!

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.