Fed's January 2024 interest rate resolution: four consecutive hold-up March rate cuts expected to cool down

Surprisingly, at a press conference after the meeting, Fed Chairman Powell put out a hawk, saying that it would be inappropriate to lower the target range until there is greater confidence that inflation continues to move towards 2%

On January 31, local time, the Federal Reserve concluded its two-day monetary policy meeting.。Unsurprisingly, the Federal Open Market Committee (FOMC) announced that it would maintain its target range for the federal funds rate at 5.25% to 5.50% unchanged, the decision to suspend the rate hike was unanimously approved by the FOMC voting committee。

Surprisingly, at a press conference after the meeting, Fed Chairman Powell put out a hawk, saying it would be inappropriate to lower the target range until there is greater confidence that inflation continues to move towards 2%。It also hinted that the first rate cut in March previously predicted by the market will probably not happen.。

After the speech, according to the CME interest rate watch tool, the probability of the Fed cutting interest rates in March from 55.4% down to 34.5%, but the probability of a rate cut of at least 150BP for the year rose from 61% to 67.2%。In addition, the 10-year U.S. bond rate fell sharply by 12 BP to 3.92%; dollar index closes up 0.12%。

Affected by the news, the three major U.S. stock indexes closed down across the board yesterday。Dow down 0.82%, the S & P 500 fell 1.61%, Nasdaq down 2.23%, the biggest one-day drop since October 25, 2023。Among them, Cisco fell 3.94%, Microsoft down 2.69%, leading the Dow down。

U.S. Economy Continues to Exceed Expectations Inflation Remains High

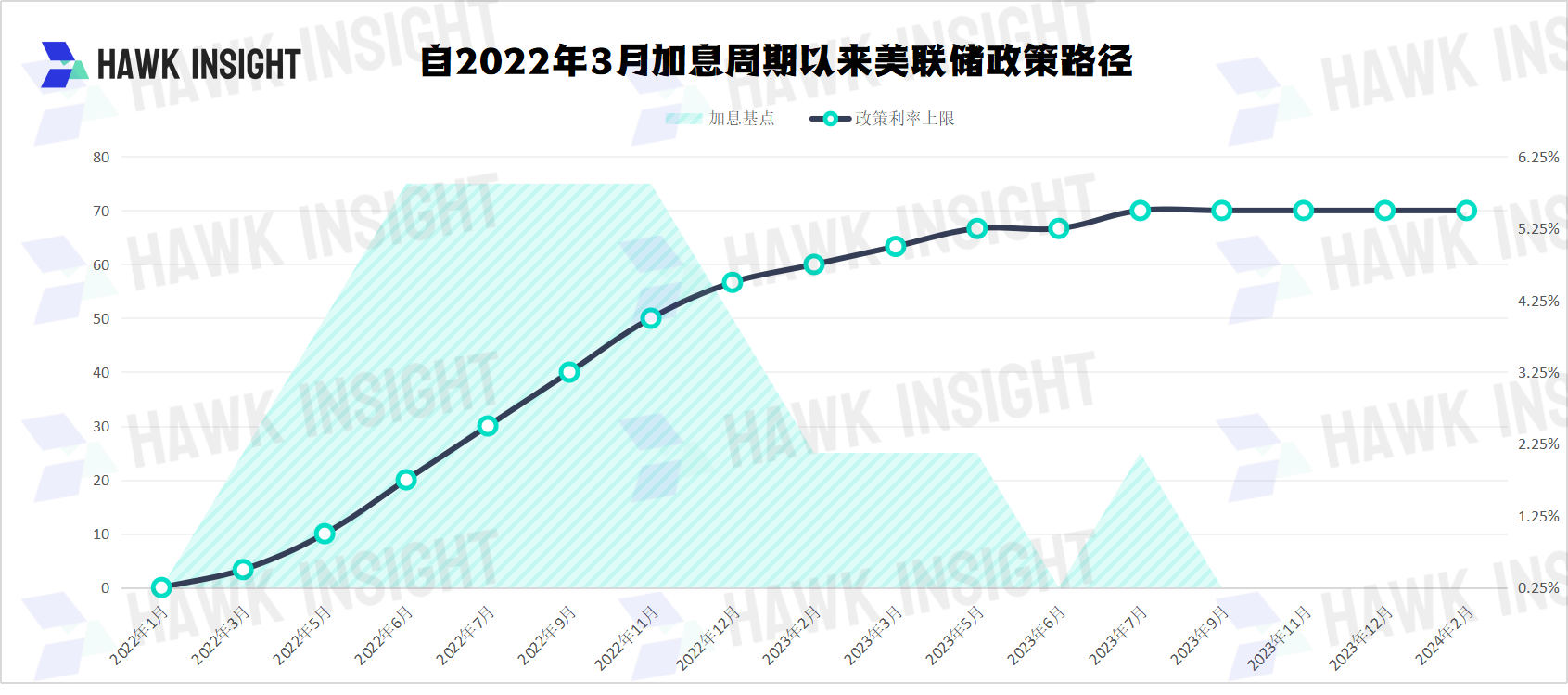

The rate decision is the fourth consecutive time the Fed has held back, and the pace of Fed policy has slowed significantly compared to the policy actions at the beginning of the rate hike cycle。Still, the Fed deliberately cooled the market in its interest rate statement。

In the interest rate statement, the Fed's statement of current economic conditions changed from the previous "growth in economic activity has slowed from strong growth in the third quarter" to "economic activity has been steadily expanding," reflecting the recent U.S. economy continued to exceed expectations.。

Specifically, according to data released by the U.S. Department of Commerce, U.S. real GDP grew by as much as 3% year-on-year in the fourth quarter of 2023..1%, greatly exceeding market expectations。Among them, consumer spending has shown a strong bias towards hot stickiness, creating a sustained boost to U.S. economic growth.。In the labor market, U.S. non-farm payrolls added 21 jobs in December..60,000, also far more than expected。

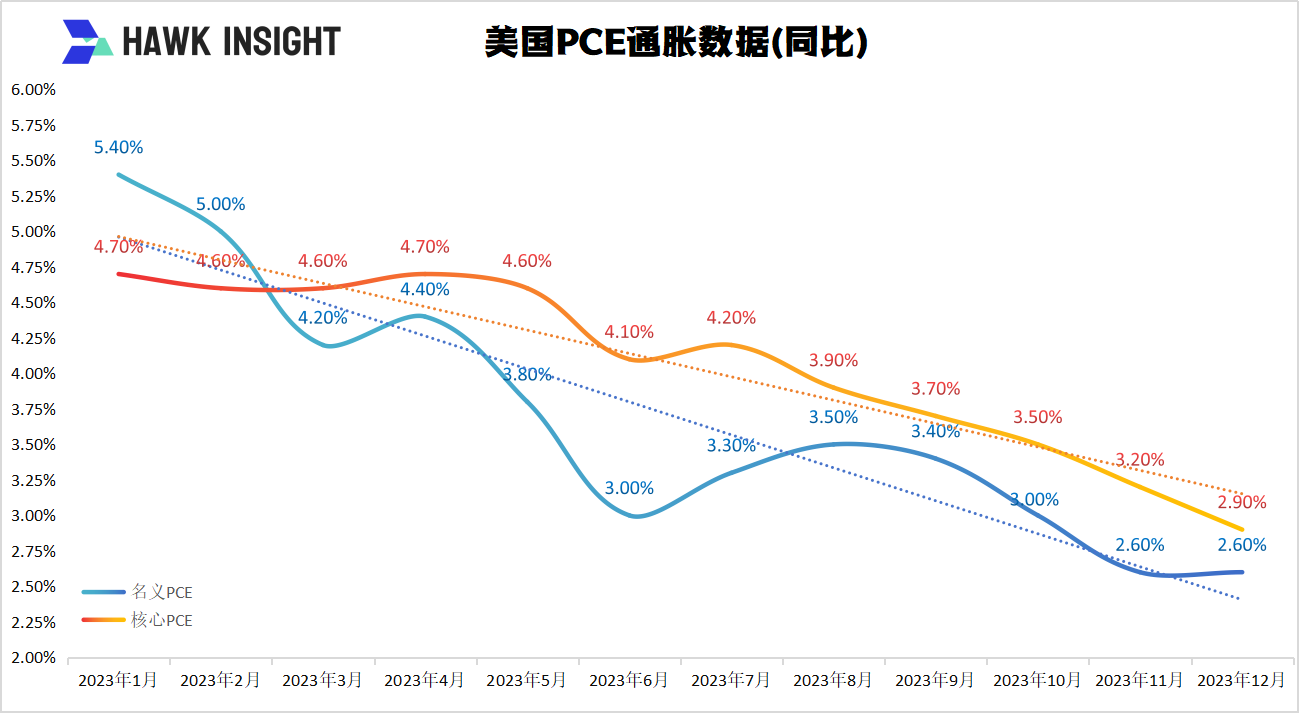

It is worth noting that while the U.S. economy is growing strongly, its inflation rate is generally trending lower.。On January 26, according to the latest data released by the U.S. Department of Commerce, after excluding volatile food and energy prices, the U.S. core personal consumption expenditure (PCE) price index rose only 2.9%, the lowest level in nearly three years。

The Fed said in its statement that job growth has slowed since the beginning of last year, but remains strong and the unemployment rate remains low.。The Fed also specifically noted that inflation has remained high over the past year, despite easing。

In this regard, is regarded as the "Fed mouthpiece," "New Fed News Agency" Wall Street Journal reporter Nick Timiraos (Nick Timiraos) commented that there have been many changes in the statement document, the tendency to further tighten disappeared, and to some extent to show that interest rate cuts are not so urgent.。

For the future policy outlook, the Fed deleted the description of the banking system, financial and credit conditions in its statement, saying that "the economic outlook is still unclear," but employment and inflation are better balanced; for the basis for future monetary policy adjustments, the statement deleted the previous wording of "the degree of additional policy tightening" and changed it to "the target range of the federal funds rate," which to some extent implied a reduction in the possibility of further tightening.。

Powell: No one is suggesting a rate cut now

In the press conference that followed, Powell also continued his argument against rate cut expectations。

Powell said the Fed believes the FOMC policy rate may be at its peak in the current cycle, so a rate cut at some point this year would be appropriate and is prepared to keep the policy rate unchanged for a longer period of time。He stressed that U.S. inflation had slowed significantly, but remained above the established target of 2 percent, and that more evidence was needed to prove that inflation had been significantly contained.。

Powell also pointed out some clues to the meeting, he said that at the meeting, due to the 12-month inflation (CPI year-on-year) down, may continue to decline, almost all members of the meeting agreed that multiple interest rate cuts this year would be appropriate, but not because of the fall in inflation on the mechanical adjustment of interest rate policy, no one recommended to cut interest rates now。He went on to say that the Fed has not yet reached the level of confidence that it will initiate a rate cut in March, and that whether it ultimately cuts rates will depend on the evolution of the economic situation。

On the balance sheet issue, Powell believes that the Fed plans to start in-depth discussion of the balance sheet issue in March, that the current tightening cycle since the tapering process is progressing well, there is no need to wait until the overnight reverse repurchase agreement (RRP) completely down to zero before slowing down the tapering process.。

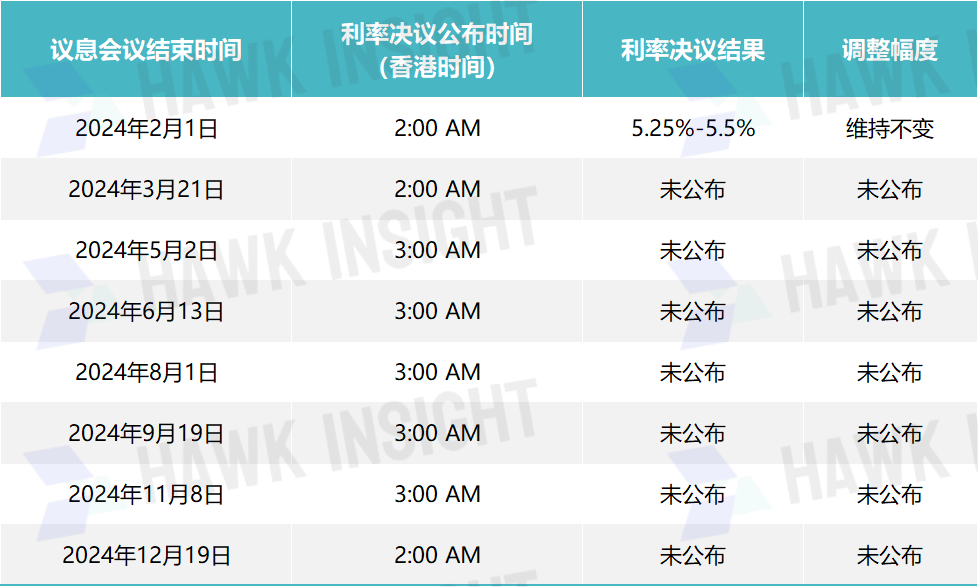

According to the Fed's schedule, the next two rate decisions of the FOMC Committee will be announced on March 21 and May 2.。With inflation continuing to fall and job growth slowing in recent months, the two meetings remain possible candidates for the first Fed rate cut。

According to that schedule, there may only be one more PCE inflation data before the Fed's March meeting, but three more PCE inflation data will be released before the May meeting.。PCE Inflation Data Is Fed's Preferred Inflation Indicator。Before the May meeting, U.S. officials will release three federal employment reports, including the January 2024 report, which will be released this Friday.。

Attached: Full text of the Federal Reserve's January 2024 Statement.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.