Fed July 2024 Rate Decision: Continues Neutral Dove Stance, September Rate Cut on Agenda

No rate cut has yet arrived.

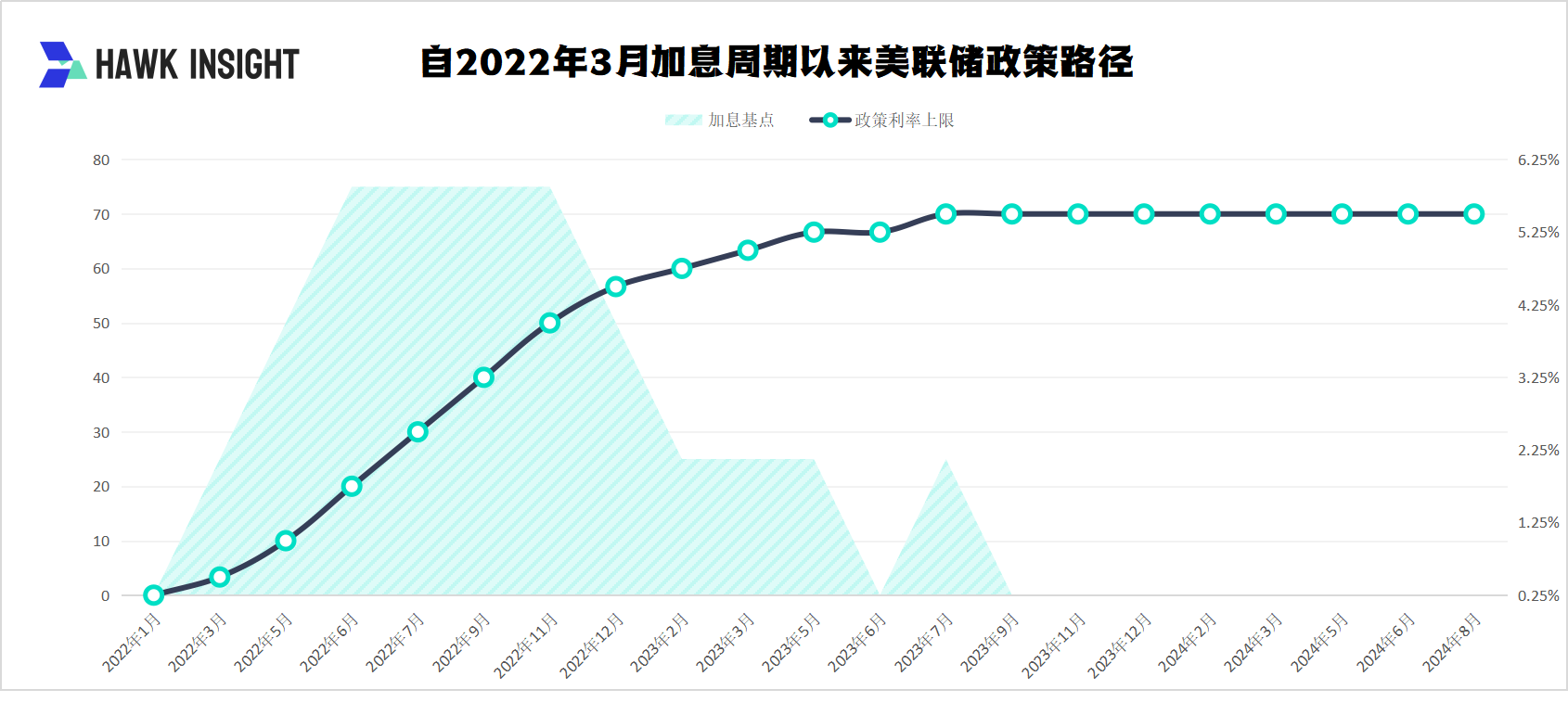

On July 31st, in line with market expectations, the Federal Reserve continued to keep interest rates unchanged, maintaining the target range at a high of 5.25% to 5.5%, and no rate cut has yet arrived.

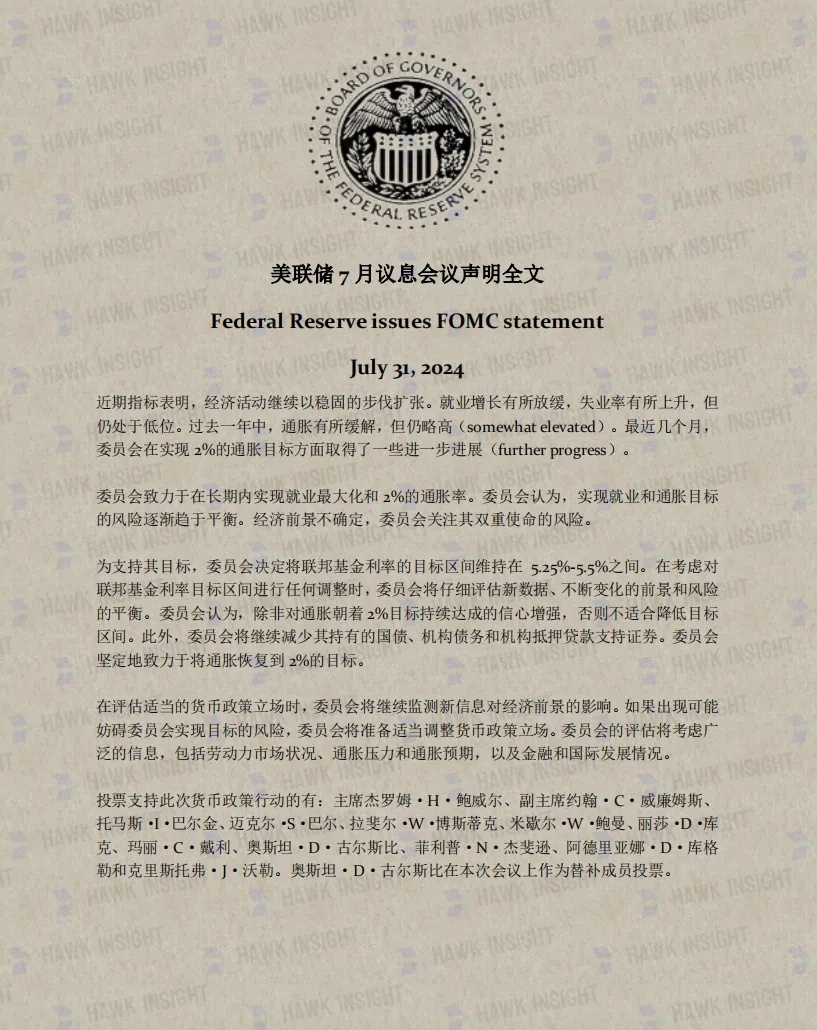

In the resolution, there were several key changes in the Federal Reserve's statement. The Fed did not remove the phrase "inflation remains high," but instead changed it to "inflation remains somewhat elevated." Additionally, the Fed added the phrase "is attentive to the risks to both sides of its dual mandate," indicating that officials are closely monitoring changes in the labor market as well as the current overall environment, in addition to inflation data.

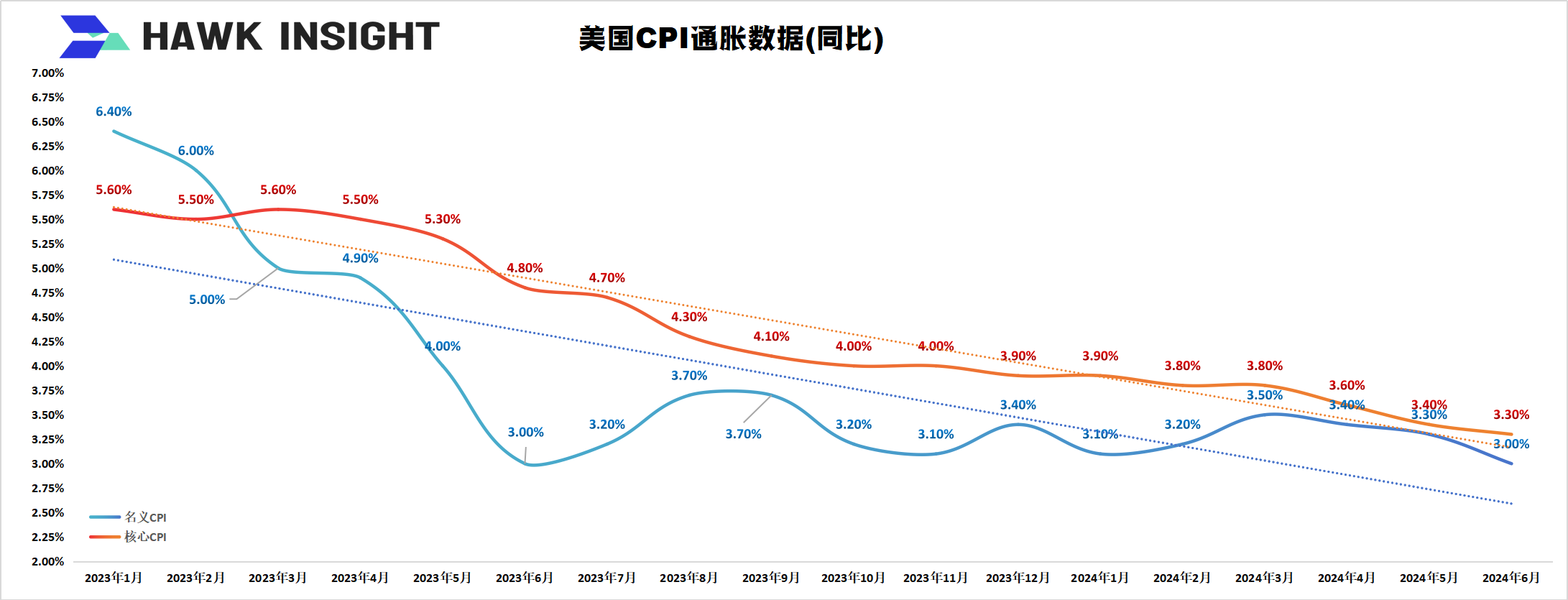

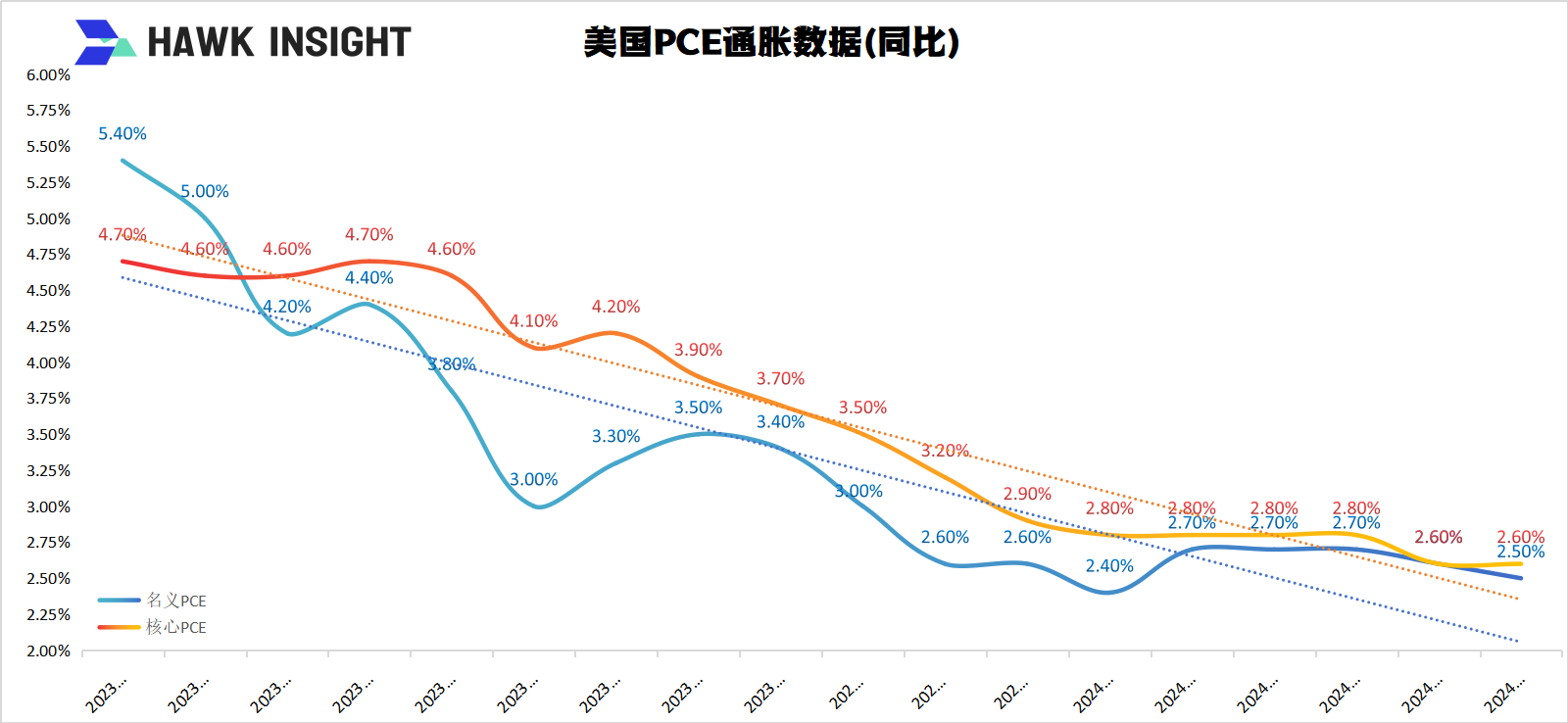

The Federal Reserve stated that recent indicators show that economic activity continues to expand at a solid pace. Job growth has slowed, and the unemployment rate has risen slightly, but it remains low. Inflation has eased over the past year but is still a bit high. In recent months, some progress has been made towards the committee's 2% inflation target.

To support its goals, the committee decided to keep the federal funds rate target range at 5.25% to 5.5%. When considering any adjustments to the federal funds rate target range, the committee will carefully assess the data received, the changing outlook, and the balance of risks. The committee expects that it is not appropriate to lower the target range until there is greater confidence in the continued progress of the inflation rate towards 2%. In addition, the committee will continue to reduce holdings of Treasury securities, agency debt, and agency mortgage-backed securities. The committee is firmly committed to bringing the inflation rate back to the 2% target.

It can be seen that the Federal Reserve's statement is not as dovish as the market expected. The Fed did not abandon the phrase "inflation remains high," but instead changed it to "inflation remains somewhat elevated," indicating that officials need more data to confirm that inflation will continue to move towards the 2% target.

At the press conference, Powell's remarks were basically consistent with the policy tone. He emphasized that the possibility of a rate cut in September does indeed exist, but it is based on the premise of seeing overall data that satisfies the Fed, not just a few individual data points. For example, the Federal Reserve may seek evidence in other indicators beyond inflation and the labor market to prove that inflation has completely cooled and there is no risk of continued rise.

This meeting was held against the backdrop of a slowdown in U.S. inflation in the second quarter, a slight rise in the unemployment rate, but still solid economic growth. Before the meeting started, there were already calls for a rate cut in July, and the probability of a rate cut in September in the swap market was approaching 100%. The market wants to know whether the Federal Reserve agrees with these calls and pricing, and how Powell will send the signal for a rate cut. Since there was no new dot plot in this meeting, the market's focus was on the interest rate decision, monetary policy statement, and Powell's press conference.

After the meeting statement, the market reacted with ease: the yield on 10-year U.S. Treasury bonds fell by about 9 basis points to 4.03%, and the US dollar index fell by about 0.4% to around 104.06. The three major U.S. stock market indices rose throughout the day, with growth stocks outperforming value stocks; the price of gold rose by about 1.6%, reaching about $2,447 per ounce.

Attached: Full text of the Federal Reserve's July monetary policy statement:

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.