Q2 Revenue and Profit Surge! Meta Stock Soars After Hours

Meta shares jumped more than 7% after hours on the back of higher revenue and net income in the second quarter and better-than-expected guidance for the next quarter.

After the U.S. stock market on Wednesday (July 31), Meta released its financial results for the second quarter of 2024 ended June 30th.

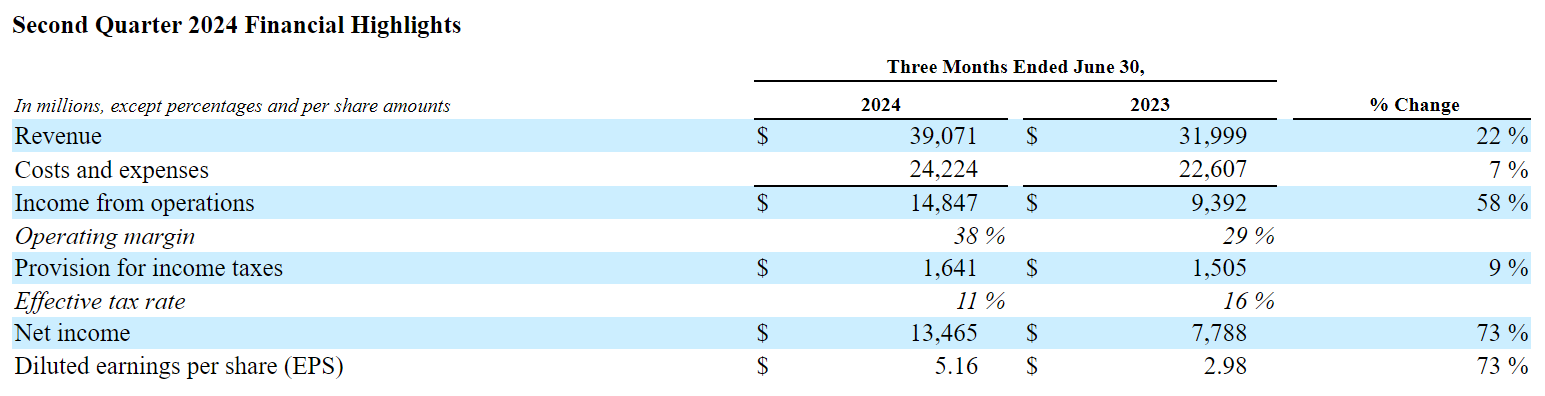

The data showed that Meta's revenue for the second quarter was $39.07 billion, beating analysts' expectations of $38.31 billion and up 22% year-over-year, marking the fourth consecutive quarter of year-over-year growth of more than 20%. Net income came in at $13.47 billion, a 73% jump year-over-year. Earnings per share were $5.16, beating analysts' estimates of $4.73.

In addition, Meta expects revenue for the third quarter of 2024 to be between $38.5 billion and $41.0 billion, with a median of $39.75 billion, again higher than analysts' previous forecast of $39.1 billion.

Meta shares jumped more than 7% after hours on the back of the double revenue and net profit growth and better-than-expected guidance for the next quarter.

Advertising revenue better than expected, Reality Labs losses widen

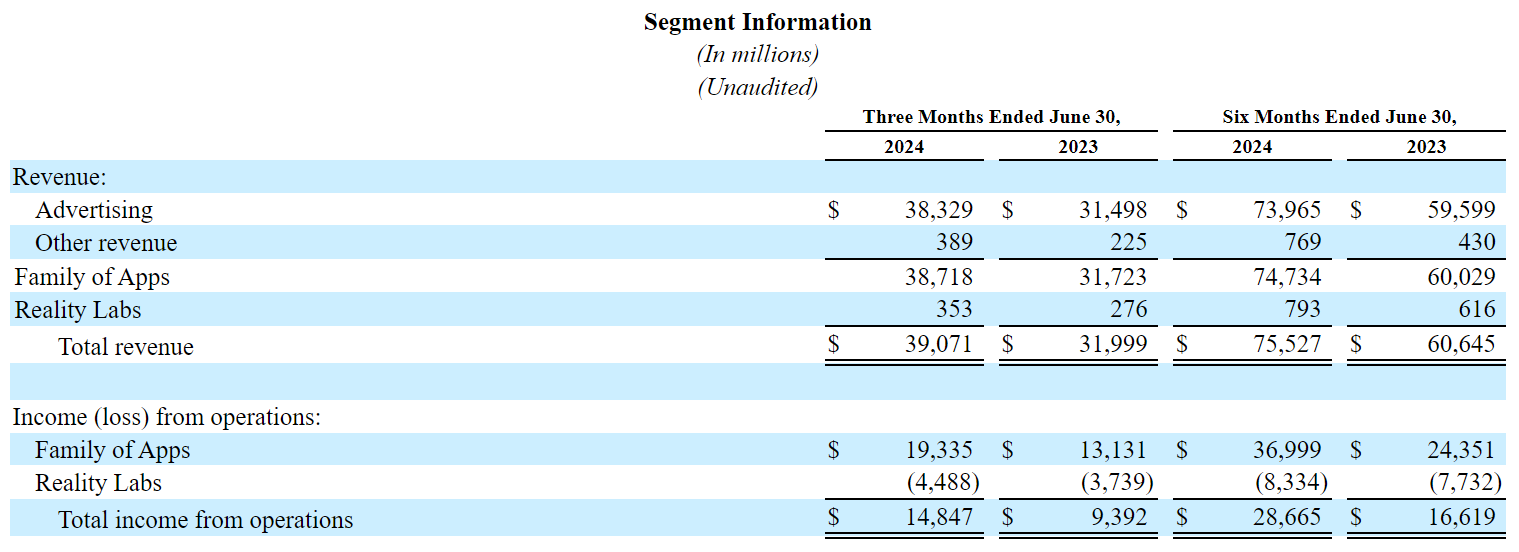

Let's look at the performance of Meta's two business units in the second quarter.

●Family of Apps ("FoA"): FoA includes Facebook, Instagram, Reels, Threads, and WhatsApp, among others, and Meta's revenues are essentially contributed by advertising revenues from these apps, accounting for approximately 98%. which accounted for around 98%.

FoA's revenue for the first quarter was $38.72 billion, up 22% year-over-year and above analysts' expectations of $37.76 billion. Operating profit came in at $19.34 billion, above estimates of $18.69 billion.

FoA's advertising revenue was $38.33 billion, up 21.7% year-on-year, a slower rate of growth than the previous quarter's 27%, but still better than market expectations.

In terms of data on FoA users, FoA's average daily active population (DAP) was 3.27 billion in June, up 7% year-on-year and roughly in line with market expectations.

●Reality Labs ("RL"): RL includes consumer hardware, software and content related to augmented reality (XR), mixed reality (MR) and virtual reality (VR).

In the second quarter, RL realized revenue of $353 million, up nearly 28% year-over-year and below analysts' expectations of $377 million. Operating loss was recorded at $4.49 billion, widening from $3.74 billion in the same period last year, though better than market expectations of a loss of $4.53 billion. Since the end of 2020, RL has accumulated losses of nearly $50 billion.

Meta said it expects RL's operating loss to increase significantly year-on-year in 2024 due to ongoing product development efforts and investments to further expand the ecosystem.

Llama 4 plans to launch next year

Meta founder and CEO Mark Zuckerberg said, "By the end of this year, Meta AI is on track to become the most used AI assistant in the world. We've released the first cutting-edge open source AI model."

Last week, Meta launched its updated open-source large language model, Llama 3.1 family.Llama 3.1 family has three parameter scales of 8 billion, 70 billion and 405 billion parameters.

This version, 405 billion parameters, is said to have been trained using over 16,000 of NVIDIA's H100 GPUs and outperforms OpenAI's current best large model, GPT-4o, in several benchmarks.Unlike other closed-source large models, users can download or use directly on cloud platforms (such as AWS, Azure, and Google Cloud) Llama 3.1.

Zuckerberg said on the earnings call that Meta has begun training for Llama 4, which is scheduled to launch next year with the goal of becoming "the most advanced model in the industry." In the call, Zuckerberg said, "Training Llama 4 can require almost 10 times the amount of computation required to train Llama 3, and future models will continue to exceed that scale."

Significant capex growth expected next year

Meta's capital expenditures saw a significant increase in the second quarter due to continued investment in artificial intelligence.

In the second quarter, Meta's capital expenditures, including principal payments on finance leases, were $8.47 billion, below market expectations of $9.5 billion and up 26% sequentially.Meta expects full-year capital expenditures to be in the range of $37 billion to $40 billion in 2024, an update from the previous range of $35 billion to $40 billion.

Meta also issued an early warning about next year's capex: "While we are still refining our plans for next year, we currently expect capex to grow significantly in 2025 as we invest to support AI research and product development efforts."

On the call, Meta executives answered questions about ROI. According to CFO Susan Li, Meta's AI investments fall broadly into two categories, core AI and generative AI.

On the core AI side, Meta says it can see relatively strong returns at this point, mainly due to improved user engagement and ad performance translating into revenue growth, and that these conditions indicate that it makes sense for the company to continue investing. On the generative AI side, it is not expected to materially drive the company's revenue growth this year, but expects the generative AI offering to open up new revenue growth opportunities over time.

While also investing heavily in AI, the market clearly reacted more positively to Meta than Alphabet and Microsoft, which reported earnings earlier.

Debra Aho Williamson, founder and principal analyst at Sonata Insights, said, "The market's positive reaction to Meta's earnings is a bellwether for AI stocks. If a company's core business is able to deliver strong results, then its investment in AI will be viewed more positively. If the core business shows any signs of weakness, as we saw on Alphabet's YouTube last week, then the stock may look more risky."

She added that Meta stands out from other tech companies with AI ambitions because it already brings in significant ad revenue, rather than trying to build a new business from scratch.

She says: "Unlike Google, which is trying to make changes that will impact its core advertising business, most of Meta's AI investments are either to make ads on its website work better or to build new features that could eventually become revenue drivers."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.