The U.S. technology industry accounts for about half of the world's market capitalization, and several Chinese peers have fallen out of the top 500.

U.S. stock market capitalization is close to half of the world's, Alibaba and Tencent's performance has declined, and Chinese technology groups have fallen out of the top 10 most valuable companies in the world.。

At present, the concentration of U.S. technology companies in the global market capitalization has reached the highest level in nearly two decades, a trend that has become increasingly prominent against the backdrop of Chinese technology companies falling into an economic downturn and lagging behind in the field of artificial intelligence.。

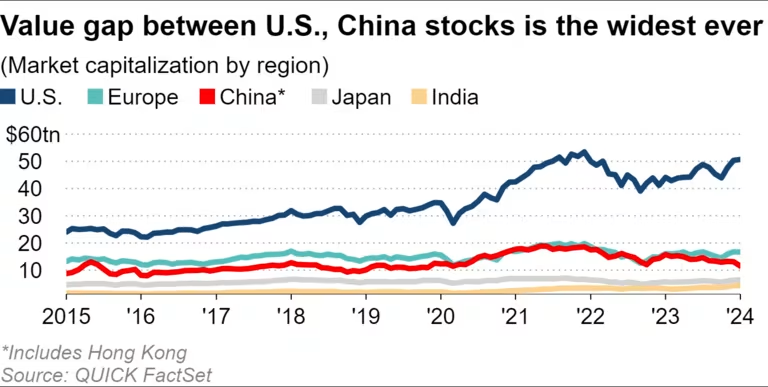

Statistics show that Chinese and Hong Kong companies have lost about 1 percent of their market value since the end of 2023..$7 trillion, largely resulting in China's share of global market capitalization to about 10 percent, about half the peak of nearly 20 percent reached in 2015.。

Over the same period, the total market capitalization of U.S. companies increased by 1.4 trillion U.S. dollars to 51 trillion U.S. dollars, accounting for up to 48.1%, the highest level since September 2003。As of now, the gap in market capitalization between U.S. and Chinese companies has widened to the largest data record since 2001。

This pattern largely reflects the different fates of the tech giants of the two countries.。Buoyed by strong quarterly earnings reports last week, Amazon and Facebook parent Meta have combined to post a $510 billion increase in market capitalization since the end of last year.。Meanwhile, Chinese e-commerce giant Alibaba Group and gaming and social media group Tencent Holdings lost a combined $31 billion in market capitalization over the same period.。

As of February 2, 236 of the world's top 500 by market capitalization were U.S. companies, up 15 percent from three years ago.。As a result, the number of Chinese companies fell by about 60 per cent, leaving only 35.。Chinese search giant Baidu, big e-commerce company Jingdong and electric car maker Weilai all fell off the list.。

In recent years, Chinese tech giants such as Tencent and Alibaba are facing a series of challenges。

At the end of 2020, Tencent and Alibaba were among the top 10 global technology companies, and their performance even reached their U.S. counterparts.。Over the years, they have become the leading platform operators in China's 1.4 billion population market, and high growth expectations have also attracted the attention of many global investors.。

Not for long, Google's parent company Alphabet recently reported quarterly earnings that showed the company's revenue and net profit hit record highs during the period, helped by strong growth in the U.S. economy, which boosted its advertising business.。On the other hand, China's weak post-epidemic economic recovery has forced domestic companies to reassess their expansion plans。Alibaba is reportedly considering selling some of its consumer businesses, which would be a major strategic shift for a group that is committed to both online and offline full-scene shopping.。

In addition to internal challenges, America's leadership in the global AI race has also brought people's horizons back to the tech industry.。

In recent years, American chipmaker Nvidia has become one of the world's sixth most valuable companies by virtue of its technological advantages and market position in the field of generative artificial intelligence processors.。However, with the changing landscape of the global semiconductor industry, companies such as Nvidia have had to face inevitable adverse changes。

Tencent is one of many high-tech industries in China that have lost ready access to these chips since 2022, when the U.S. government began banning the export of advanced semiconductors to China due to concerns about the misuse of civilian technology by the military.。

In China, due to U.S. export restrictions on chip manufacturing equipment suppliers such as Applied Materials, the Chinese government hopes to produce the necessary chips domestically.。However, these restrictions have severely hampered China's ability to catch up in the semiconductor sector, resulting in a significant decline in the international market value of Chinese semiconductor companies.。Since the beginning of 2024, SMIC has lost nearly a quarter of its international market value.。

At the same time, Chinese technology companies are struggling to respond to pressure from their own governments。Late last year, regulators imposed restrictions on online games, reigniting investor concerns about regulatory risks。

In this context, investors are starting to look to the rest of Asia, especially India。Over the past three years, India has roughly doubled the number of companies on the Global Market Capitalization 500 list to 21.。Given high expectations for India's population growth and rising incomes, companies focused on domestic demand, such as state-run life insurance, have attracted investors' attention as one of their popular destinations.。

Not only that, but the stability of Japanese companies has rekindled investor enthusiasm, slowing the decline in Japanese companies' share of global market capitalization。Toyota's dollar valuation is almost on par with Tencent's, making it the third most valuable company in Asia, behind TSMC and Samsung Electronics.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.