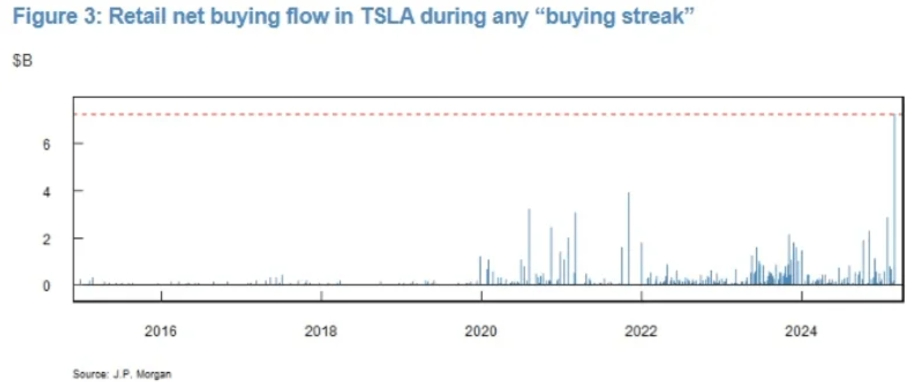

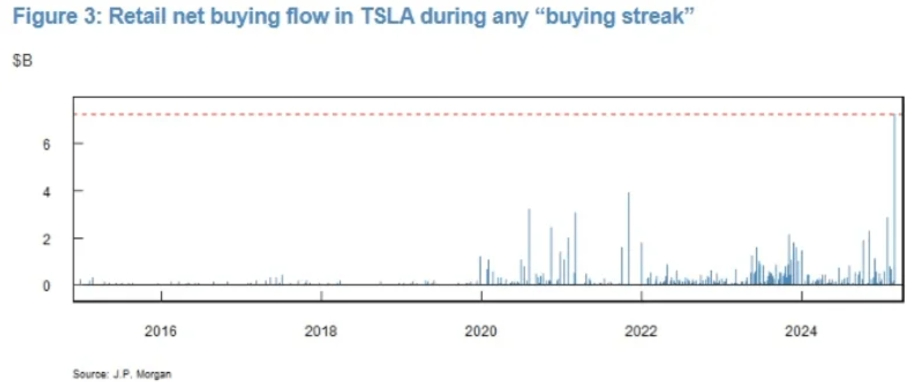

In the week ended March 19, 2025, retail investors injected more than $12 billion into U.S. stocks

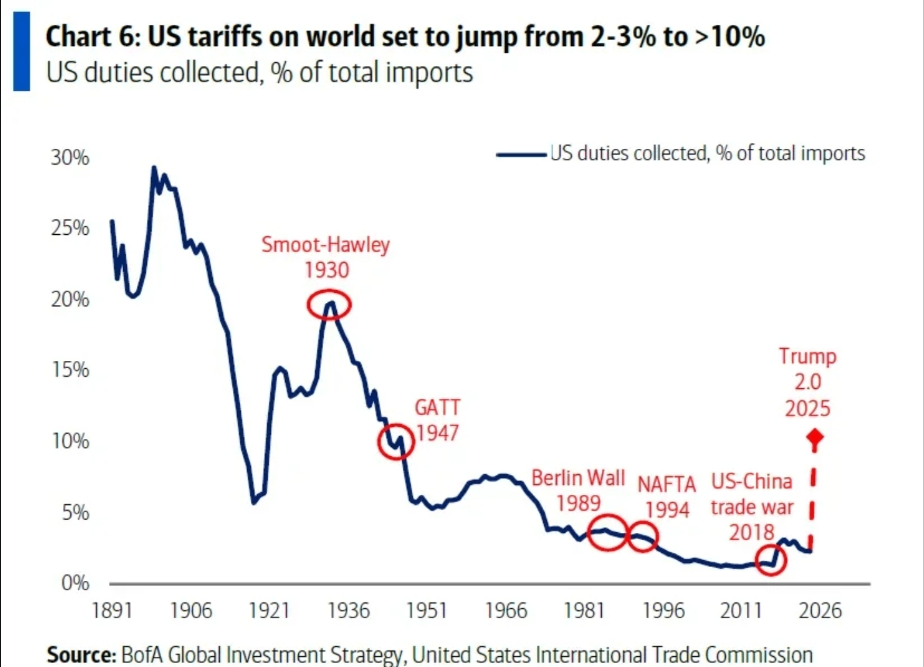

On March 22, JPMorgan retail trading data showed that despite escalating trade frictions, weak economic data and policy uncertainty exacerbating market volatility, individual investors showed rare enthusiasm to bucking the trend and increase positions.

In the week ended March 19, 2025, retail investors injected more than $12 billion into U.S. stocks, far exceeding the average of the past 12 months.

Retail investors 'bucking the trend and adding positions to some extent reflects their enthusiasm for the long-term narrative of technology stocks.AI hardware and software companies represented by Nvidia and Microsoft, although their valuations have dropped from their peak in 2023, their P/E ratios have remained above 30 times, and the commercialization progress of some application-oriented companies has not yet met market expectations.JPMorgan Chase's move to increase its holdings of Chinese stocks such as Weimeng Group suggests that funds are beginning to seek valuation depressions-the P/E ratio of Hong Kong stock technology stocks is only 1/3 of that of U.S. stocks, and the room for valuation repair of A-share consumer leaders is also favored by institutions.

Emma Wu, global equity derivatives strategist at JPMorgan Chase, said recent behavior of individual investors is consistent with typical characteristics of a "market downturn year."She pointed out that a similar situation occurred in 2022, when the benchmark stock market index fell by 19%, the only negative growth year in the past six years."This reflects their 'buy on dips' mentality.

Not only JPMorgan Chase has discovered the trend of buying the dip in the market, but Bank of America chief investment strategist Michael Hartnett also said in a latest report that funds are flowing into the stock market at a record level, marginalizing trade concerns.According to Bank of America citing EPFR Global data, global equity funds recorded inflows of approximately US$43.4 billion in the week ended Wednesday, the highest level so far this year.

Last week, Powell and Trump took turns to "rescue" U.S. stocks, and S & P rebounded like a roller coaster this week.On Wednesday, Powell "rescued the market", and the S & P hit its largest Fed resolution gain of 900 million yuan. After Trump's speech on Friday, all three major stock indexes rose in the late session, smoothing out a decline of more than 1% in early trading. The S & P and the Nasdaq were able to fully rise and end a four-week losing streak.Boeing, which won the U.S. government's largest order for next-generation fighter jets, rose more than 3%, leading the gains in Dow components.

Faced with a highly volatile environment, the strategic adjustments of professional institutions are worth learning from by retail investors.Goldman Sachs recommends adopting "bottom-line thinking" to pursue growth sectors such as AI and add defensive assets such as utilities and consumer necessities to balance portfolio risks.The activity in the options market also reveals the cautious attitude of institutions-trading volume of put options and straddle strategies surged ahead of the Fed's interest-rate meeting, indicating that investors are hedging policy shocks through derivatives.

Faced with a highly volatile market environment, how to grasp investment?ETFs with uniform rain and dew may be effective in reducing volatility.

Like the current seven sisters in the U.S. stock market, each of them has a high share price.Not all securities firms support stock splits. In contrast, artificial intelligence-related ETFs have the advantage of low funding thresholds, and generally only costs more than 100 dollars to purchase one piece (100 copies).

ETFs have a rich selection of products, covering upstream and downstream companies in the artificial intelligence industry chain. Investors can achieve risk diversification and share the dividends of industry development without in-depth research on individual stocks.In addition, ETFs have no risk of suspension or delisting, and can trade normally even in a bear market, providing investors with an opportunity to stop losses.Based on its advantages such as low threshold, transparent trading, rich selection, high stability and support for on-floor trading, ETFs have become an ideal choice for ordinary investors and novice investors to participate in the U.S. stock market.

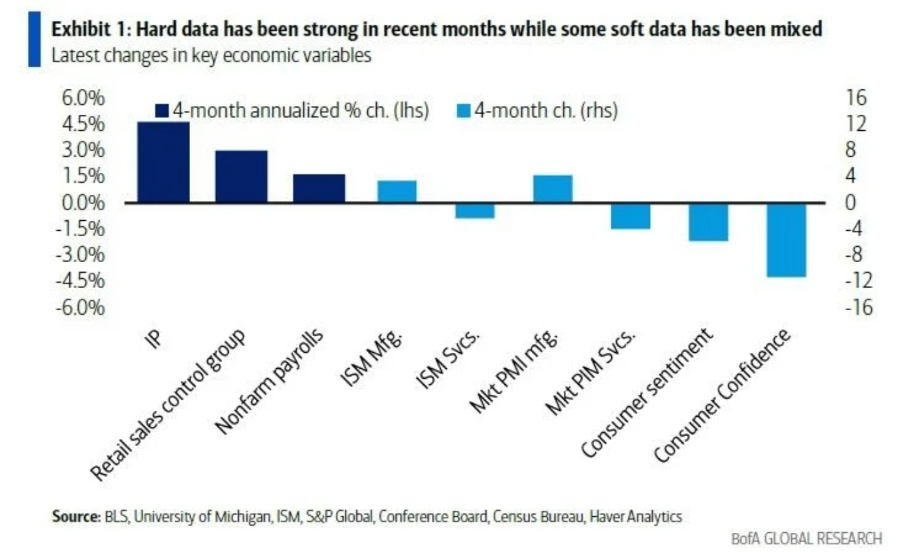

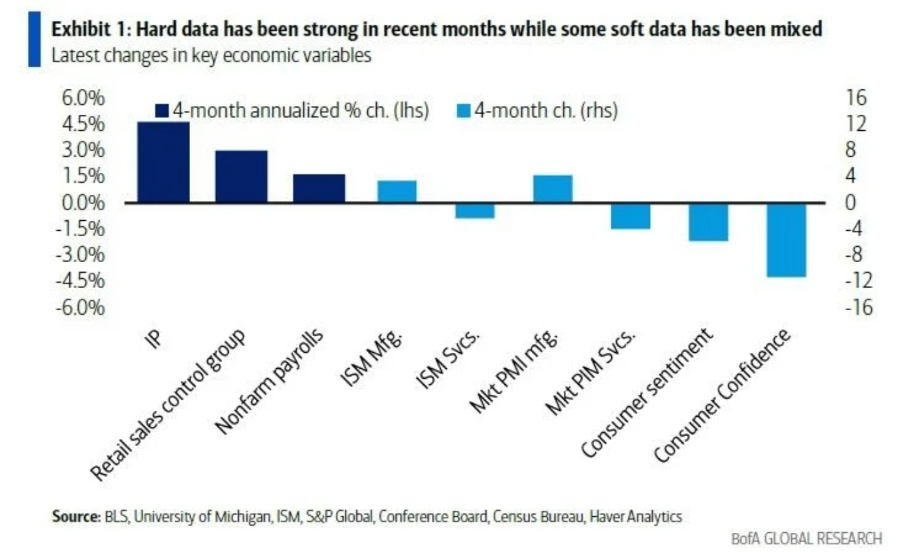

Morgan Stanley pointed out that the U.S. economy will slow down. It is only in a downturn, huge uncertainty has not yet arrived, and investors should focus on hard data rather than soft data.In the economic and financial field, hard data is quantifiable and objective economic indicators, while soft data is subjective information that is difficult to quantify, such as consumer confidence and market sentiment.Recent hard data such as industrial production index, retail sales and non-agricultural data show that the U.S. economy has not yet reached the stage of recession.

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

January retail sales data scared many investors, but last week's February data showed that concerns were exaggerated.Morgan Stanley said: A meaningful slowdown may not occur until another quarter, and we will be watching non-farm payrolls data more closely than usual.

This suggests that the U.S. stock market's buy the dip may continue.